As global markets navigate a landscape marked by fluctuating corporate earnings, AI competition concerns, and central bank rate decisions, investors are keenly observing the performance of major indices. Amidst this volatility, dividend stocks continue to attract attention for their potential to provide steady income streams and resilience in uncertain times. In light of these market dynamics, selecting dividend stocks with strong fundamentals and consistent payout histories can be a strategic approach for investors seeking stability and income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.74% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.13% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.48% | ★★★★★★ |

Click here to see the full list of 1944 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

SRA Holdings (TSE:3817)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SRA Holdings, Inc. operates in systems development, operation/administration, and product solutions marketing both in Japan and internationally, with a market cap of ¥55.65 billion.

Operations: SRA Holdings generates revenue from Sales Business (¥16.91 billion), Operation/Construction Business (¥6.72 billion), and Construction in Progress - Development (¥25.32 billion).

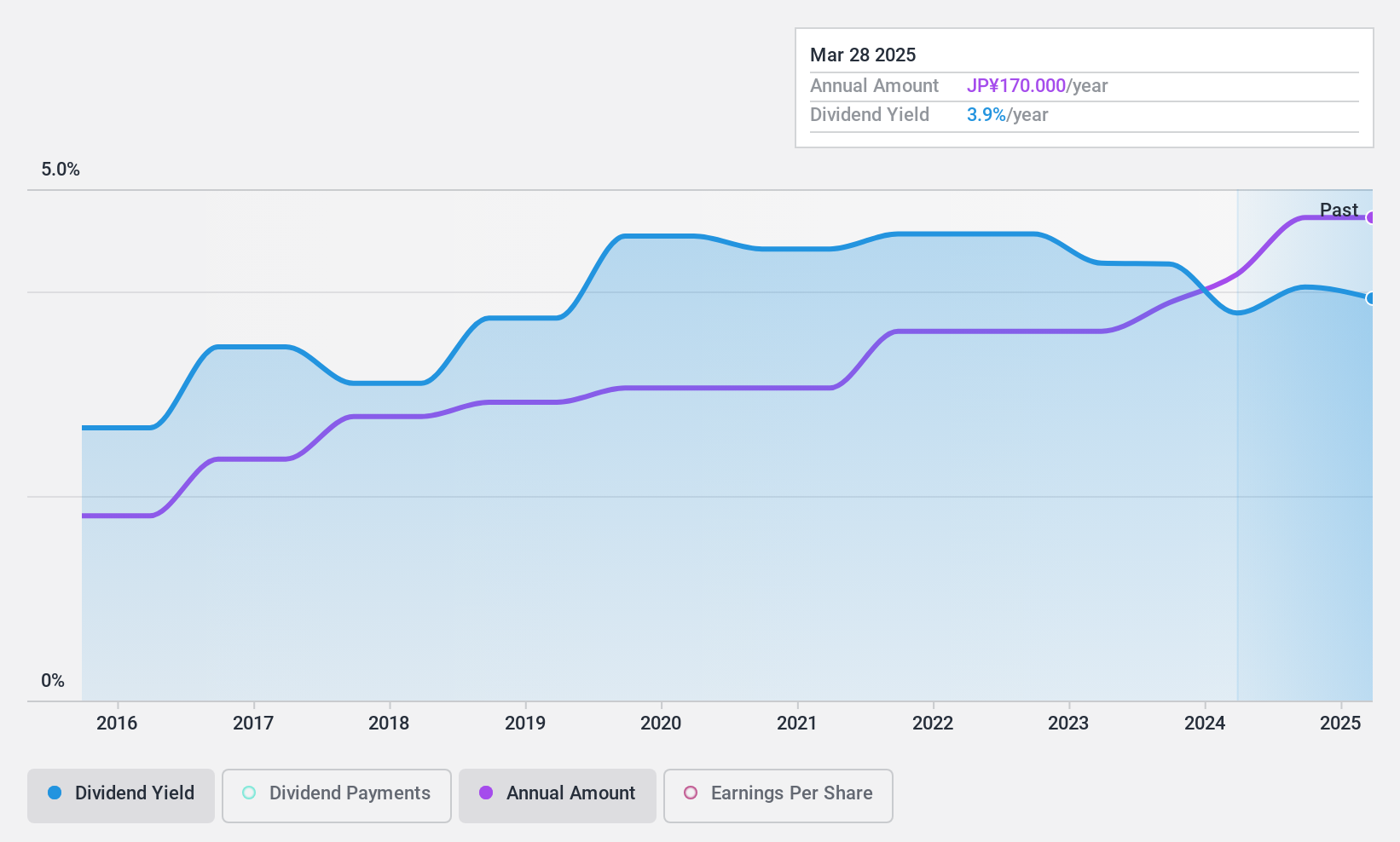

Dividend Yield: 3.8%

SRA Holdings offers a stable dividend profile, with consistent growth and reliability over the past decade. The dividend yield of 3.8% ranks in the top 25% of Japan's market, supported by a reasonable payout ratio of 66.7% from earnings and an 87.9% cash payout ratio. Earnings have surged by over two times in the past year, enhancing dividend sustainability. Its price-to-earnings ratio of 15x suggests good value compared to industry peers.

