As global markets navigate a period marked by central banks adjusting interest rates and the Nasdaq Composite achieving new highs, technology stocks continue to capture investor attention with their potential for growth. In this dynamic environment, identifying high-growth tech stocks involves examining companies that demonstrate resilience and innovation amidst fluctuating economic indicators and market sentiment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★★☆

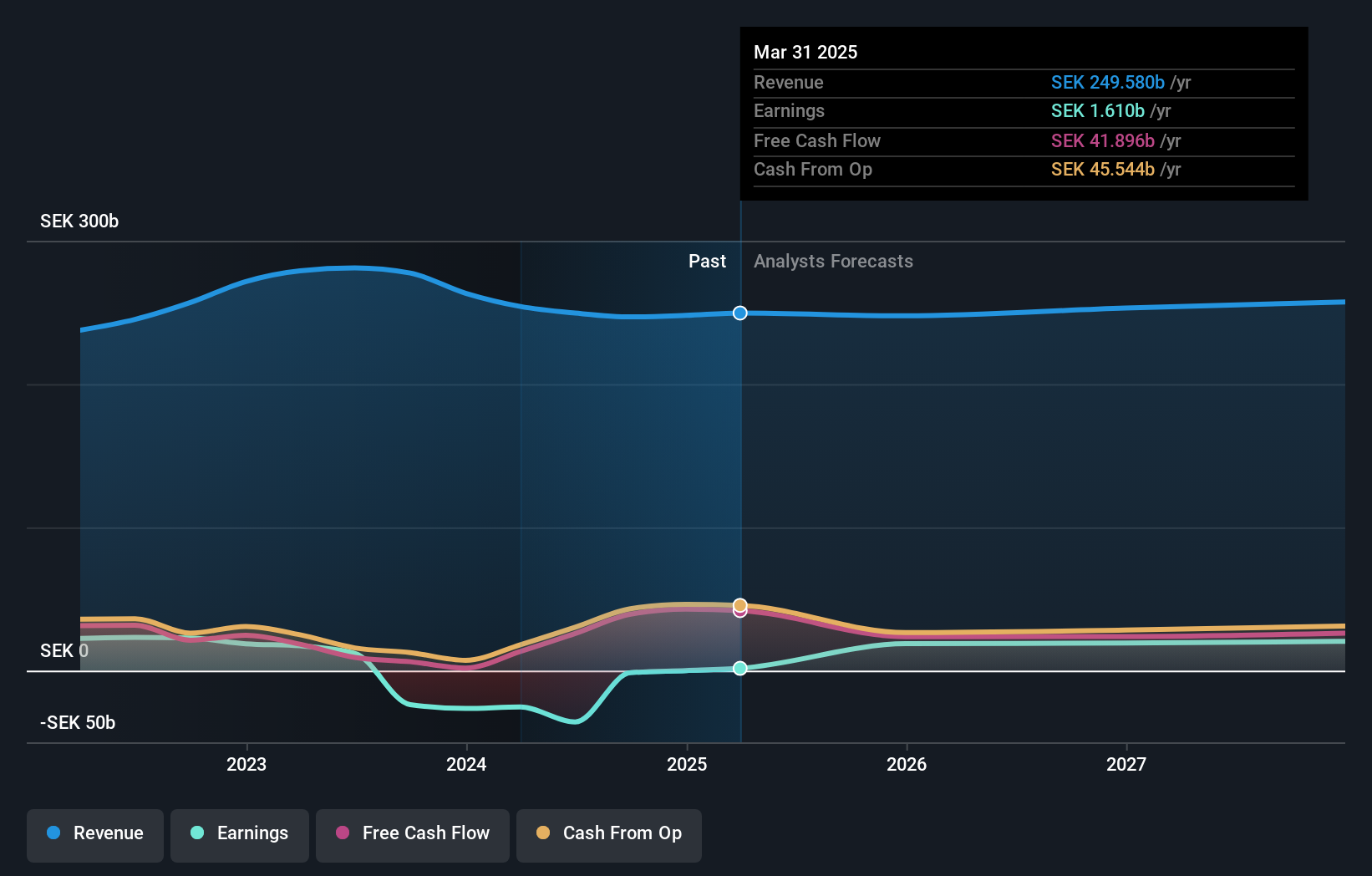

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions for telecom operators and enterprise customers across multiple regions worldwide, with a market capitalization of approximately SEK302.22 billion.

