- Japan

- /

- Hospitality

- /

- TSE:3397

Undervalued Japanese Stocks With Intrinsic Value Estimates For September 2024

Reviewed by Simply Wall St

Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index fell by 1.0%. Amid currency headwinds and a hawkish outlook from the Bank of Japan, investors are keenly watching for opportunities in undervalued stocks that offer strong intrinsic value. In this environment, identifying stocks with solid fundamentals and attractive valuations becomes crucial for discerning investors. Here are three Japanese stocks that may be considered undervalued based on their intrinsic value estimates for September 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3440.00 | ¥6748.58 | 49% |

| Kotobuki Spirits (TSE:2222) | ¥1722.50 | ¥3434.73 | 49.9% |

| Stella Chemifa (TSE:4109) | ¥4170.00 | ¥8120.45 | 48.6% |

| I-PEX (TSE:6640) | ¥1493.00 | ¥2887.45 | 48.3% |

| SaizeriyaLtd (TSE:7581) | ¥5130.00 | ¥10119.73 | 49.3% |

| West Holdings (TSE:1407) | ¥2630.00 | ¥5105.11 | 48.5% |

| Infomart (TSE:2492) | ¥323.00 | ¥617.11 | 47.7% |

| Kadokawa (TSE:9468) | ¥2989.00 | ¥5594.98 | 46.6% |

| Adventure (TSE:6030) | ¥3890.00 | ¥7426.83 | 47.6% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2824.00 | ¥5310.68 | 46.8% |

Here's a peek at a few of the choices from the screener.

West Holdings (TSE:1407)

Overview: West Holdings Corporation, with a market cap of ¥104.31 billion, operates in the renewable energy sector both in Japan and internationally through its subsidiaries.

Operations: West Holdings generates revenue from its renewable energy operations within Japan and internationally through its subsidiaries.

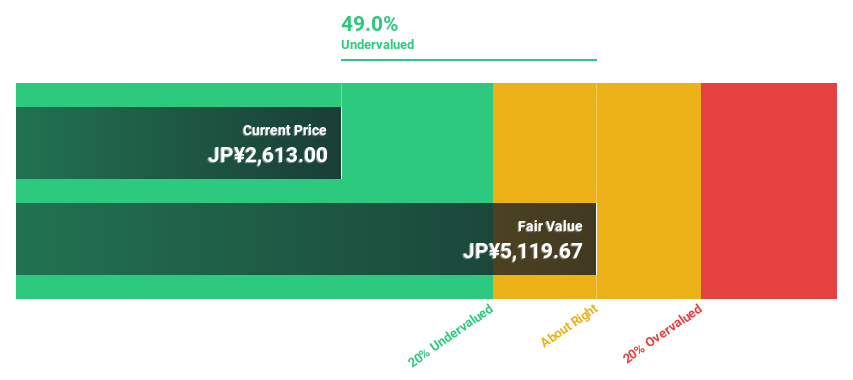

Estimated Discount To Fair Value: 48.5%

West Holdings appears undervalued based on cash flows, trading at ¥2630, which is 48.5% below its estimated fair value of ¥5105.11. Despite debt not being well covered by operating cash flow and a dividend yield of 2.09% that isn't well covered by free cash flows, the company's earnings are forecast to grow significantly at 22.16% per year, outpacing the Japanese market average of 8.7%. Recent buyback activities totaling ¥2.79 billion further indicate management's confidence in the stock's valuation.

- Our comprehensive growth report raises the possibility that West Holdings is poised for substantial financial growth.

- Dive into the specifics of West Holdings here with our thorough financial health report.

TORIDOLL Holdings (TSE:3397)

Overview: TORIDOLL Holdings Corporation operates and manages restaurants in Japan and internationally, with a market cap of ¥312.70 billion.

Operations: TORIDOLL Holdings Corporation's revenue segments include Marugame Seimen at ¥118.26 billion, Overseas Business at ¥97.12 billion, and Domestic Others at ¥29.77 billion.

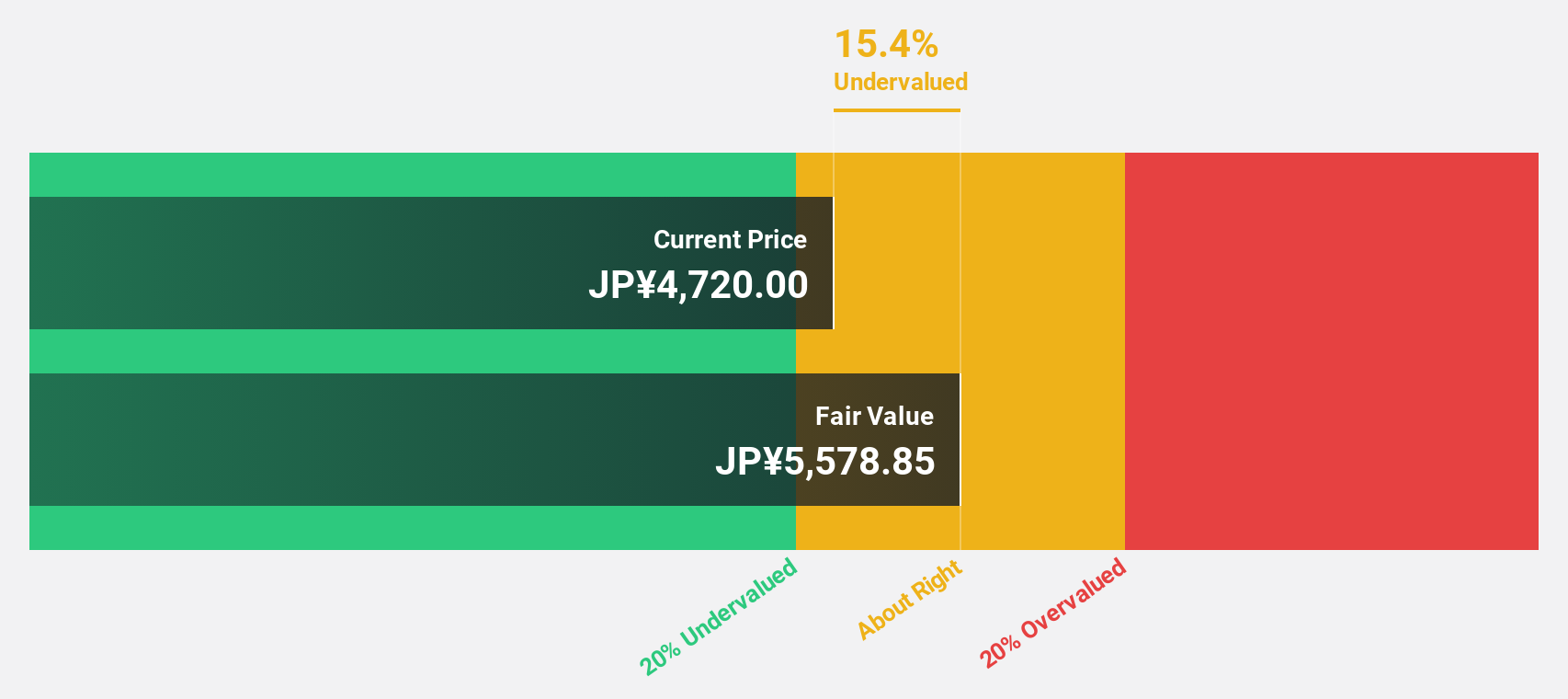

Estimated Discount To Fair Value: 45.8%

TORIDOLL Holdings is trading at ¥3580, significantly below its estimated fair value of ¥6603.34. Despite a low forecasted Return on Equity (11%) in three years and large one-off items impacting financial results, the company's earnings are expected to grow rapidly at 38.1% per year, outpacing the Japanese market's 8.7%. Recent guidance indicates strong performance with fiscal year revenue projected at ¥265 billion and operating profit at ¥14.10 billion for FY2025.

- The analysis detailed in our TORIDOLL Holdings growth report hints at robust future financial performance.

- Take a closer look at TORIDOLL Holdings' balance sheet health here in our report.

SHIFT (TSE:3697)

Overview: SHIFT Inc. provides software quality assurance and testing solutions in Japan, with a market cap of ¥219.55 billion.

Operations: The company generates revenue through its software quality assurance and testing solutions in Japan.

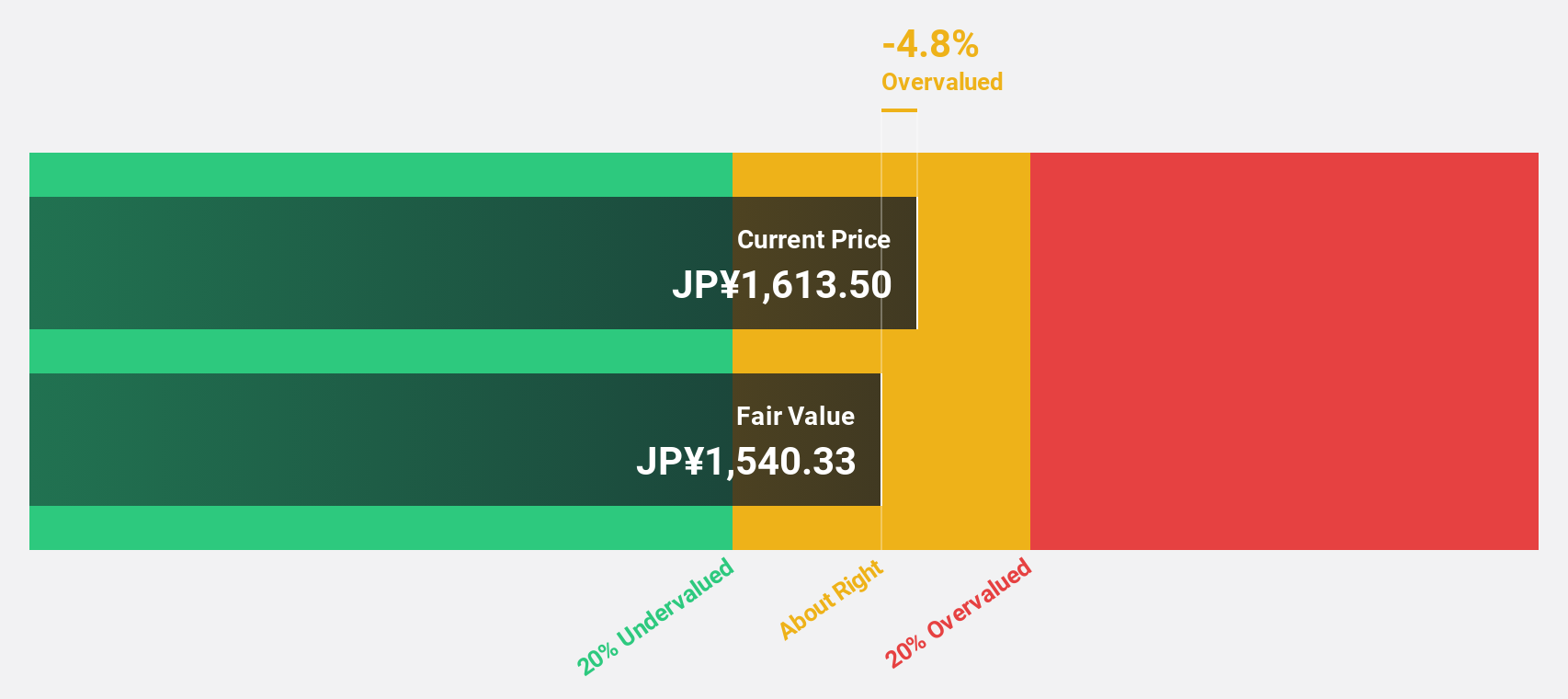

Estimated Discount To Fair Value: 46.6%

SHIFT is trading at ¥12470, significantly below its estimated fair value of ¥23338.51, suggesting it is undervalued based on cash flows. The company's earnings have grown 36.3% per year over the past five years and are forecast to grow 32.21% annually, outpacing the Japanese market's average growth of 8.7%. Despite recent share price volatility, SHIFT's revenue is projected to grow at 19.5% per year, indicating strong future performance potential.

- Our expertly prepared growth report on SHIFT implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of SHIFT stock in this financial health report.

Taking Advantage

- Delve into our full catalog of 78 Undervalued Japanese Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TORIDOLL Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3397

TORIDOLL Holdings

Through its subsidiaries, operates and manages restaurants in Japan and internationally.

Excellent balance sheet with reasonable growth potential.