Regulatory Momentum and Profit Surge Might Change the Case For Investing In Sansan (TSE:4443)

Reviewed by Sasha Jovanovic

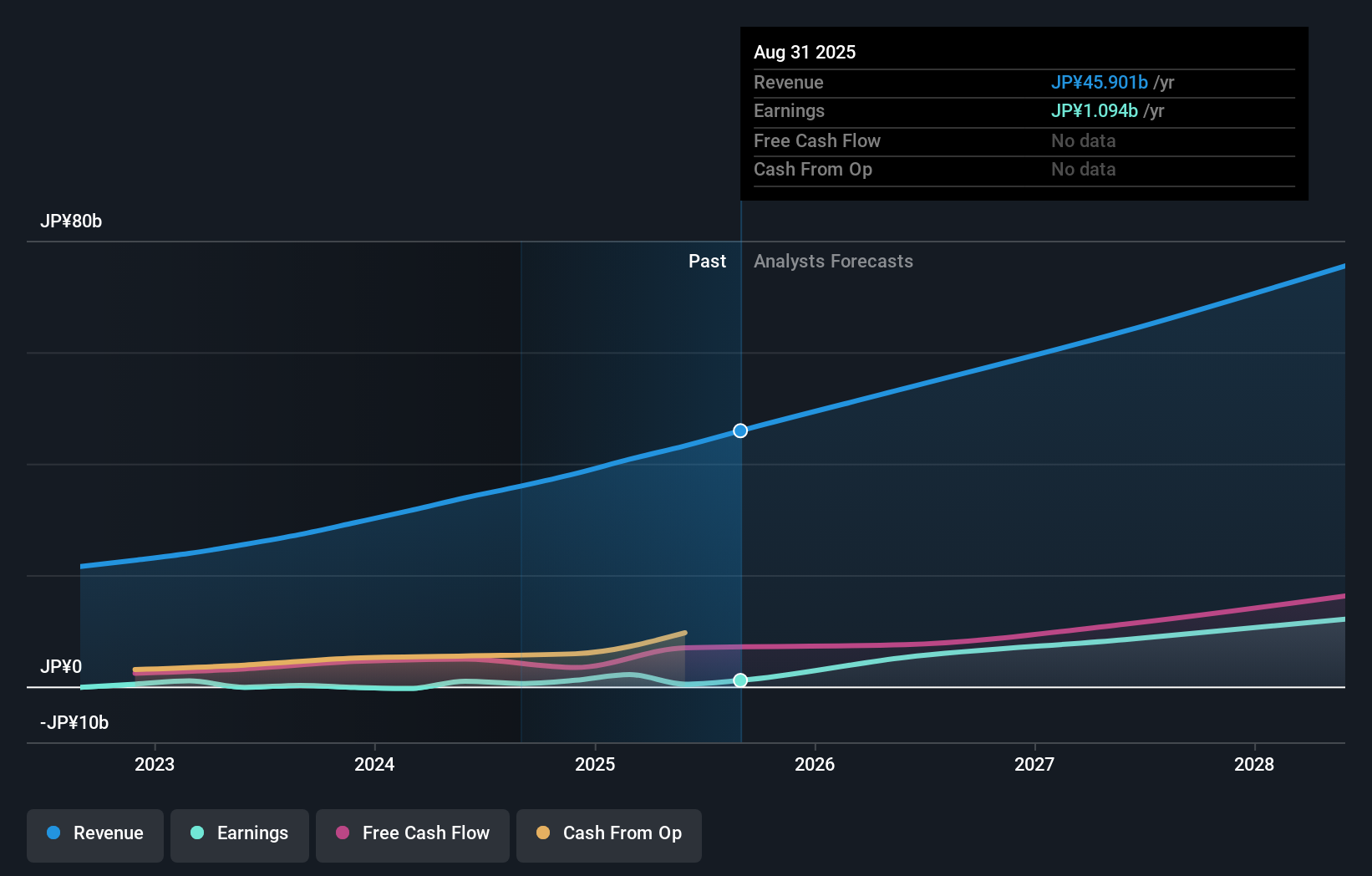

- Sansan Inc recently released its Q1 FY2025 financial results, reporting accelerated growth across all business segments and a very large 178.8% increase in adjusted operating profit.

- The company highlighted strong expansion potential for its Bill One invoice management solution, supported by favorable regulatory changes in Japan.

- We'll examine how supportive regulatory trends for Bill One are shaping Sansan's investment narrative following these results.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Sansan's Investment Narrative?

For many shareholders, the big picture with Sansan centers on whether strong top-line growth and improving profitability can be sustained, especially in light of the company’s recent Q1 FY2025 results showing a very large jump in adjusted operating profit. The bullish case still hinges on management’s ability to tap into secular trends like digital transformation and regulatory drivers, particularly through the Bill One platform, which just received a booster from new supportive rules in Japan. This positive news does shift near-term catalysts, making adoption and revenue ramp in Bill One more front-of-mind than before. Risks remain, though: despite the growth headline, shares have struggled recently, and there was a significant one-off loss impacting prior twelve-month earnings. Investors may also want to watch for future margin pressure and whether expanding overseas, like in Southeast Asia, adds to costs or delivers scale benefits.

However, the pace and success of Bill One’s adoption is still uncertain and could sway results.

Exploring Other Perspectives

Explore another fair value estimate on Sansan - why the stock might be worth as much as 35% more than the current price!

Build Your Own Sansan Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sansan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sansan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sansan's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4443

Sansan

Engages in the planning, development, and selling of cloud-based solutions in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)