Operations: Ericsson generates revenue primarily from its Networks segment, which accounts for SEK156.41 billion, followed by Cloud Software and Services at SEK62.74 billion, and Enterprise at SEK25.47 billion. The company's focus on these segments highlights its commitment to providing comprehensive mobile connectivity solutions across diverse markets globally.

Telefonaktiebolaget LM Ericsson's strategic moves in the tech sector, particularly in 5G and AI innovations, underscore its commitment to advancing digital transformation globally. Recent alliances, such as with FPT Corporation to boost 5G adoption and digital capabilities in Vietnam, highlight Ericsson's role in enhancing technological infrastructures that support advanced applications from healthcare to retail. Additionally, its collaboration with Atombeam through the TAP program leverages cutting-edge data transmission technologies to optimize network efficiencies—an essential step for robust IoT and AI integrations. These initiatives not only expand Ericsson’s technological footprint but also demonstrate a forward-thinking approach in a rapidly evolving industry landscape.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

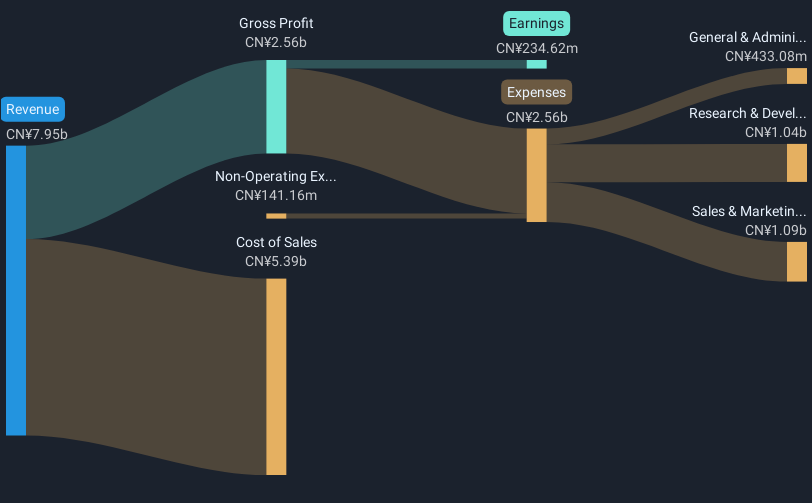

Overview: China Transinfo Technology Co., Ltd. operates in the transportation and IoT sectors with a market capitalization of CN¥17.05 billion.

Operations: The company focuses on transportation and IoT sectors, generating revenue primarily through its technological solutions and services in these areas. Its business model leverages advanced technology to address infrastructure needs, enhancing efficiency and connectivity.

China Transinfo Technology Co., Ltd, despite a challenging year with net income dropping significantly to CNY 15.76 million from CNY 323.54 million, shows promising signs with a revenue increase to CNY 5,408.27 million and maintaining basic earnings per share at CNY 0.01. This resilience is underpinned by an impressive forecast of annual earnings growth at 59.3% and revenue growth at 14.9%, outpacing the broader Chinese market's expectations. The company’s aggressive pursuit of innovation is evident in its substantial R&D investment aimed at enhancing technological capabilities and securing a competitive edge in the rapidly evolving tech landscape.

Safie (TSE:4375)