- Dive into the specifics of SRA Holdings here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that SRA Holdings is priced higher than what may be justified by its financials.

Trinity Industrial (TSE:6382)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Trinity Industrial Corporation designs, manufactures, sells, and installs coating plants, machinery, and industrial equipment in Japan with a market cap of ¥18.01 billion.

Operations: Trinity Industrial's revenue is primarily derived from its Equipment Department, contributing ¥29.65 billion, and its Auto Parts Department, which adds ¥10.27 billion.

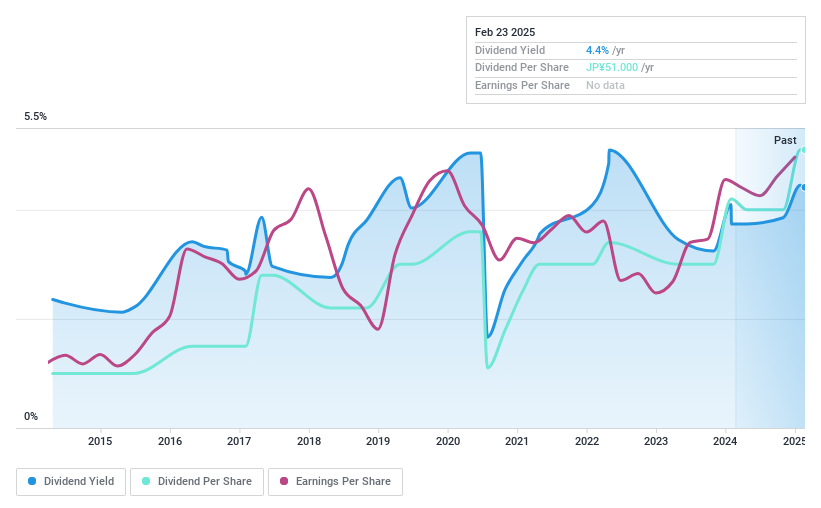

Dividend Yield: 4.5%

Trinity Industrial's dividend yield of 4.47% is among the top 25% in Japan, supported by a low payout ratio of 31.2%. However, dividends have been volatile over the past decade with significant annual drops and are not covered by free cash flows despite recent earnings growth of 9.2%. The stock is attractively valued with a price-to-earnings ratio of 7.9x, well below the market average, though its share price has been highly volatile recently.

- Unlock comprehensive insights into our analysis of Trinity Industrial stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Trinity Industrial shares in the market.

Sangetsu (TSE:8130)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Sangetsu Corporation, along with its subsidiaries, is involved in the planning, development, manufacture, sale, and installation of interior decorating products both in Japan and internationally; it has a market cap of approximately ¥168.67 billion.

Operations: Sangetsu Corporation generates its revenue from various segments, including ¥26.16 billion from abroad, ¥6.39 billion from domestic exterior products, and ¥160.62 billion from domestic interior products, which include space creation.

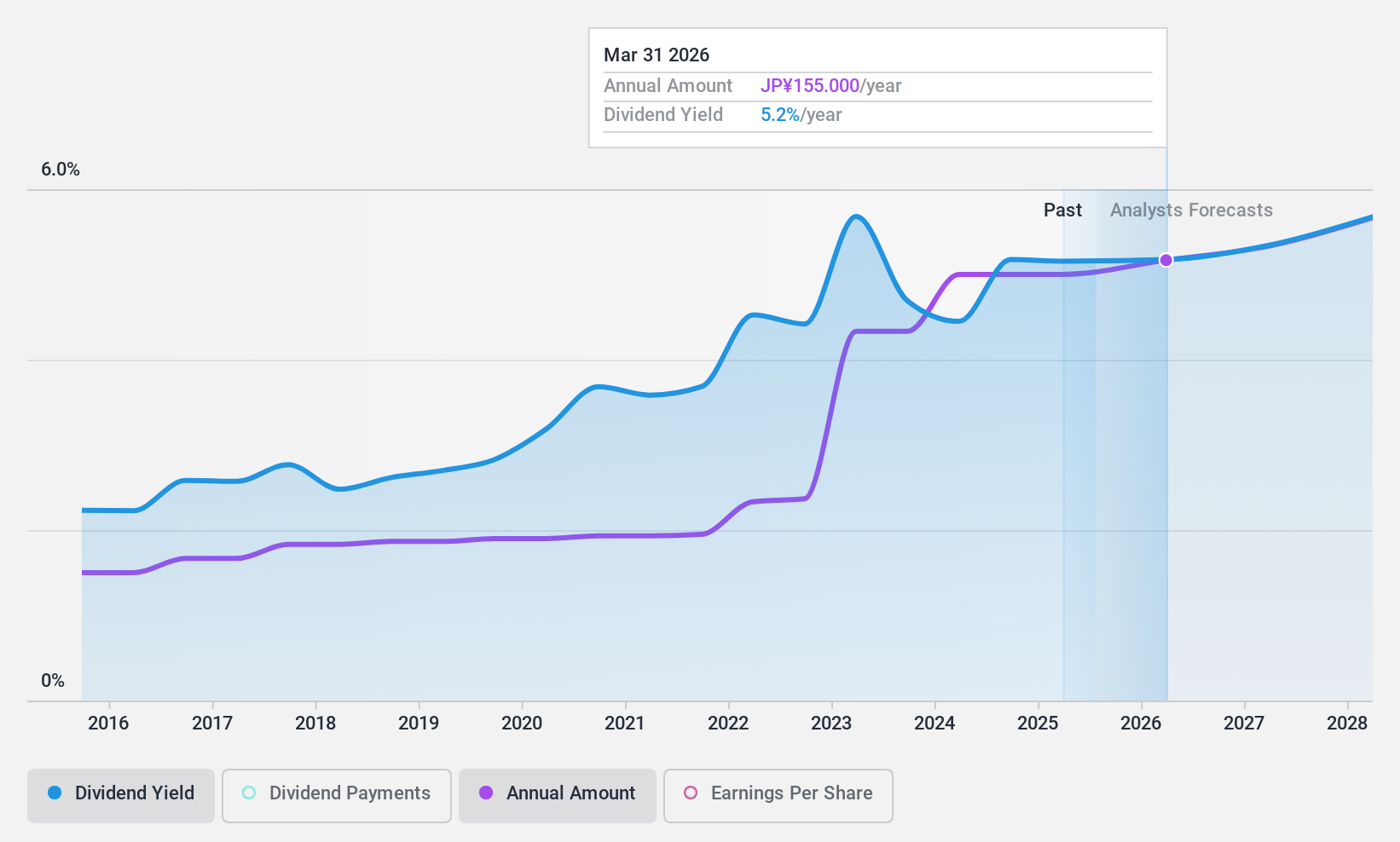

Dividend Yield: 5%

Sangetsu offers a compelling dividend yield of 5.02%, ranking in the top 25% of Japanese dividend payers, with stable and growing dividends over the past decade. The payout ratios are sustainable, covered by earnings (72.4%) and cash flows (68.9%). Recent guidance indicates steady financial performance, expecting net sales of ¥196 billion and operating profit of ¥16 billion for fiscal year ending March 2025. Dividends have increased from ¥65 to ¥75 per share recently, reflecting growth confidence.

- Click here to discover the nuances of Sangetsu with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Sangetsu's current price could be quite moderate.

Seize The Opportunity

- Navigate through the entire inventory of 1944 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3817

SRA Holdings

Engages in the provision of IT consulting, system construction, operation services, products, and solutions in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion