Densan System Holdings Co., Ltd.'s (TSE:4072) 25% Jump Shows Its Popularity With Investors

The Densan System Holdings Co., Ltd. (TSE:4072) share price has done very well over the last month, posting an excellent gain of 25%. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

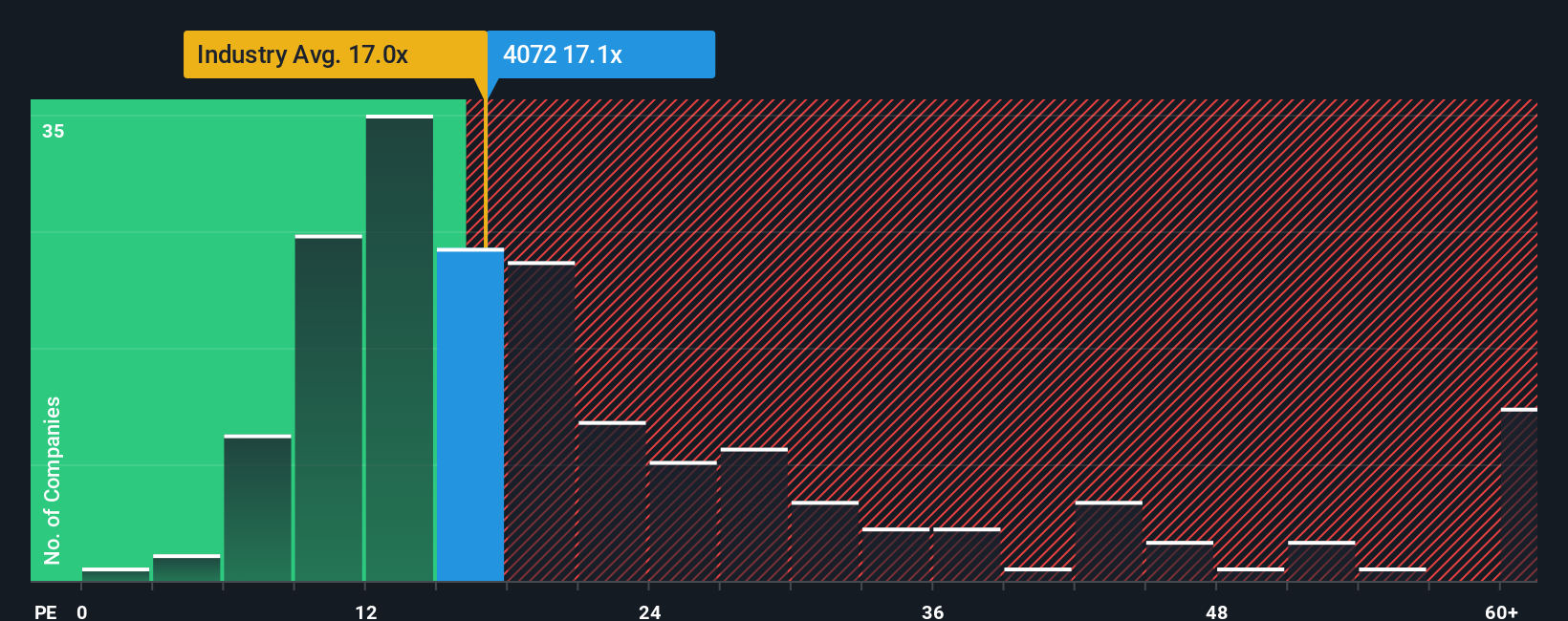

After such a large jump in price, Densan System Holdings may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 17.1x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 10x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Densan System Holdings has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Densan System Holdings

Is There Enough Growth For Densan System Holdings?

The only time you'd be truly comfortable seeing a P/E as high as Densan System Holdings' is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 18%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 22% per annum as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 9.5% per annum growth forecast for the broader market.

In light of this, it's understandable that Densan System Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Densan System Holdings' P/E?

The large bounce in Densan System Holdings' shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Densan System Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Densan System Holdings that you should be aware of.

If you're unsure about the strength of Densan System Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4072

Densan System Holdings

Provides information and collection agency services in Japan.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)