Simply Wall St Growth Rating: ★★★★☆☆

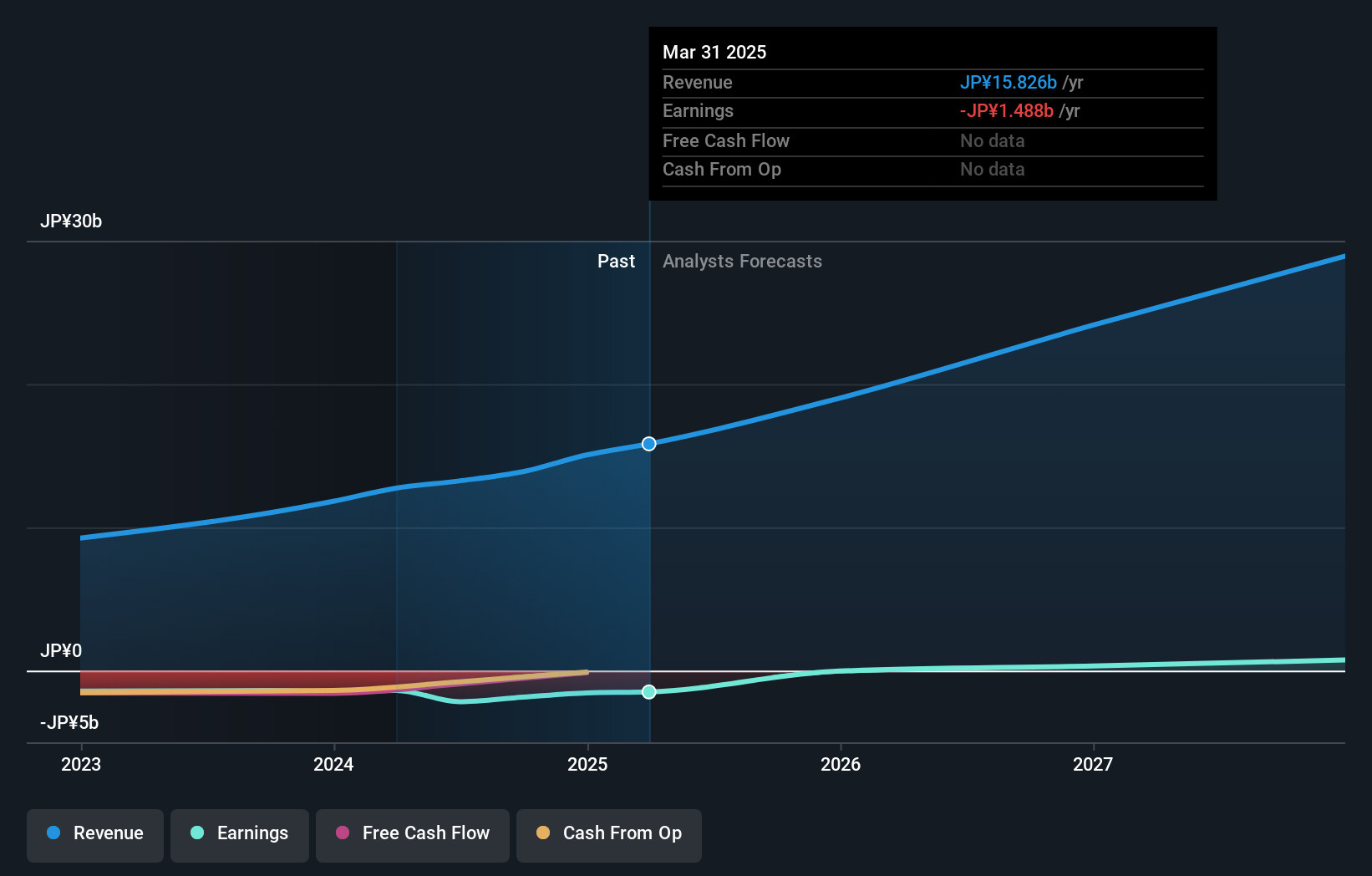

Overview: Safie Inc. is a Japanese company that develops and operates a cloud-based video recording platform under the Safie brand, with a market cap of ¥43.89 billion.

Operations: The company generates revenue primarily through its cloud-based video recording platform in Japan. With a focus on technology development and operational efficiency, it aims to optimize its cost structure while enhancing service offerings.

Safie Inc., amidst a volatile share price, has demonstrated significant revenue growth of 19.7% annually, outpacing the Japanese market's average of 4.2%. This growth is bolstered by a robust projection in earnings, expected to surge by 108.75% per year, signaling potential profitability within three years. Despite its current unprofitability and less than three years of financial data, Safie's commitment to innovation could be inferred from its sector performance where it grew revenue by 26.1% over the past year alone. The company's strategic focus may position it well in an evolving tech landscape, especially as it navigates through upcoming quarterly results announced for November 14, 2024.

- Click here to discover the nuances of Safie with our detailed analytical health report.

Understand Safie's track record by examining our Past report.

Seize The Opportunity

- Unlock our comprehensive list of 1267 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002373

China Transinfo Technology

Engages in the transportation and IoT businesses.

Flawless balance sheet with reasonable growth potential.