Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate cuts from the ECB and SNB, alongside expectations for a potential Fed rate cut, small-cap stocks like those in the Russell 2000 have faced challenges, underperforming against larger indices such as the S&P 500. Despite this backdrop of economic uncertainty and cooling labor markets, opportunities still exist within smaller companies that exhibit strong fundamentals and resilience. In this context, identifying undiscovered gems with robust growth potential can be particularly rewarding for investors seeking diversification and long-term value in their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Guangdong Rifeng Electric Cable (SZSE:002953)

Simply Wall St Value Rating: ★★★★★☆

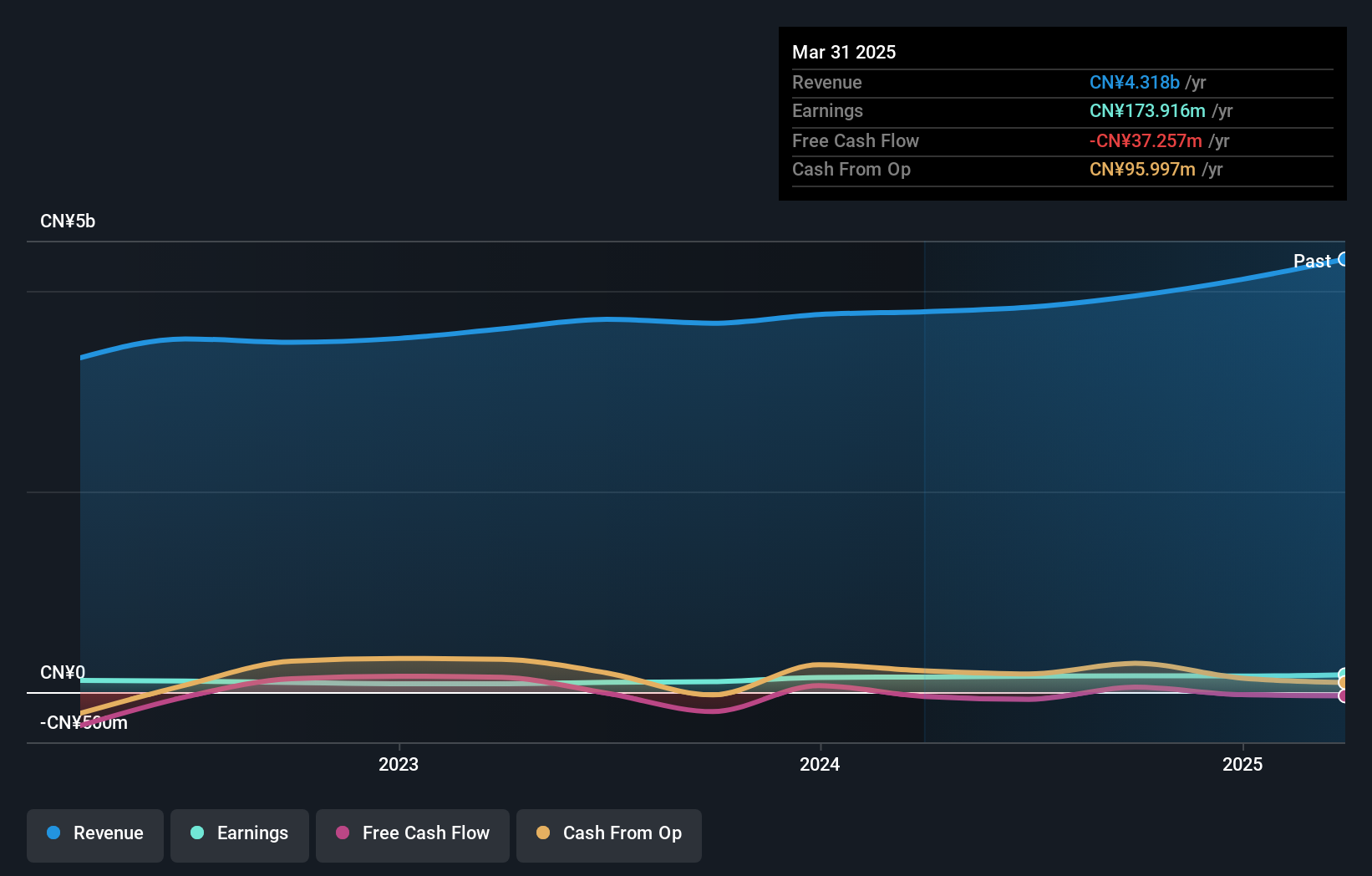

Overview: Guangdong Rifeng Electric Cable Co., Ltd. operates in the electric cable industry, focusing on the production and distribution of wire and cable products, with a market cap of CN¥6.63 billion.

Operations: Rifeng Electric Cable generates revenue primarily from its wire and cable products, totaling CN¥3.95 billion.

Guangdong Rifeng Electric Cable, a relatively small player in the electrical industry, has shown notable progress. Over the past year, its earnings surged by 57%, outpacing the industry's average growth of 1.1%. The company's net profit margin stands at 4.1% for nine months ending September 2024, with sales reaching CNY 3.06 billion compared to CNY 2.88 billion last year. A recent private placement aims to raise approximately CNY 230 million through issuing new shares at CNY 6.73 each, while a buyback program saw repurchases totaling around CNY 32 million in October alone, reflecting strategic financial maneuvers aimed at enhancing shareholder value and future growth potential.

- Click here and access our complete health analysis report to understand the dynamics of Guangdong Rifeng Electric Cable.

Learn about Guangdong Rifeng Electric Cable's historical performance.

Japan System Techniques (TSE:4323)

