WingArc1st Inc.'s (TSE:4432) Price Is Out Of Tune With Earnings

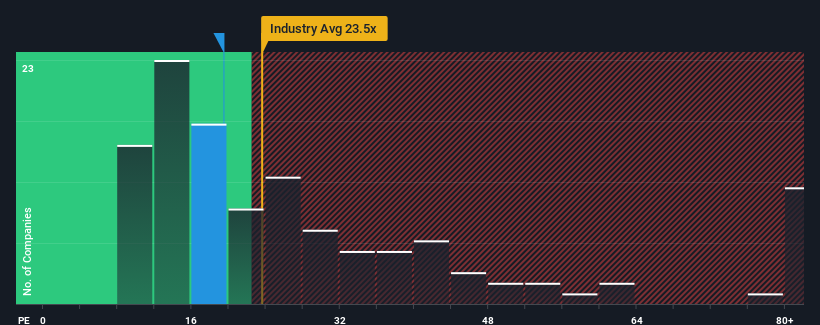

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider WingArc1st Inc. (TSE:4432) as a stock to potentially avoid with its 19.5x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's inferior to most other companies of late, WingArc1st has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for WingArc1st

How Is WingArc1st's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as WingArc1st's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. However, a few strong years before that means that it was still able to grow EPS by an impressive 83% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 13% over the next year. Meanwhile, the rest of the market is forecast to expand by 11%, which is not materially different.

With this information, we find it interesting that WingArc1st is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of WingArc1st's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for WingArc1st you should know about.

If you're unsure about the strength of WingArc1st's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if WingArc1st might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4432

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.