- China

- /

- Interactive Media and Services

- /

- SZSE:000681

Top Growth Companies With Insider Ownership For December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating interest rates and mixed economic signals, growth stocks have continued to outperform value stocks, with the Nasdaq Composite reaching new heights. In this environment, companies with high insider ownership often attract attention for their potential alignment of management interests with shareholders, offering a compelling case for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's explore several standout options from the results in the screener.

Visual China GroupLtd (SZSE:000681)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visual China Group Co., Ltd., along with its subsidiaries, offers internet media and related services both within China and globally, with a market capitalization of approximately CN¥21 billion.

Operations: Visual China Group Co., Ltd. generates its revenue through the provision of internet media and related services across domestic and international markets.

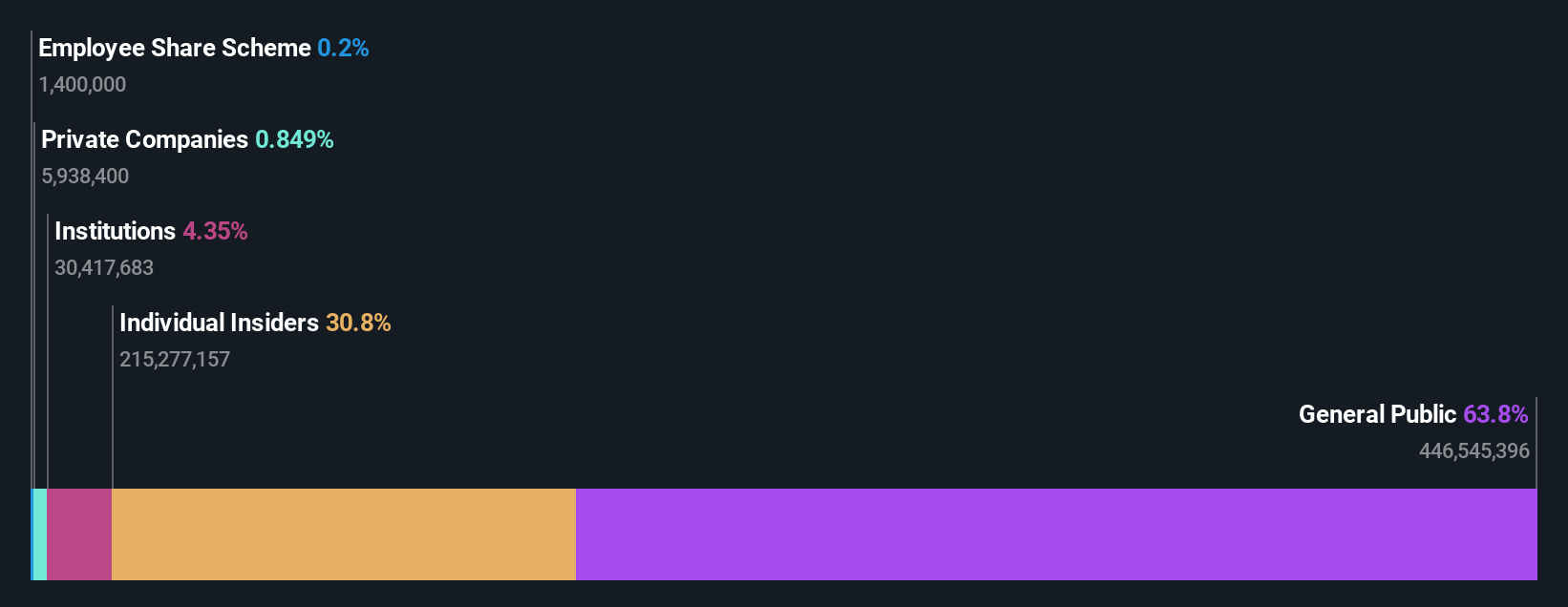

Insider Ownership: 31.6%

Visual China Group Ltd. has demonstrated a mixed financial performance with revenue increasing to CNY 608.03 million for the first nine months of 2024, yet net income declined from the previous year. Despite lower profit margins, earnings are forecast to grow significantly at 28.7% annually, outpacing the Chinese market average. The company recently held shareholder meetings to amend employee stock plans and elect directors, reflecting active management involvement but lacks recent insider trading activity information.

- Get an in-depth perspective on Visual China GroupLtd's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Visual China GroupLtd is priced higher than what may be justified by its financials.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co.Ltd, along with its subsidiaries, engages in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally with a market cap of CN¥20.63 billion.

Operations: Revenue segments for the company include intelligent controller products, which are developed, manufactured, sold, and marketed domestically and internationally.

Insider Ownership: 16.2%

Shenzhen H&T Intelligent Control Ltd. shows strong growth potential with earnings forecasted to grow significantly at 38.7% annually, surpassing the Chinese market average. The company reported increased revenue of CNY 7.04 billion for the first nine months of 2024, although profit margins have decreased from last year. Despite a volatile share price and modest dividend coverage by free cash flow, insider ownership remains high with no recent substantial insider trading activity noted.

- Dive into the specifics of Shenzhen H&T Intelligent ControlLtd here with our thorough growth forecast report.

- Our valuation report here indicates Shenzhen H&T Intelligent ControlLtd may be overvalued.

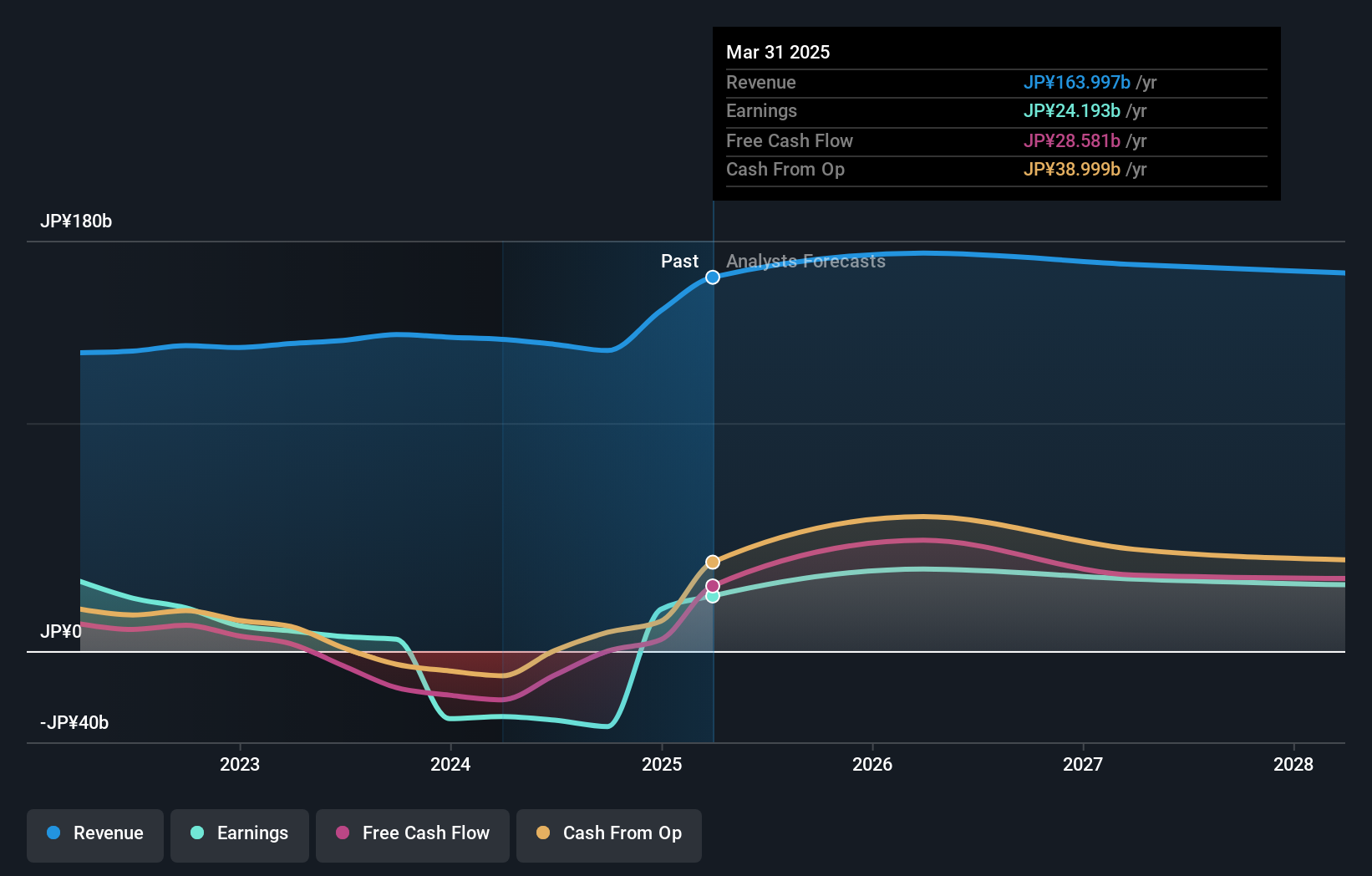

