As global markets navigate a period of economic adjustments, with central banks like the ECB and SNB cutting rates and expectations rising for a Federal Reserve rate cut, investors are keenly observing how these shifts might influence their portfolios. Amidst this backdrop, dividend stocks present an attractive option for those looking to secure steady income streams, especially when yields can reach up to 5%. In such fluctuating market conditions, selecting dividend stocks with strong fundamentals and consistent payout histories becomes crucial for maintaining financial stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.19% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1869 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

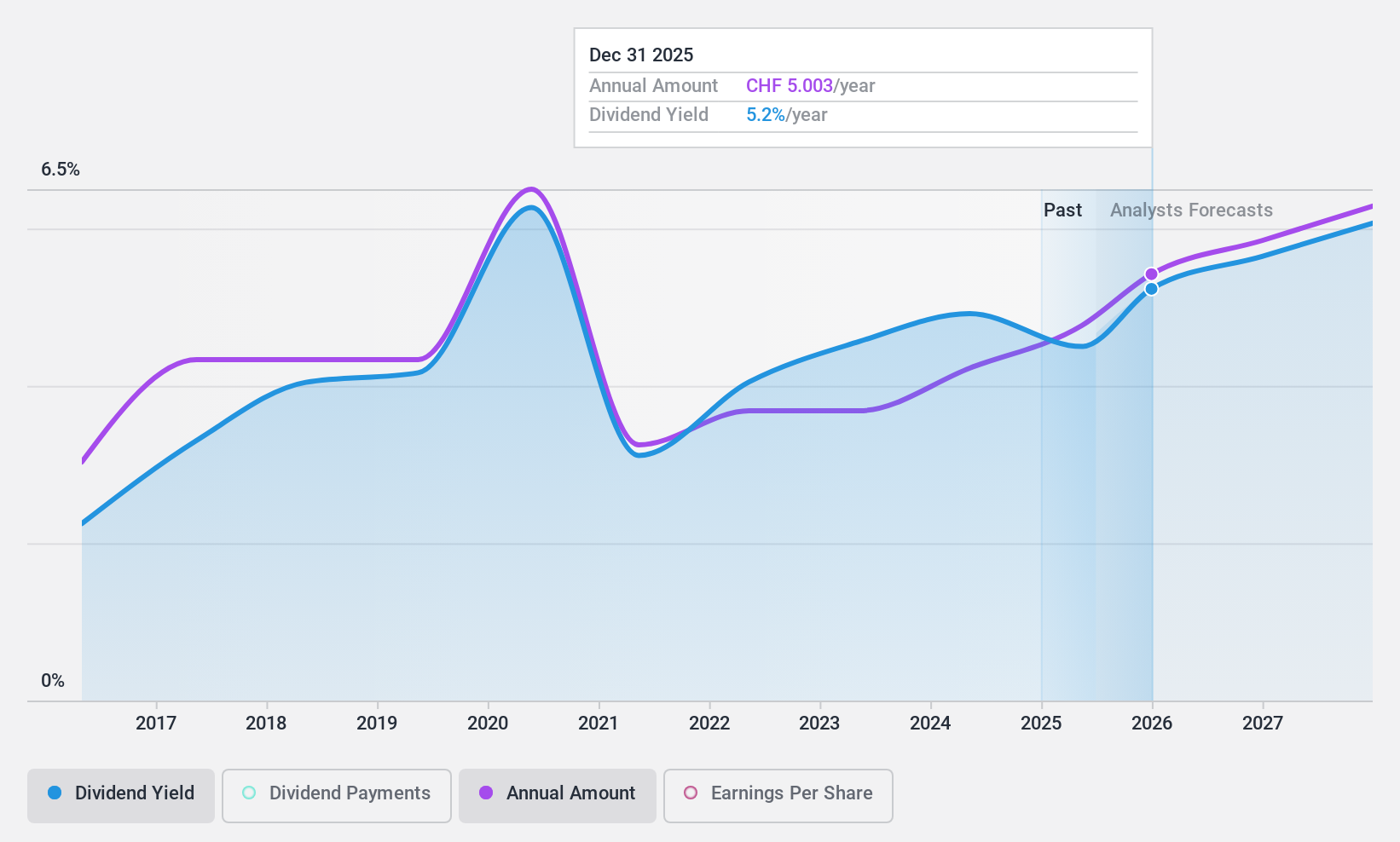

Orell Füssli (SWX:OFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orell Füssli AG operates in security solutions and book retailing both in Switzerland and internationally, with a market cap of CHF150.92 million.

Operations: Orell Füssli AG's revenue segments include Book Trade at CHF118.52 million, Security Printing at CHF75.94 million, and Industrial Systems at CHF21.24 million.

Dividend Yield: 5.1%

Orell Füssli's dividend payments have been volatile over the past nine years, with a payout ratio of 86.9% indicating coverage by earnings, while a cash payout ratio of 33% suggests strong cash flow support. Despite its unstable dividend history, the company's yield is in the top 25% for Swiss market payers at 5.06%. Trading significantly below fair value estimates, Orell Füssli presents potential for value-focused investors seeking income.

- Get an in-depth perspective on Orell Füssli's performance by reading our dividend report here.

- Our valuation report here indicates Orell Füssli may be undervalued.

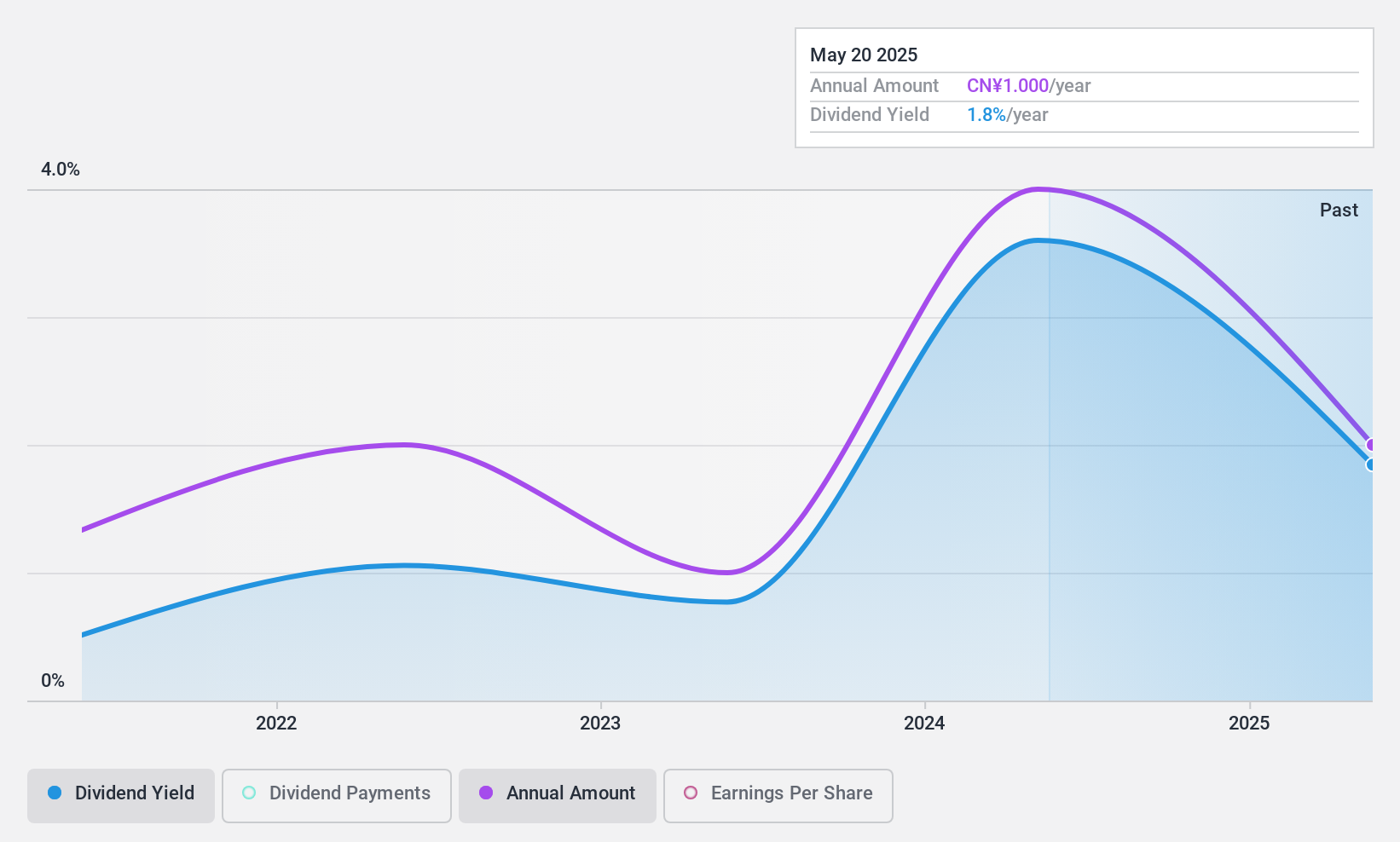

Chengdu Kanghua Biological Products (SZSE:300841)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Kanghua Biological Products Co., Ltd. is a company engaged in the research, development, production, and sale of biological products with a market cap of CN¥7.53 billion.

Operations: The revenue segments for Chengdu Kanghua Biological Products Co., Ltd. are not specified in the provided text.

Dividend Yield: 3.5%

Chengdu Kanghua Biological Products has a top-tier dividend yield of 3.45% in the Chinese market, with dividends covered by earnings and cash flows, featuring payout ratios of 48.6% and 62.8%, respectively. However, its four-year dividend history shows volatility and unreliability. Recent earnings growth of 12.9% reflects solid financial performance, while trading at 34.8% below estimated fair value might appeal to value investors despite the recent acquisition activity affecting its ownership structure.

- Navigate through the intricacies of Chengdu Kanghua Biological Products with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Chengdu Kanghua Biological Products is trading behind its estimated value.

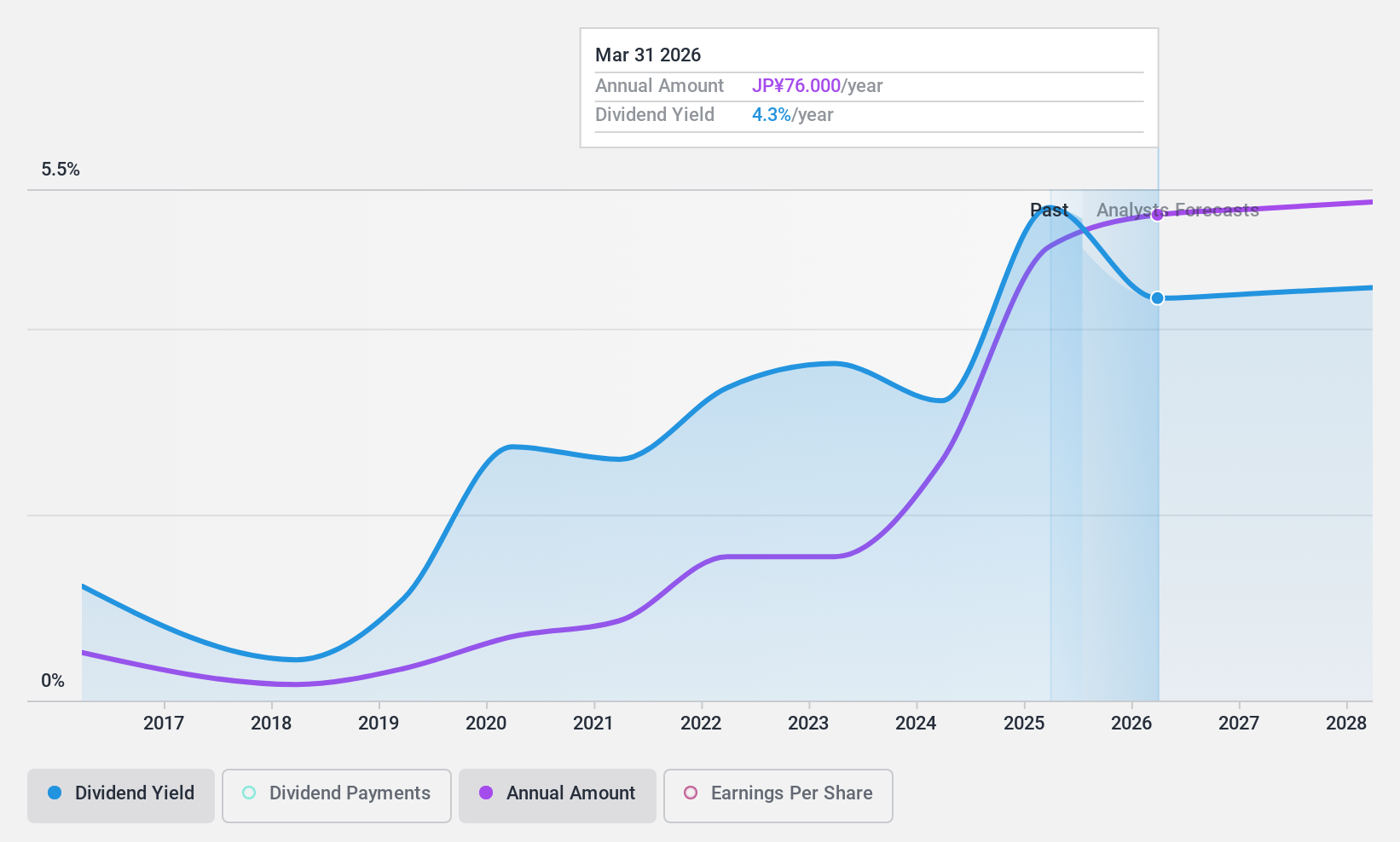

TOA (TSE:1885)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TOA Corporation offers construction and engineering services in Japan with a market cap of ¥93.78 billion.

Operations: TOA Corporation's revenue is primarily derived from its Domestic Civil Engineering Business, which accounts for ¥138.17 billion, and its Domestic Construction Business, contributing ¥99.24 billion, with additional income from Foreign Operations totaling ¥51.73 billion.

Dividend Yield: 4.6%

TOA Corporation's dividend yield ranks in the top 25% of Japan's market, supported by low payout ratios of 25.1% for earnings and 33.3% for cash flows, indicating strong coverage. The company raised its annual dividend forecast to JPY 54 per share following a stock split, reflecting improved financial guidance with increased profits expected. Despite historical volatility in dividends and share price, current trading suggests good relative value compared to peers and industry standards.

- Click to explore a detailed breakdown of our findings in TOA's dividend report.

- According our valuation report, there's an indication that TOA's share price might be on the cheaper side.

Seize The Opportunity

- Unlock our comprehensive list of 1869 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300841

Chengdu Kanghua Biological Products

Chengdu Kanghua Biological Products Co., Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives