High Growth Tech Stocks With Promising Potential In Global Markets

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by dovish Federal Reserve signals and mixed economic indicators, small-cap stocks have notably outperformed larger counterparts, with the Russell 2000 Index advancing significantly. In this environment, where technology shares are rebounding amid renewed optimism about growth potential, identifying high-growth tech stocks involves looking for companies that can leverage technological advancements and adapt to shifting market dynamics effectively.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Gold Circuit Electronics | 28.44% | 34.07% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 36.20% | 52.06% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

NextVision Stabilized Systems (TASE:NXSN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NextVision Stabilized Systems, Ltd. specializes in developing, manufacturing, and marketing stabilized day and night photography solutions for ground and aerial vehicles globally, with a market cap of ₪12.77 billion.

Operations: The company generates revenue primarily from its electronic security devices segment, amounting to $151.04 million.

NextVision Stabilized Systems has demonstrated robust financial health, with third-quarter sales soaring to $47.29 million from $29.15 million the previous year, reflecting a significant revenue uptick. The company's net income also impressively climbed to $28.17 million, up from $18.02 million, underpinning a strong profit trajectory with basic earnings per share rising from $0.2253 to $0.3409 in the same period. This performance is bolstered by strategic client engagements and recent inclusion in major indices like TA-35 and FTSE All-World, which could enhance its market visibility and investor confidence moving forward.

- Click here and access our complete health analysis report to understand the dynamics of NextVision Stabilized Systems.

Learn about NextVision Stabilized Systems' historical performance.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: I'LL Inc. is a Japanese company specializing in system solutions, with a market capitalization of ¥59.45 billion.

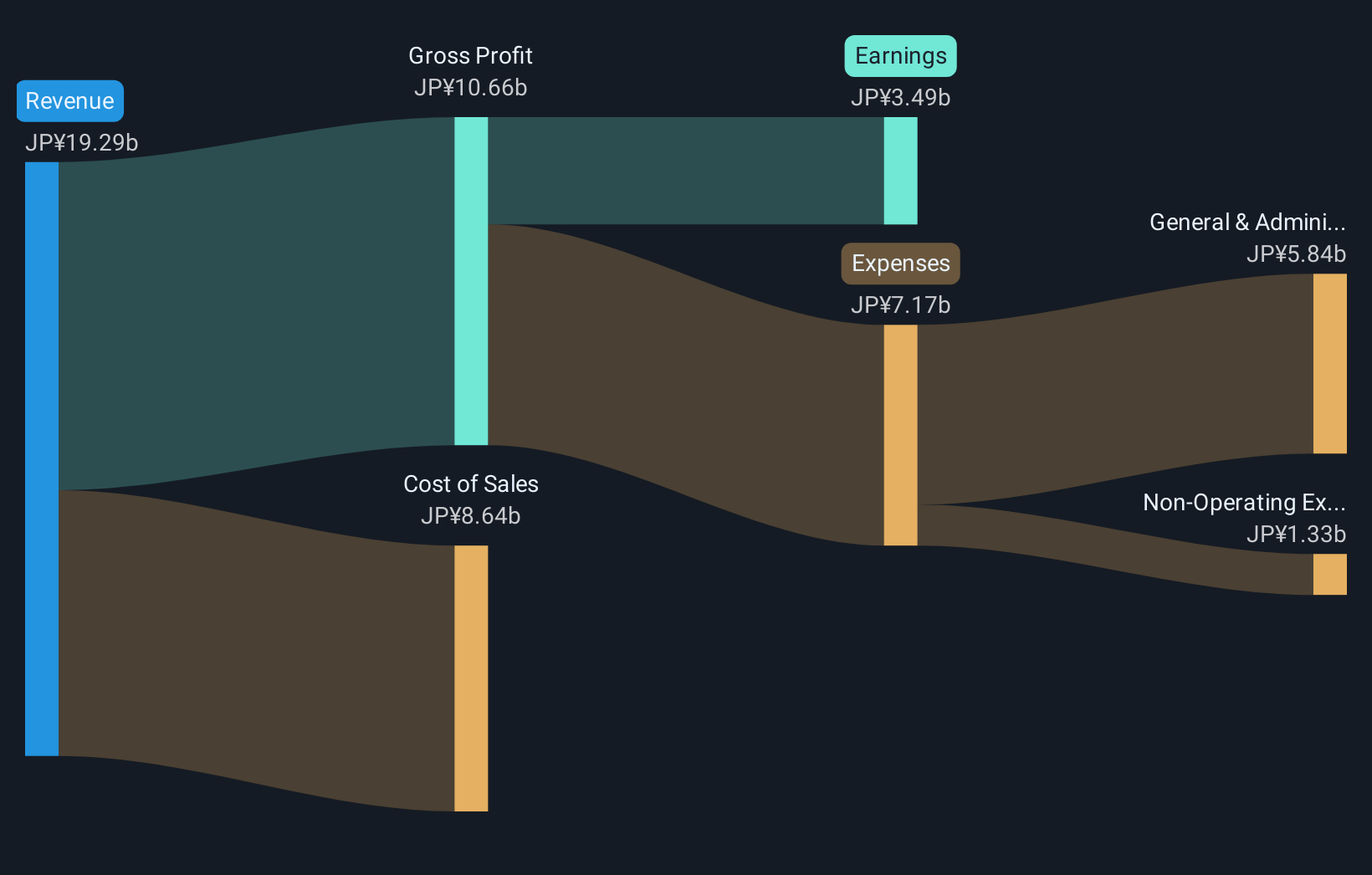

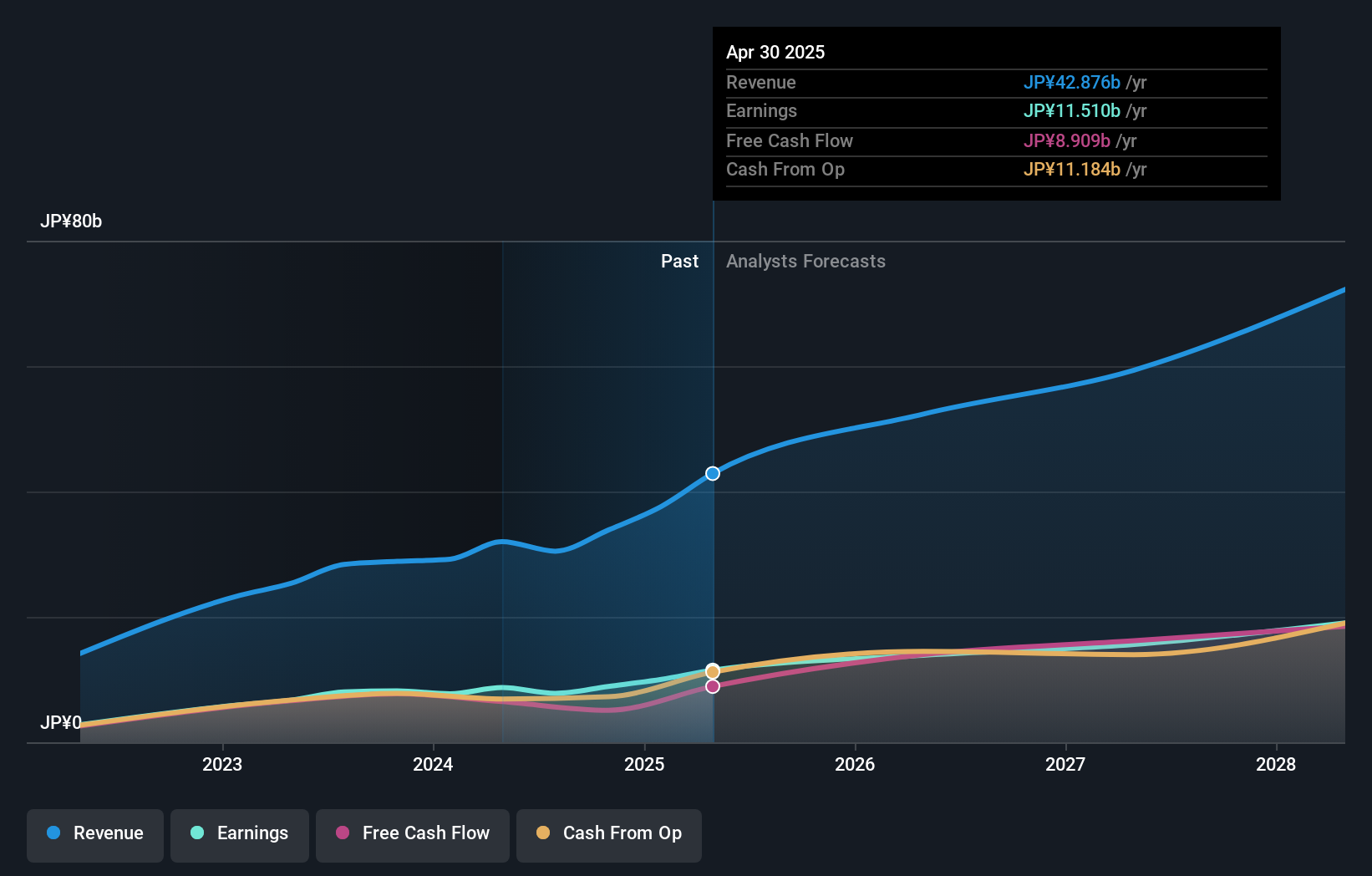

Operations: The company focuses on providing system solutions in Japan, generating revenue primarily from computer services, which amount to ¥19.29 billion.

I'LL Inc. is navigating the competitive tech landscape with a strategic focus on R&D, earmarking significant funds to fuel innovation and maintain its competitive edge. In the last fiscal year, R&D expenses reached JPY 2.1 billion, accounting for approximately 9.5% of total revenue, reflecting a commitment to evolving its tech offerings in line with market demands. This investment supports I'LL's robust revenue growth forecast of 8.4% annually, outpacing the Japanese market average of 4.5%. Additionally, recent corporate activities including dividend increases and detailed earnings guidance suggest proactive management in shareholder engagement and financial planning, projecting an operating profit jump to JPY 6.312 billion by July 2028.

- Get an in-depth perspective on I'LL's performance by reading our health report here.

Explore historical data to track I'LL's performance over time in our Past section.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company operating both in Japan and internationally, with a market capitalization of approximately ¥365.96 billion.

Operations: The company generates revenue through its entertainment operations, primarily focusing on digital content and virtual talent management. It operates both domestically in Japan and internationally, leveraging its diverse portfolio to capture a broad audience. With a market cap of approximately ¥365.96 billion, the business model emphasizes innovation within the digital entertainment sector.

ANYCOLOR Inc. is capitalizing on the expanding virtual entertainment sector, with a recent upward revision in earnings guidance signaling robust performance and strategic execution. The company's R&D commitment is evident from its investment in new VTuber initiatives and merchandising strategies that have significantly boosted engagement and revenue outcomes, leading to an expected increase in annual profits by 11.7%. With revenue growth projected at 12.2% per year, ANYCOLOR outpaces the Japanese market forecast of 4.5%. This growth trajectory is supported by innovative live events like the NIJISANJI WORLD TOUR 2025, which surpassed expectations, demonstrating ANYCOLOR's effective adaptation to market dynamics and consumer preferences.

- Dive into the specifics of ANYCOLOR here with our thorough health report.

Gain insights into ANYCOLOR's past trends and performance with our Past report.

Next Steps

- Reveal the 246 hidden gems among our Global High Growth Tech and AI Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3854

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026