Nihon EnterpriseLtd (TSE:4829) Has Announced A Dividend Of ¥3.00

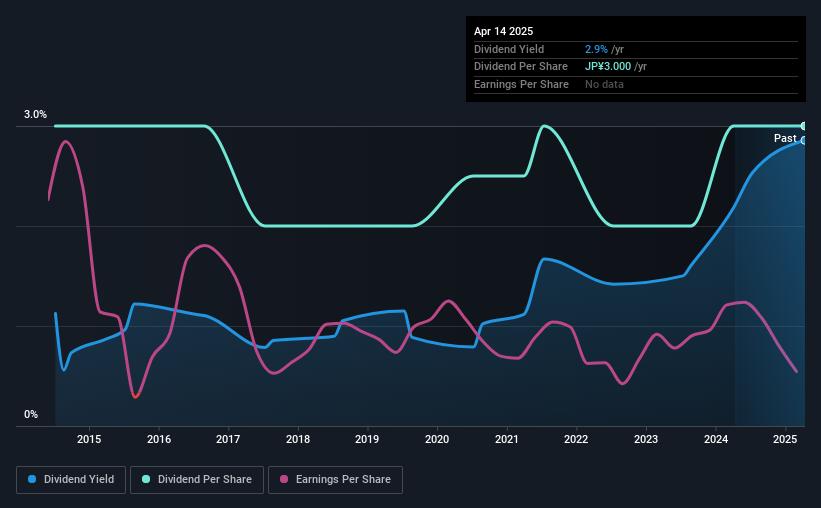

Nihon Enterprise Co.,Ltd. (TSE:4829) will pay a dividend of ¥3.00 on the 1st of September. This means the annual payment is 2.9% of the current stock price, which is above the average for the industry.

Our free stock report includes 4 warning signs investors should be aware of before investing in Nihon EnterpriseLtd. Read for free now.Nihon EnterpriseLtd's Projections Indicate Future Payments May Be Unsustainable

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, the company was paying out 236% of what it was earning. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Looking forward, EPS could fall by 25.4% if the company can't turn things around from the last few years. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 315%, which could put the dividend under pressure if earnings don't start to improve.

See our latest analysis for Nihon EnterpriseLtd

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The last annual payment of ¥3.00 was flat on the annual payment from10 years ago. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though Nihon EnterpriseLtd's EPS has declined at around 25% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Nihon EnterpriseLtd's Dividend Doesn't Look Great

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 4 warning signs for Nihon EnterpriseLtd (2 shouldn't be ignored!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nihon EnterpriseLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4829

Nihon EnterpriseLtd

Plans, develops, and operates content for smartphone and other multi devices.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)