DeNA (TSE:2432)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DeNA Co., Ltd. develops and operates mobile and online services worldwide, with a market cap of ¥298.93 billion.

Operations: The company's revenue is primarily derived from its Game Business at ¥50.20 billion, Sports Businesses at ¥27.56 billion, Livestreaming Business at ¥41.37 billion, and Healthcare & Medical Business at ¥9.77 billion.

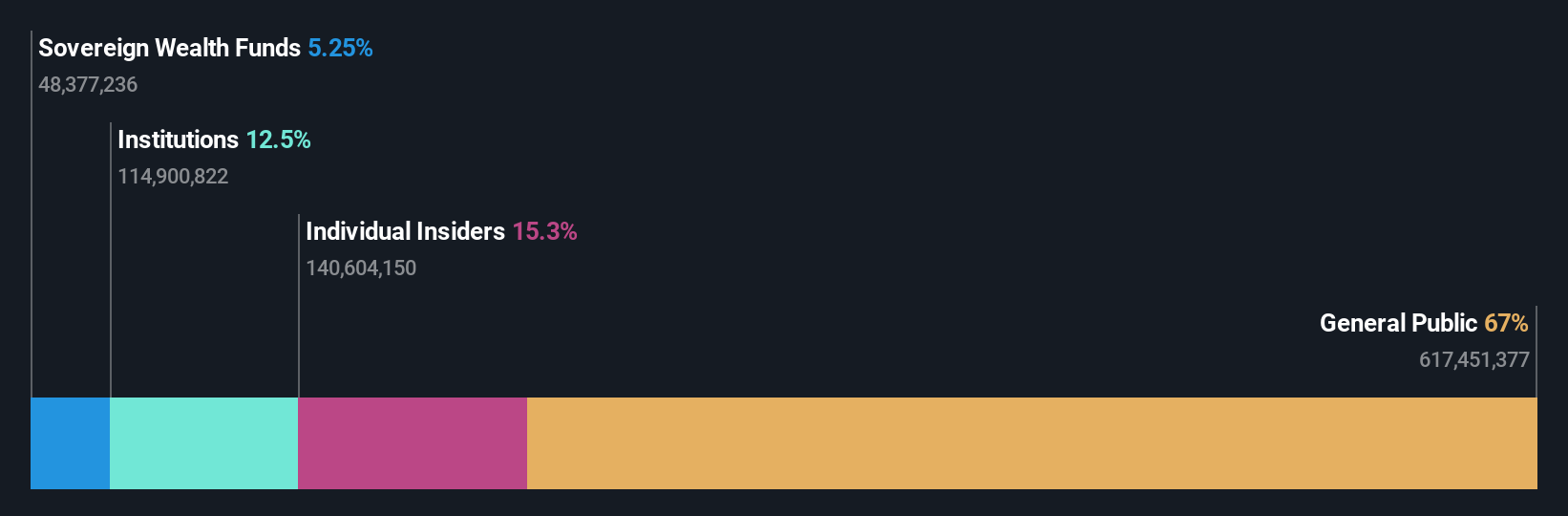

Insider Ownership: 21.1%

DeNA's earnings are forecast to grow significantly at 89.21% annually, with revenue expected to rise by 4.8% per year, outpacing the Japanese market average. Although its Return on Equity is projected to be low at 5.4%, the company is anticipated to become profitable within three years. Despite recent share price volatility and no substantial insider trading activity in the past three months, insider ownership remains significant, indicating confidence in long-term growth prospects.

- Click here to discover the nuances of DeNA with our detailed analytical future growth report.

- The analysis detailed in our DeNA valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Reveal the 1529 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000681

Visual China GroupLtd

Provides internet media and other services in China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives