There's Reason For Concern Over CHANGE Holdings,Inc.'s (TSE:3962) Massive 25% Price Jump

CHANGE Holdings,Inc. (TSE:3962) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 7.9% isn't as impressive.

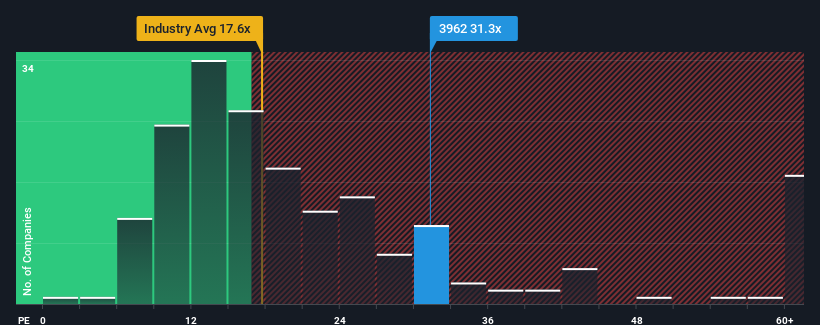

Following the firm bounce in price, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider CHANGE HoldingsInc as a stock to avoid entirely with its 31.3x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that CHANGE HoldingsInc's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for CHANGE HoldingsInc

Is There Enough Growth For CHANGE HoldingsInc?

In order to justify its P/E ratio, CHANGE HoldingsInc would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 51%. As a result, earnings from three years ago have also fallen 19% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 12% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that CHANGE HoldingsInc is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Shares in CHANGE HoldingsInc have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of CHANGE HoldingsInc revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for CHANGE HoldingsInc you should know about.

Of course, you might also be able to find a better stock than CHANGE HoldingsInc. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3962

CHANGE HoldingsInc

Engages in the digital transformation (DX) business in Japan.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)