Densan System Holdings (TSE:4072) Has Announced That It Will Be Increasing Its Dividend To ¥40.00

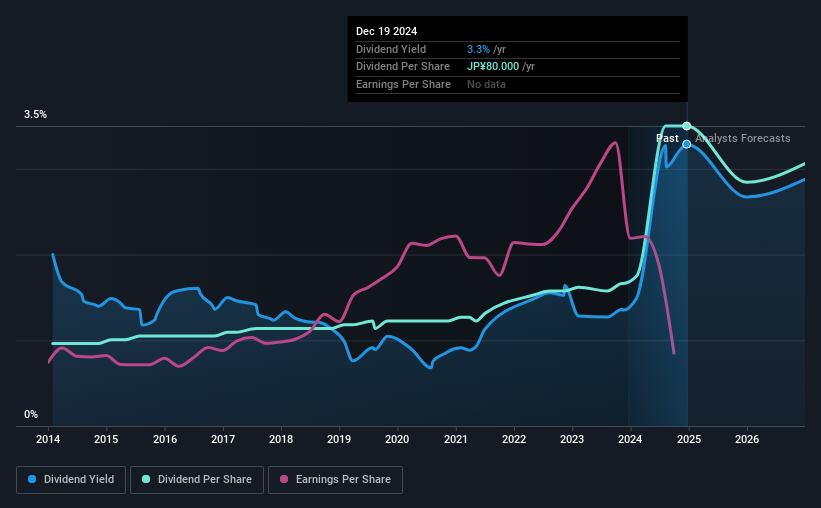

Densan System Holdings Co., Ltd.'s (TSE:4072) dividend will be increasing from last year's payment of the same period to ¥40.00 on 27th of March. This makes the dividend yield 3.3%, which is above the industry average.

View our latest analysis for Densan System Holdings

Densan System Holdings' Payment Could Potentially Have Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. However, prior to this announcement, Densan System Holdings' dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

The next year is set to see EPS grow by 33.2%. If the dividend continues on this path, the payout ratio could be 64% by next year, which we think can be pretty sustainable going forward.

Densan System Holdings Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2014, the annual payment back then was ¥22.00, compared to the most recent full-year payment of ¥80.00. This means that it has been growing its distributions at 14% per annum over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. Densan System Holdings' EPS has fallen by approximately 13% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

Our Thoughts On Densan System Holdings' Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 2 warning signs for Densan System Holdings that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4072

Densan System Holdings

Provides information and collection agency services in Japan.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)