In the current global market landscape, uncertainty surrounding the incoming U.S. administration's policies and rising long-term interest rates have contributed to fluctuations in key indices, including small-cap stocks represented by the Russell 2000. Amidst this backdrop of economic shifts and sector-specific movements, identifying promising opportunities requires a keen understanding of market dynamics and potential growth drivers that align with evolving investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.20% | 16.85% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market capitalization of CHF 1.22 billion.

Operations: The company generates revenue from three main regions: Europe, Middle East and Africa (CHF 452.85 million), Americas (CHF 352.67 million), and Asia-Pacific (CHF 273.16 million).

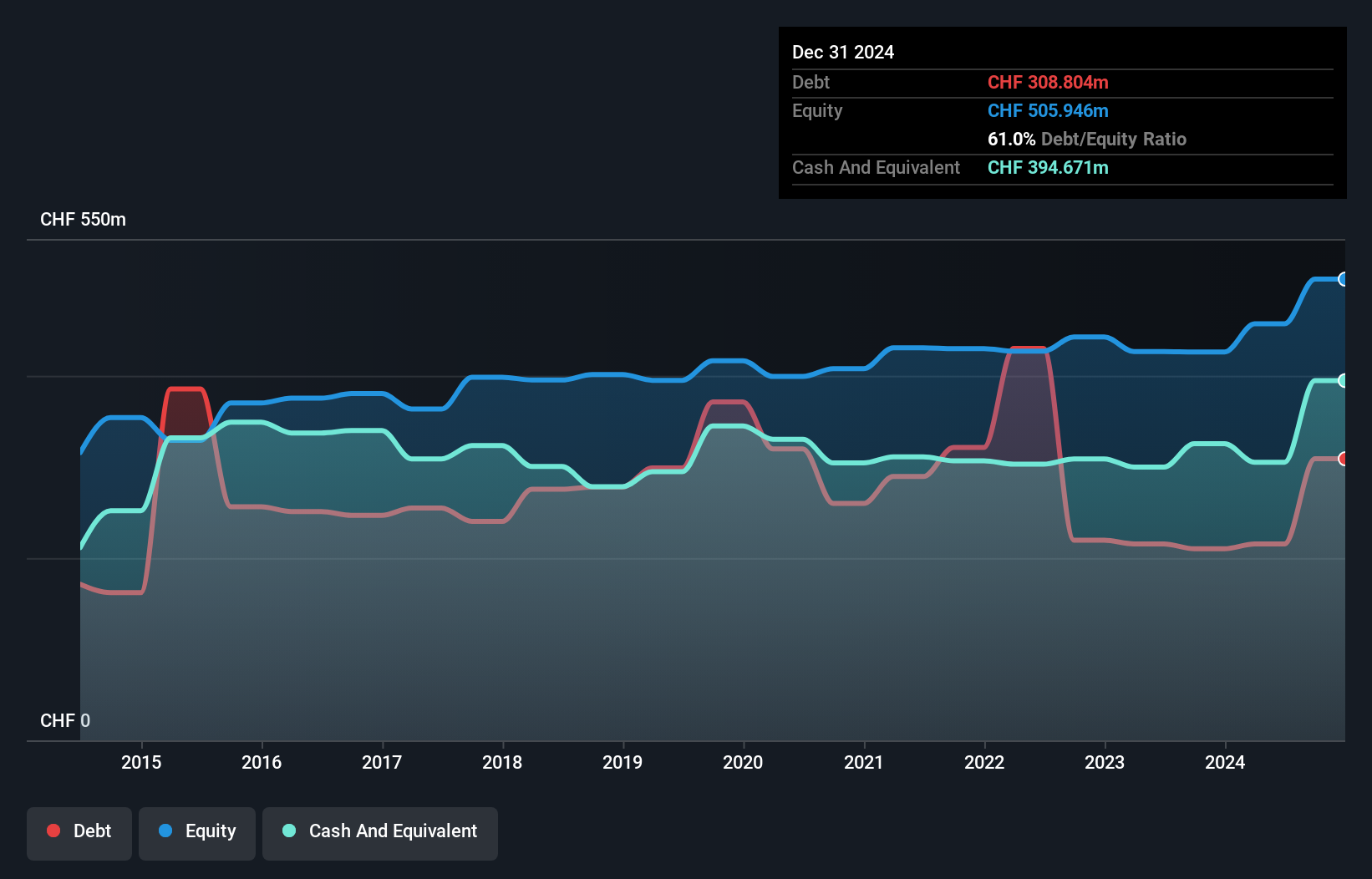

Compagnie Financière Tradition, a financial services firm, is trading at 28.9% below its estimated fair value, presenting potential for investors eyeing undervalued opportunities. The company has successfully reduced its debt-to-equity ratio from 75.7% to 47.1% over five years, signaling improved financial health. Recent earnings show a net income increase to CHF 59.99 million from CHF 51.02 million the previous year and basic earnings per share rising to CHF 7.98 from CHF 6.86, reflecting strong performance with high-quality earnings growth of 16.1%, outpacing the industry average of -3.3%.

Arad (TASE:ARD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Arad Ltd. designs, develops, manufactures, and sells water systems in Israel and internationally with a market cap of ₪1.32 billion.

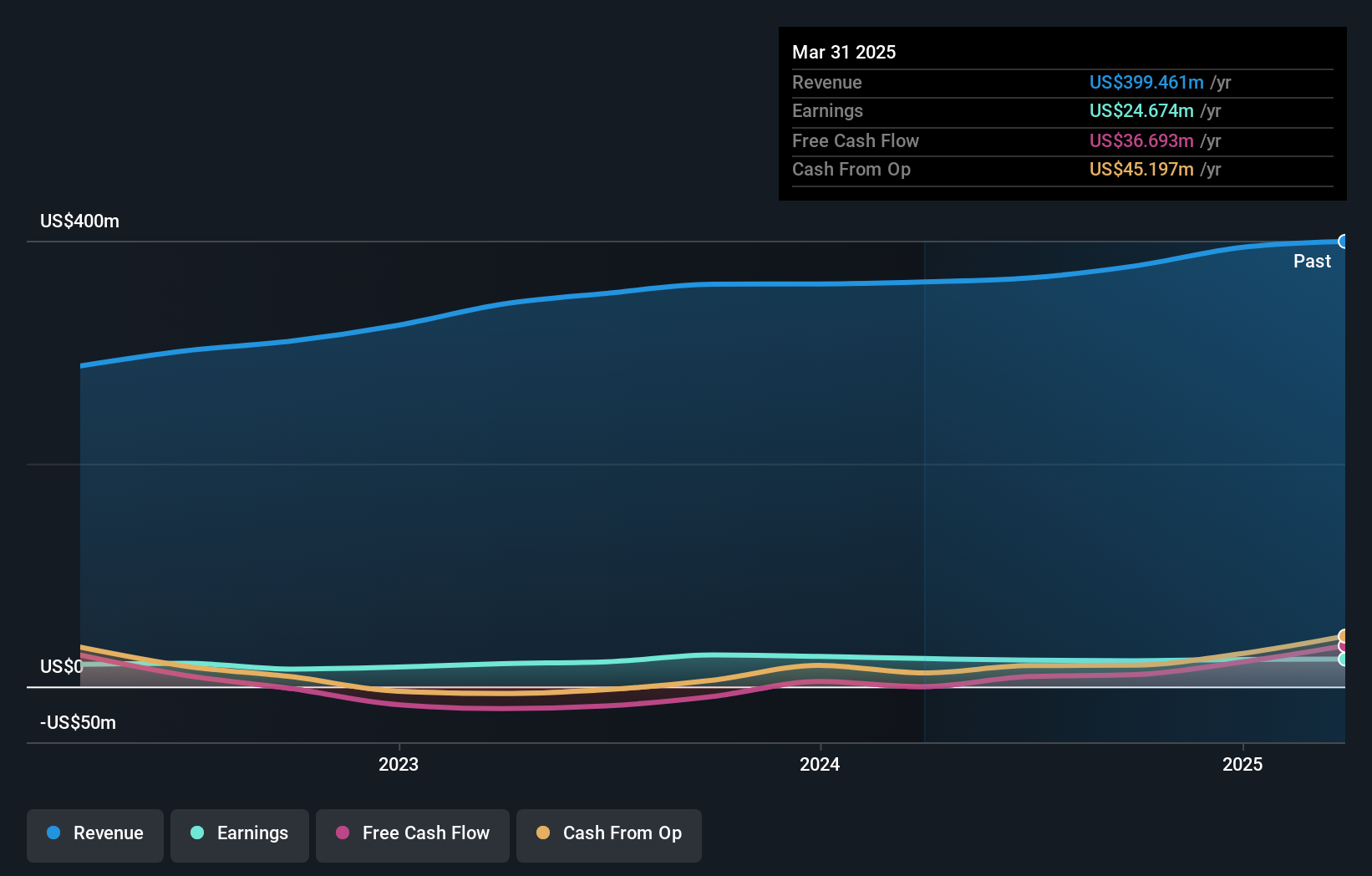

Operations: Arad generates revenue primarily from its Electronic Test & Measurement Instruments segment, amounting to $366.61 million.

Arad, a smaller player in the electronics sector, showcases high-quality earnings despite a net debt to equity ratio of 43.8%, which is on the higher side. The company's interest payments are comfortably covered by EBIT at 4.3 times, indicating sound financial health in that aspect. Over the past year, Arad's earnings grew by 6.5%, outperforming the broader electronic industry's -0.3% change, though net income for recent quarters showed some strain with US$6.26 million compared to US$7.83 million previously and sales rising slightly from US$93.73 million to US$97.3 million year-over-year for Q2 2024.

Cresco (TSE:4674)

Simply Wall St Value Rating: ★★★★★★

Overview: Cresco Ltd., along with its subsidiaries, offers IT services and digital solutions in Japan, with a market capitalization of approximately ¥52.10 billion.

Operations: Cresco Ltd. generates revenue primarily from its IT service business, with significant contributions from the finance (¥16.15 billion), enterprise (¥21.15 billion), and manufacturing (¥14.50 billion) sectors, alongside its digital solution business (¥3.83 billion).

Cresco, a company that's quietly making waves, is trading at 59.1% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. Over the past five years, Cresco's earnings have grown by an impressive 9.9% annually, while its debt-to-equity ratio has improved from 19% to just 6.6%, indicating prudent financial management. Despite not outpacing the broader software industry with an 11.8% earnings growth last year compared to the industry's 15.4%, Cresco remains free cash flow positive and profitable, ensuring interest payments are well-covered without concerns about cash runway limitations.

- Get an in-depth perspective on Cresco's performance by reading our health report here.

Review our historical performance report to gain insights into Cresco's's past performance.

Key Takeaways

- Get an in-depth perspective on all 4658 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ARD

Arad

Plans, develops, manufactures, and sells water measurement and management products and solutions in Israel, Latin America, Asia, Europe, North America, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)