- South Korea

- /

- Entertainment

- /

- KOSDAQ:A263750

High Growth Tech Stocks To Watch In May 2025

Reviewed by Simply Wall St

Amid renewed tariff threats and Treasury market volatility, global markets have seen a downturn, with small- and mid-cap indexes suffering the most significant declines. As investors navigate these turbulent times, identifying high-growth tech stocks that can withstand economic pressures becomes crucial, as these companies often demonstrate resilience through innovation and adaptability.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| CD Projekt | 33.21% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★☆☆

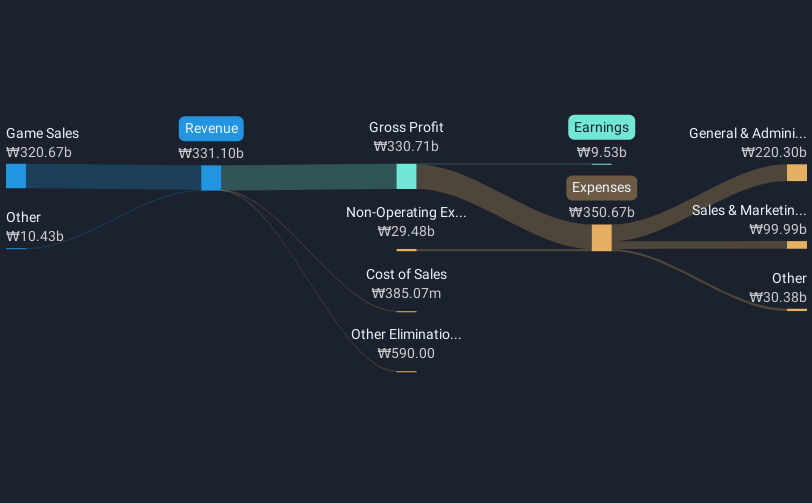

Overview: Pearl Abyss Corp. is a company that focuses on software development for games, with a market capitalization of ₩2.32 trillion.

Operations: Pearl Abyss generates revenue primarily through game sales, amounting to ₩331.88 billion. The company is focused on developing and selling software for the gaming industry.

Pearl Abyss, a contender in the tech arena, is demonstrating robust growth with its revenue and earnings outpacing the broader South Korean market. With an annual revenue increase of 14.7% and earnings surging by 21.6%, the company significantly exceeds Korea's average growth rates of 7.4% and 20.5%, respectively. This performance is underpinned by substantial R&D investments, which are pivotal for maintaining its competitive edge in gaming and digital entertainment—a sector where innovation directly correlates with user engagement and market share. Despite challenges like a low forecasted Return on Equity at 10.5%, Pearl Abyss's strategic focus on expanding its technological capabilities could enhance its long-term position in the global market, especially as it continues to evolve within high-demand segments of online entertainment.

- Delve into the full analysis health report here for a deeper understanding of Pearl Abyss.

Understand Pearl Abyss' track record by examining our Past report.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★☆

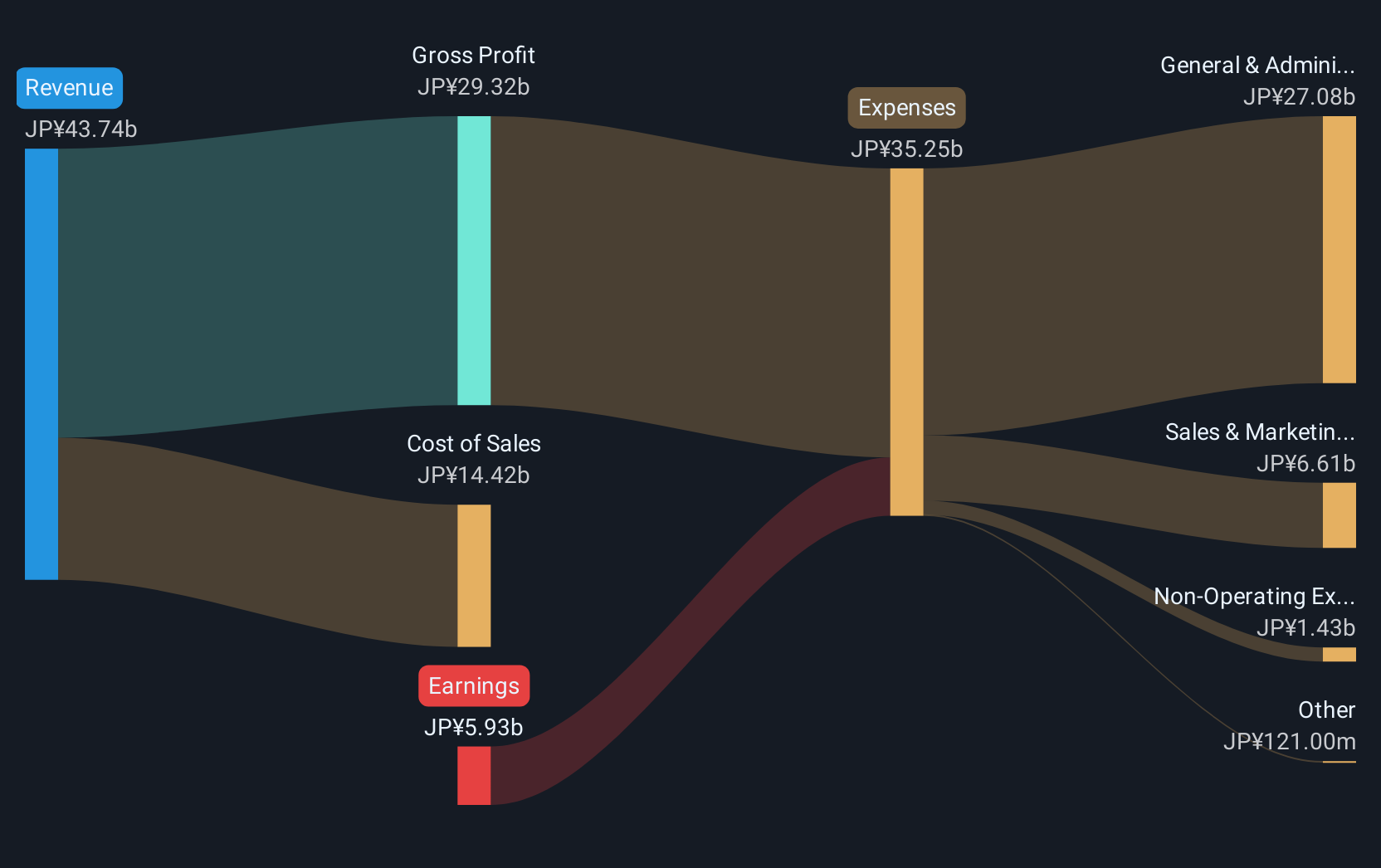

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan with a market capitalization of ¥251.40 billion.

Operations: The Platform Services Business segment of Money Forward, Inc. generated ¥42.53 billion in revenue. The company's financial solutions cater to a range of clients including individuals, financial institutions, and corporations primarily within Japan.

Money Forward is navigating a dynamic trajectory in the tech industry, marked by an impressive annual revenue growth of 18.6%. Despite recent adjustments to its fiscal year guidance, reflecting a more conservative outlook with expected net sales between JPY 49.5 billion and JPY 52.1 billion, the firm's commitment to innovation remains evident through its R&D expenditures which are critical for staying competitive in software development. This strategic focus is further underscored by an anticipated earnings growth rate of 60.6% per annum, positioning Money Forward to capitalize on emerging market opportunities despite current profitability challenges and a highly volatile share price over the past three months.

Future (TSE:4722)

Simply Wall St Growth Rating: ★★★★☆☆

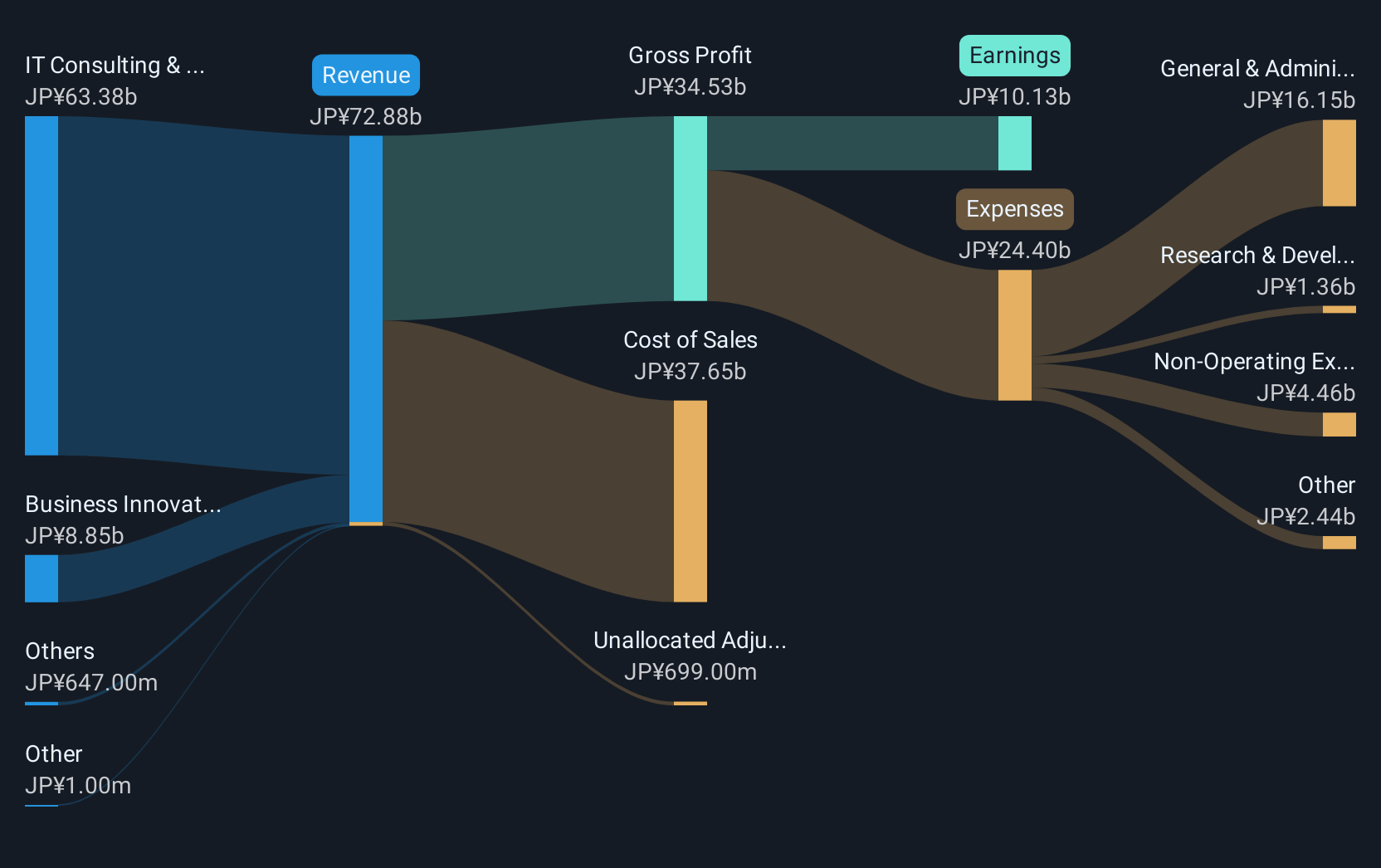

Overview: Future Corporation is a Japanese company specializing in IT consulting and services, with a market capitalization of ¥183.90 billion.

Operations: Future Corporation generates revenue primarily through IT consulting and services, which includes package software and related services, contributing ¥63.38 billion. The Business Innovation segment adds another ¥8.85 billion to the company's revenue stream.

Future Corporation is shaping its trajectory in the tech sector with a robust focus on R&D, allocating significant resources to foster innovation and maintain competitiveness. With a solid revenue forecast of JPY 76 billion and an operating profit projection of JPY 16.05 billion for the year ending December 2025, the company's strategic investments in technology are paying off. These financial commitments are complemented by an increase in dividends, signaling confidence in sustained profitability and shareholder value. Moreover, Future's recent decision to dispose of treasury stock as restricted shares underscores a strategic approach to capital management amidst its growth narrative. This blend of prudent financial strategies and aggressive market positioning illustrates Future’s potential to navigate through the evolving demands of the tech industry effectively.

- Click to explore a detailed breakdown of our findings in Future's health report.

Examine Future's past performance report to understand how it has performed in the past.

Taking Advantage

- Delve into our full catalog of 748 Global High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A263750

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)