Simply Wall St Value Rating: ★★★★★★

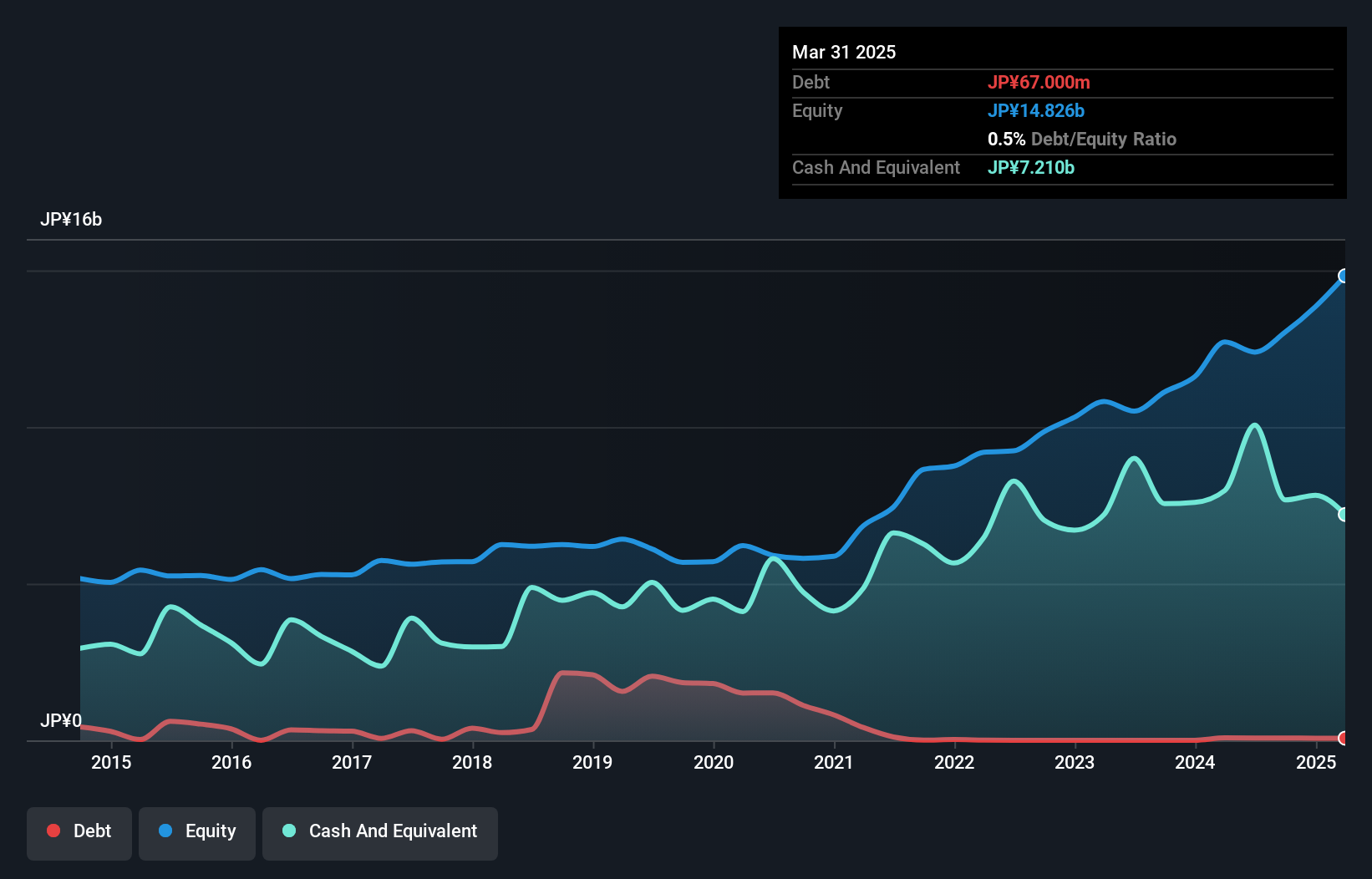

Overview: Japan System Techniques Co., Ltd. operates in the software industry both domestically and internationally, with a market capitalization of ¥49.94 billion.

Operations: Japan System Techniques Co., Ltd. generates revenue primarily from its DX & SI Business, contributing ¥16.29 billion, followed by the Packaging Business at ¥5.25 billion and Global Business at ¥3.07 billion. The Medical Care Big Data Business adds another ¥2.86 billion to its revenue streams.

Japan System Techniques (JAST) stands out with a notable reduction in its debt to equity ratio, from 32.4% to 0.5% over five years, reflecting a solid financial foundation. The company has outpaced the software industry with earnings growth of 24.9%, compared to the industry's 12.7%. JAST's recent initiatives include launching a digital certificate system for universities and integrating AI-driven voicebots in call centers, enhancing operational efficiency and service delivery. Despite these advancements, the stock has experienced high volatility recently, which investors should consider when evaluating this promising tech player from Japan's vibrant market landscape.

Oiles (TSE:6282)

Simply Wall St Value Rating: ★★★★★★

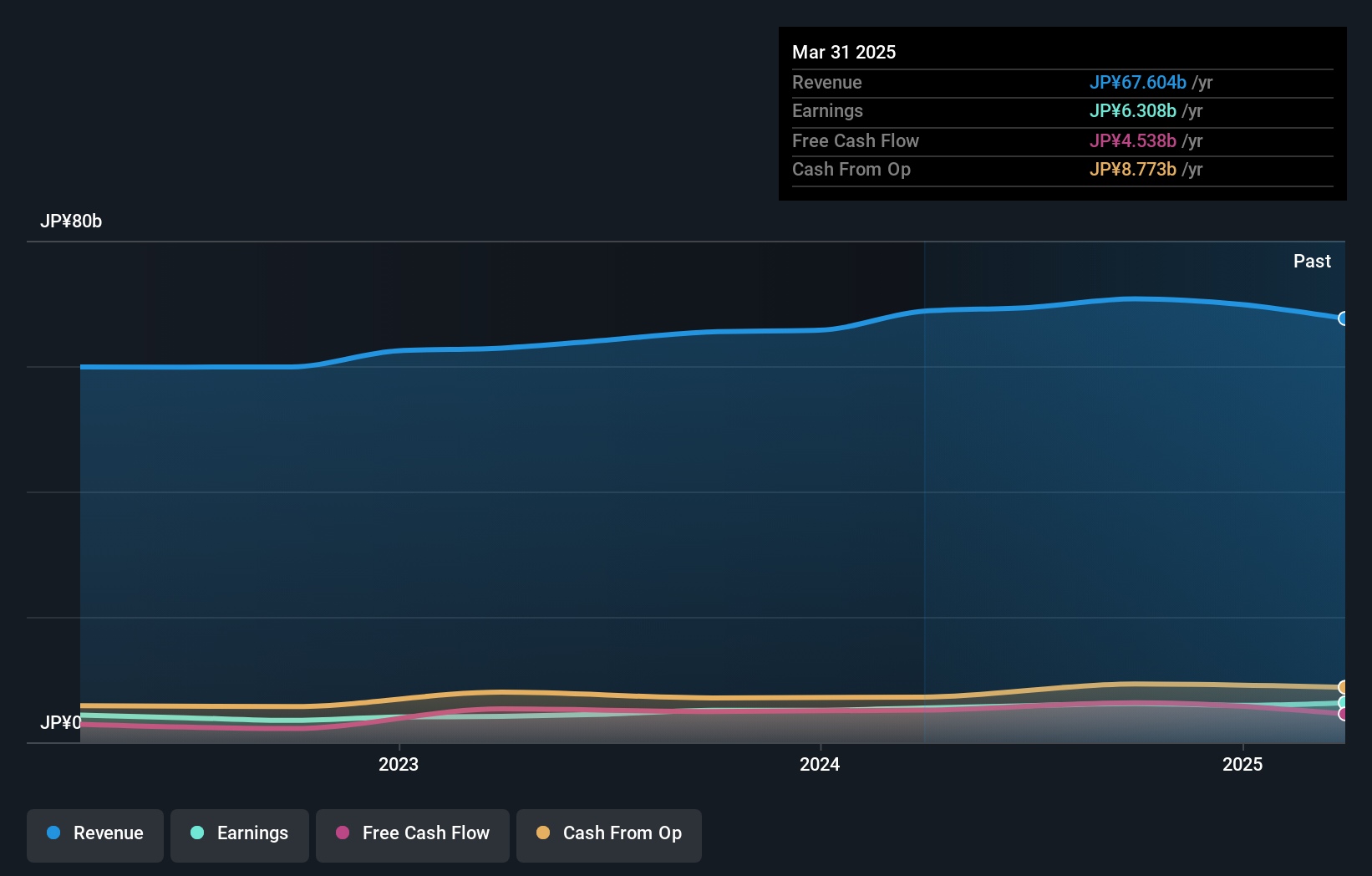

Overview: Oiles Corporation is a company that specializes in manufacturing and selling bearings, structural equipment, and construction equipment both in Japan and internationally, with a market cap of ¥76.12 billion.

Operations: Oiles Corporation generates revenue primarily from its Automotive Bearing Equipment and General Bearing Equipment segments, contributing ¥33.76 billion and ¥14.48 billion, respectively. The Structural Equipment segment adds ¥13.82 billion to the revenue stream, while Construction Equipment accounts for ¥6.20 billion.

Oiles, a small player in its sector, has demonstrated notable financial discipline with its debt to equity ratio shrinking from 10% to 2.1% over five years. This improvement is complemented by robust earnings growth of 20.4%, outpacing the industry's modest 0.8%. The company is trading at a significant discount, around 68.7% below estimated fair value, which could suggest potential upside for investors seeking undervalued opportunities. Recently, Oiles announced a share buyback program aiming to repurchase up to one million shares worth ¥2 billion by April 2025, likely enhancing shareholder returns and capital efficiency further.

- Unlock comprehensive insights into our analysis of Oiles stock in this health report.

Gain insights into Oiles' historical performance by reviewing our past performance report.

Taking Advantage

- Investigate our full lineup of 4621 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6282

Oiles

Manufactures and sells bearings, structural equipment, and construction equipment in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives