As global markets experience broad-based gains, with U.S. indexes nearing record highs and positive sentiment driven by strong labor market data, investors are increasingly focused on companies that demonstrate robust growth potential. In this favorable economic climate, stocks with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests, suggesting confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. designs and manufactures passive optical components for both domestic and international markets, with a market cap of CN¥11.72 billion.

Operations: The company generates revenue from its Optoelectronic Devices and Other Electronic Devices segment, amounting to CN¥924.78 million.

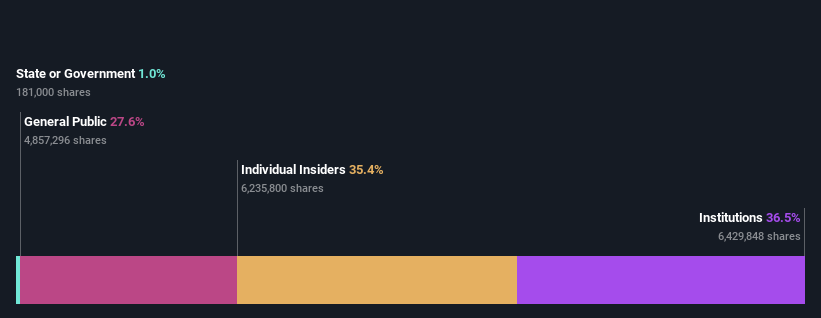

Insider Ownership: 32.1%

Earnings Growth Forecast: 42.1% p.a.

Advanced Fiber Resources (Zhuhai) demonstrates substantial growth potential with earnings projected to increase 42.13% annually, outpacing the CN market's 26.1%. Despite a volatile share price and declining profit margins, revenue is expected to grow at 23.7% per year. Recent financials show sales rising to CNY 738.95 million over nine months, with net income increasing modestly. The company announced a private placement for additional funding and held a meeting on stock incentive plans, indicating strategic moves for future expansion.

- Click here and access our complete growth analysis report to understand the dynamics of Advanced Fiber Resources (Zhuhai).

- Our comprehensive valuation report raises the possibility that Advanced Fiber Resources (Zhuhai) is priced higher than what may be justified by its financials.

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. is a bio-medical company that focuses on the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals both in China and internationally, with a market cap of approximately CN¥50.04 billion.

Operations: The company's revenue is primarily derived from its in vitro diagnostic segment, amounting to CN¥4.44 billion.

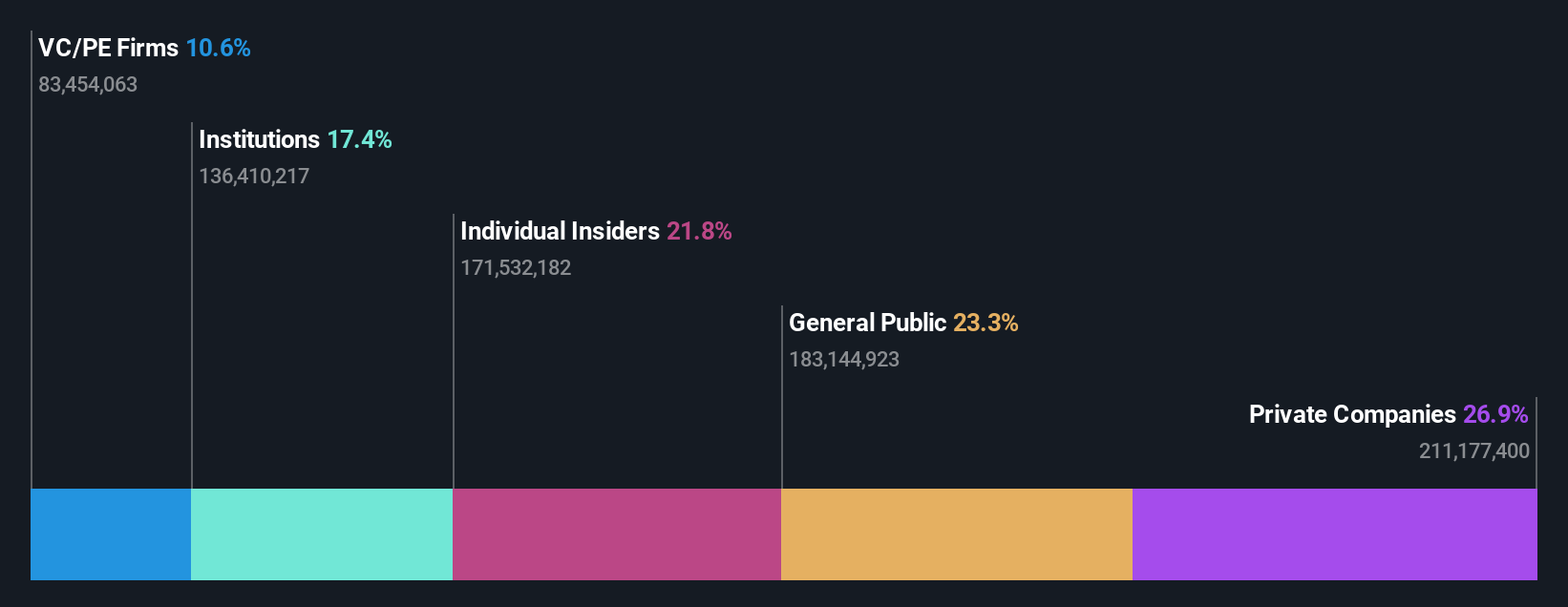

Insider Ownership: 21.8%

Earnings Growth Forecast: 22.1% p.a.

Shenzhen New Industries Biomedical Engineering is poised for growth, with revenue forecasted to rise 21.5% annually, surpassing the CN market's average. Despite earnings growth lagging behind the market at 22.1%, its return on equity is expected to be strong at 24.1%. Recent earnings show a solid performance with sales reaching CNY 3.41 billion, up from CNY 2.91 billion year-on-year, and net income increasing to CNY 1.38 billion, reflecting robust business momentum amidst strategic board changes and bylaw amendments.

- Navigate through the intricacies of Shenzhen New Industries Biomedical Engineering with our comprehensive analyst estimates report here.

- Our valuation report here indicates Shenzhen New Industries Biomedical Engineering may be undervalued.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥264.97 billion.

Operations: The company's revenue segments include ¥71.34 billion from software testing related services and ¥35.01 billion from software development related services.

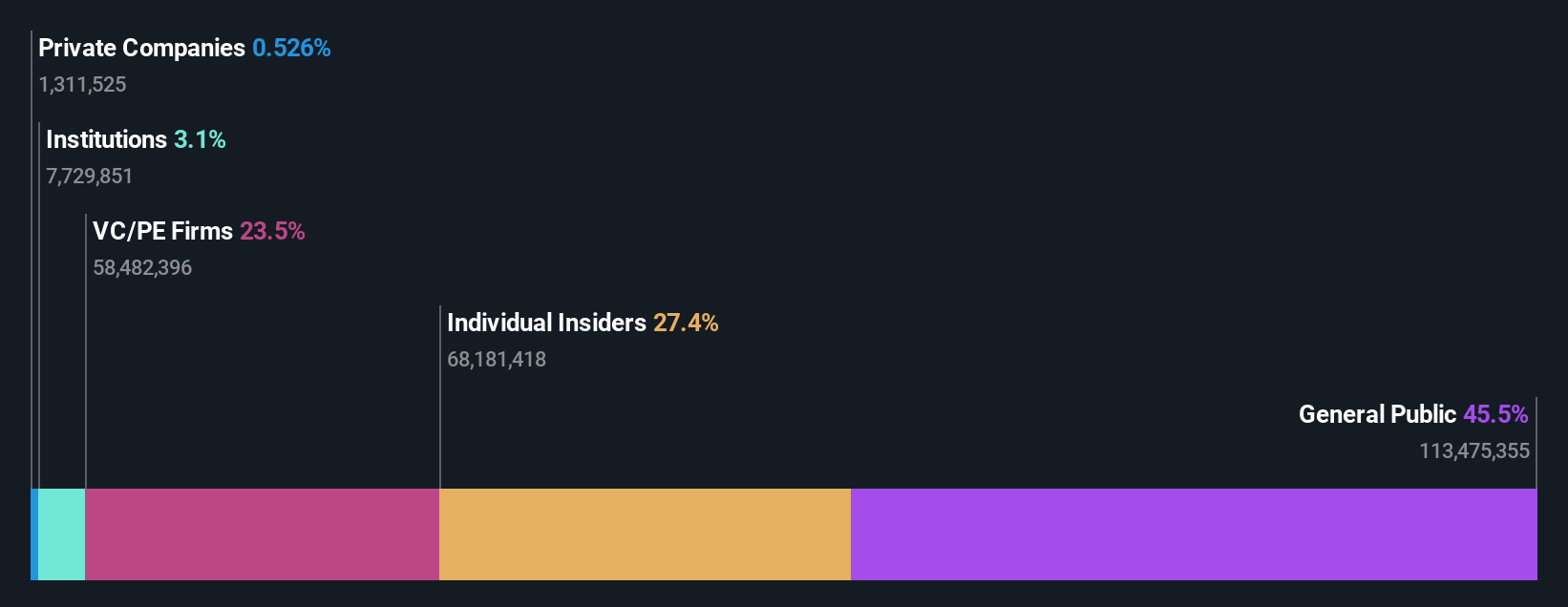

Insider Ownership: 35.4%

Earnings Growth Forecast: 33.4% p.a.

SHIFT Inc. demonstrates potential as a growth company, trading at 28.1% below its estimated fair value and forecasted to achieve significant earnings growth of 33.45% annually, outpacing the JP market's average. Despite recent volatility in share price and declining profit margins from last year, the company has engaged in a strategic share buyback program to enhance shareholder value, repurchasing shares worth ¥999.61 million as part of its ongoing efforts to maximize corporate value.

- Get an in-depth perspective on SHIFT's performance by reading our analyst estimates report here.

- The analysis detailed in our SHIFT valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Access the full spectrum of 1524 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3697

SHIFT

Provides software quality assurance and testing solutions in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives