- Japan

- /

- Healthtech

- /

- TSE:4483

Exploring JMDC And Two Other High Growth Tech Leaders In Japan

Reviewed by Simply Wall St

Japan’s stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index declined by 1.0%, reflecting a cautious sentiment amid expectations of additional rate hikes by the Bank of Japan. Despite these macroeconomic challenges, high-growth tech stocks in Japan continue to capture investor interest due to their potential for innovation and market disruption. When evaluating high-growth tech stocks like JMDC and others, it is crucial to consider factors such as strong revenue growth, innovative technology solutions, and robust market positioning—all of which can help navigate current economic uncertainties and capitalize on emerging opportunities in the tech sector.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. offers medical statistics data services in Japan and has a market cap of ¥303.83 billion.

Operations: JMDC Inc. generates revenue primarily from Healthcare-Big Data services (¥27.17 billion), Tele-Medicine (¥5.77 billion), and Dispensing Pharmacy Support (¥1.22 billion). The company focuses on leveraging medical statistics for varied applications in the healthcare sector in Japan.

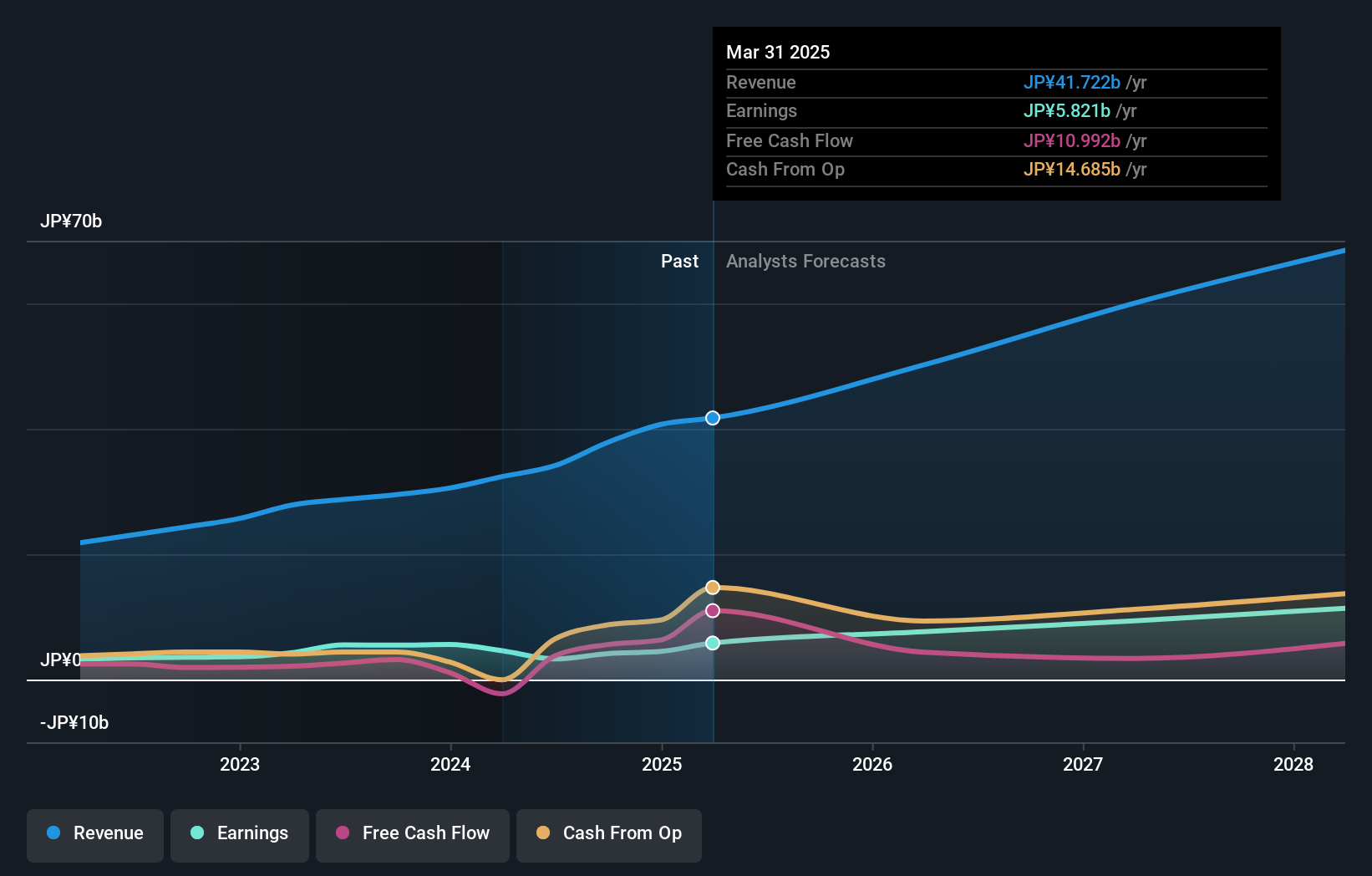

JMDC, a notable player in the healthcare data analytics sector, is projected to see its earnings grow at 25.7% annually, outpacing the broader Japanese market's 8.7%. Despite a recent dip in profit margins from 19.3% to 9.7%, the company continues to invest heavily in R&D, with expenses accounting for ¥2 billion last year alone. The upcoming board meeting on Aug 22 will address share subscription rights issuance, potentially impacting future capital structure and growth strategies. In its latest guidance for the six months ending September 2024, JMDC expects revenue of ¥18.70 billion and an operating profit of ¥2.80 billion, reflecting robust operational performance despite industry challenges. The company's focus on leveraging AI and big data analytics positions it well within Japan's tech landscape, particularly as software firms increasingly shift towards SaaS models for recurring revenue streams.

- Click here and access our complete health analysis report to understand the dynamics of JMDC.

Gain insights into JMDC's past trends and performance with our Past report.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trend Micro Incorporated develops and sells security-related software for computers and related services in Japan and internationally, with a market cap of ¥1.16 trillion.

Operations: The company generates revenue primarily from Japan (¥84.17 billion), the Americas (¥70.46 billion), Europe (¥63.59 billion), and Asia Pacific (¥126.28 billion). Its business focuses on developing and selling security-related software for computers and related services across these regions.

Trend Micro, a leading cybersecurity firm in Japan, is experiencing significant growth prospects with earnings projected to increase by 21.8% annually, outpacing the broader market's 8.7%. Despite a recent dip in profit margins from 11.2% to 6.4%, the company remains committed to innovation, investing ¥39 billion in share repurchases this year and focusing heavily on AI-driven security solutions through partnerships like GMI Cloud and initiatives under COSAI. With R&D expenses accounting for ¥2 billion last year, Trend Micro is well-positioned to tackle emerging threats and capitalize on the growing demand for advanced cybersecurity measures.

- Click here to discover the nuances of Trend Micro with our detailed analytical health report.

Understand Trend Micro's track record by examining our Past report.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates in industrial automation, device and module solutions, social systems, and healthcare businesses worldwide with a market cap of ¥1.18 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion). The company operates globally across these diverse segments, contributing to its overall market presence.

OMRON, a leader in industrial automation, has partnered with Digimarc to integrate digital watermarks and machine vision technology, enhancing product identification and quality control. With earnings projected to grow 46.2% annually and revenue forecasted at 5.6% per year, OMRON is investing heavily in innovation. The company spent ¥1 billion on R&D last year, focusing on advanced automation solutions that improve efficiency and sustainability across manufacturing processes.

- Click to explore a detailed breakdown of our findings in OMRON's health report.

Evaluate OMRON's historical performance by accessing our past performance report.

Where To Now?

- Click through to start exploring the rest of the 114 Japanese High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4483

Flawless balance sheet with reasonable growth potential.