Japan's stock markets have recently experienced a decline, with the Nikkei 225 Index and the broader TOPIX Index both falling, as easing domestic inflation has led to speculation about future interest rate decisions by the Bank of Japan. In this context, identifying high-growth tech stocks involves looking for companies that can navigate these economic conditions effectively, leveraging innovation and market demand to drive growth despite broader market challenges.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.22% | 71.29% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Finatext Holdings (TSE:4419)

Simply Wall St Growth Rating: ★★★★★☆

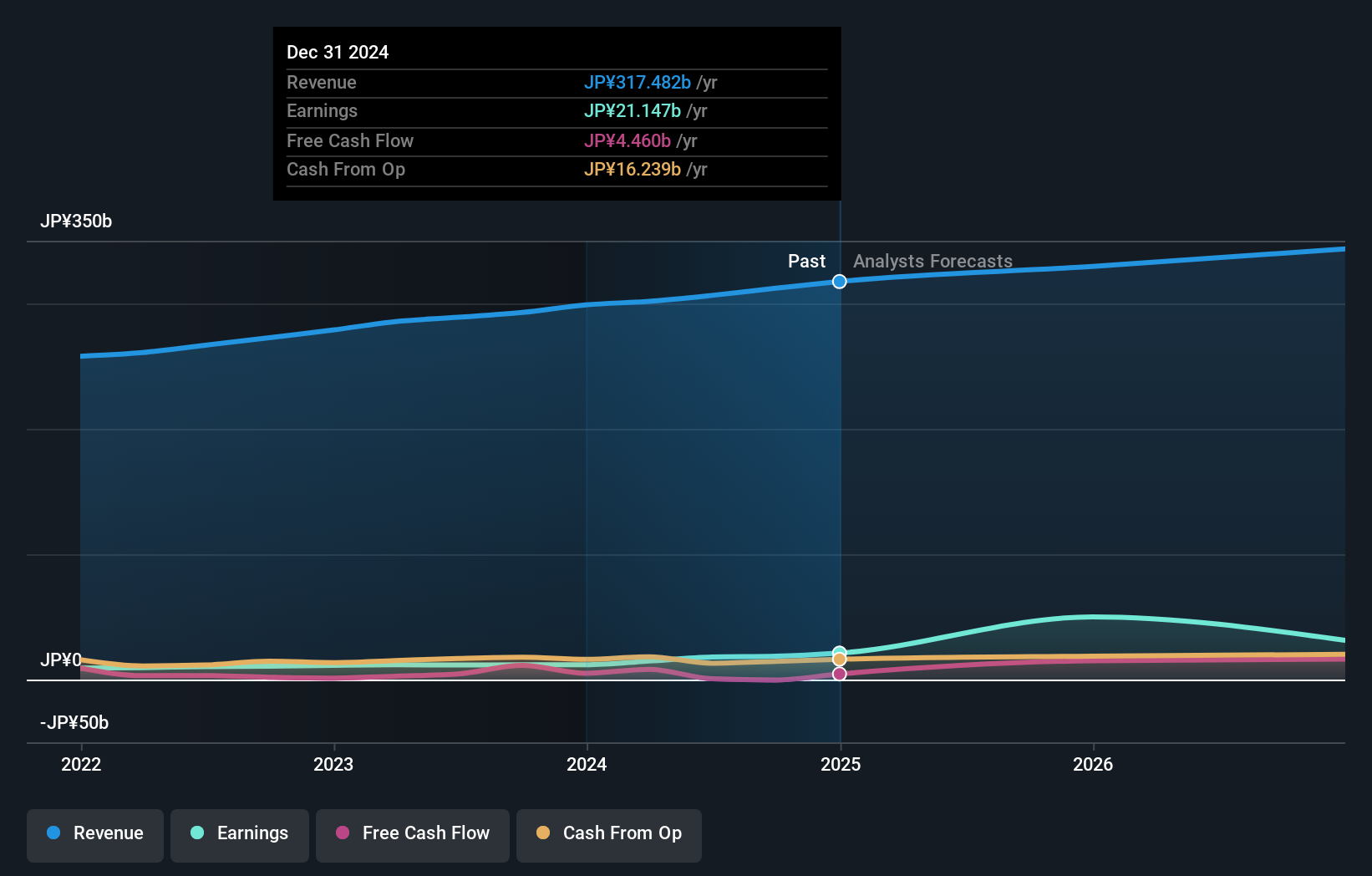

Overview: Finatext Holdings Ltd. operates in Japan, focusing on fintech solutions, big data analysis, and financial infrastructure businesses, with a market capitalization of ¥49.08 billion.

Operations: The company's revenue primarily stems from its Financial Infrastructure Business, generating ¥3.43 billion, followed by Big Data Analysis and Fintech Solution businesses at ¥1.42 billion and ¥1.22 billion, respectively.

Finatext Holdings has emerged as a noteworthy contender in Japan's tech sector, particularly highlighted by its impressive forecasted annual revenue growth of 26.2% and earnings growth of 63.4%. Despite facing challenges such as a highly volatile share price and shareholder dilution over the past year, the company's recent transition into profitability underscores its potential resilience and adaptability in a competitive market. Notably, Finatext is investing significantly in R&D to innovate and stay relevant against industry giants; however, specific figures on R&D spending were not disclosed. As it stands, the firm's ability to maintain this momentum could be pivotal for its standing in high-growth tech sectors moving forward.

- Get an in-depth perspective on Finatext Holdings' performance by reading our health report here.

Evaluate Finatext Holdings' historical performance by accessing our past performance report.

Takara Bio (TSE:4974)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Takara Bio Inc., along with its subsidiaries, operates in the bioindustry, contract development and manufacturing organization (CDMO), and gene therapy sectors across Japan, China, the rest of Asia, the United States, Europe, and other international markets with a market capitalization of ¥128.24 billion.

Operations: The company generates revenue primarily from its drug discovery segment, which contributes ¥42.82 billion. It operates across multiple regions, including Japan, China, and the United States.

Takara Bio, navigating through a challenging year with a 99.1% drop in earnings, still forecasts an impressive annual revenue increase of 5.6%, outpacing the Japanese market's average of 4.2%. Despite these hurdles, the company projects robust earnings growth at 30.2% annually, signaling strong recovery potential and resilience in the biotech sector. R&D investments remain pivotal for Takara Bio as it seeks to innovate within its field; however, specific expenditure figures were not disclosed in recent updates. With recent guidance indicating expected full-year net sales reaching ¥48.9 billion and an operating profit of ¥5 billion, Takara Bio is positioning itself to leverage its scientific capabilities to meet growing market demands effectively.

- Click to explore a detailed breakdown of our findings in Takara Bio's health report.

Gain insights into Takara Bio's past trends and performance with our Past report.

Fuji Soft (TSE:9749)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fuji Soft Incorporated is an IT company with operations in Japan and internationally, and it has a market cap of ¥608.29 billion.

Operations: The company generates revenue primarily from its SI Business segment, which accounts for ¥290.11 billion. The Facility Business contributes ¥3.42 billion to the total revenue.

Fuji Soft, amidst a transformative period marked by digitalization and heightened M&A activity, has shown notable financial dynamism. With earnings growth outpacing the Japanese market at 21.7% annually compared to the broader market's 8.7%, and revenue projections modestly climbing by 4.7% per year, the company is strategically positioned within its sector. Recent acquisition interest from global investment firms like KKR underscores Fuji Soft's pivotal role in Japan’s IT services landscape, further buoyed by a significant tender offer priced at a premium of over 97%. This corporate maneuvering not only reflects confidence in Fuji Soft’s future prospects but also highlights its central position in an industry increasingly reliant on advanced technology solutions.

- Navigate through the intricacies of Fuji Soft with our comprehensive health report here.

Assess Fuji Soft's past performance with our detailed historical performance reports.

Key Takeaways

- Explore the 119 names from our Japanese High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4419

Finatext Holdings

Engages in the fintech solution, big data analysis, and financial infrastructure businesses in Japan.

High growth potential with excellent balance sheet.