SHIFT (TSE:3697) Joins Nikkei 225 Is Index Inclusion Enough to Reshape Its Investment Narrative?

Reviewed by Sasha Jovanovic

- SHIFT Inc. was recently added to the Nikkei 225 Index, following a board meeting held on September 30, 2025.

- This inclusion places SHIFT among Japan’s most prominent listed companies, often attracting heightened investor attention and index fund participation.

- We’ll explore how SHIFT’s entry into the Nikkei 225 may impact its investment narrative through increased visibility and institutional engagement.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is SHIFT's Investment Narrative?

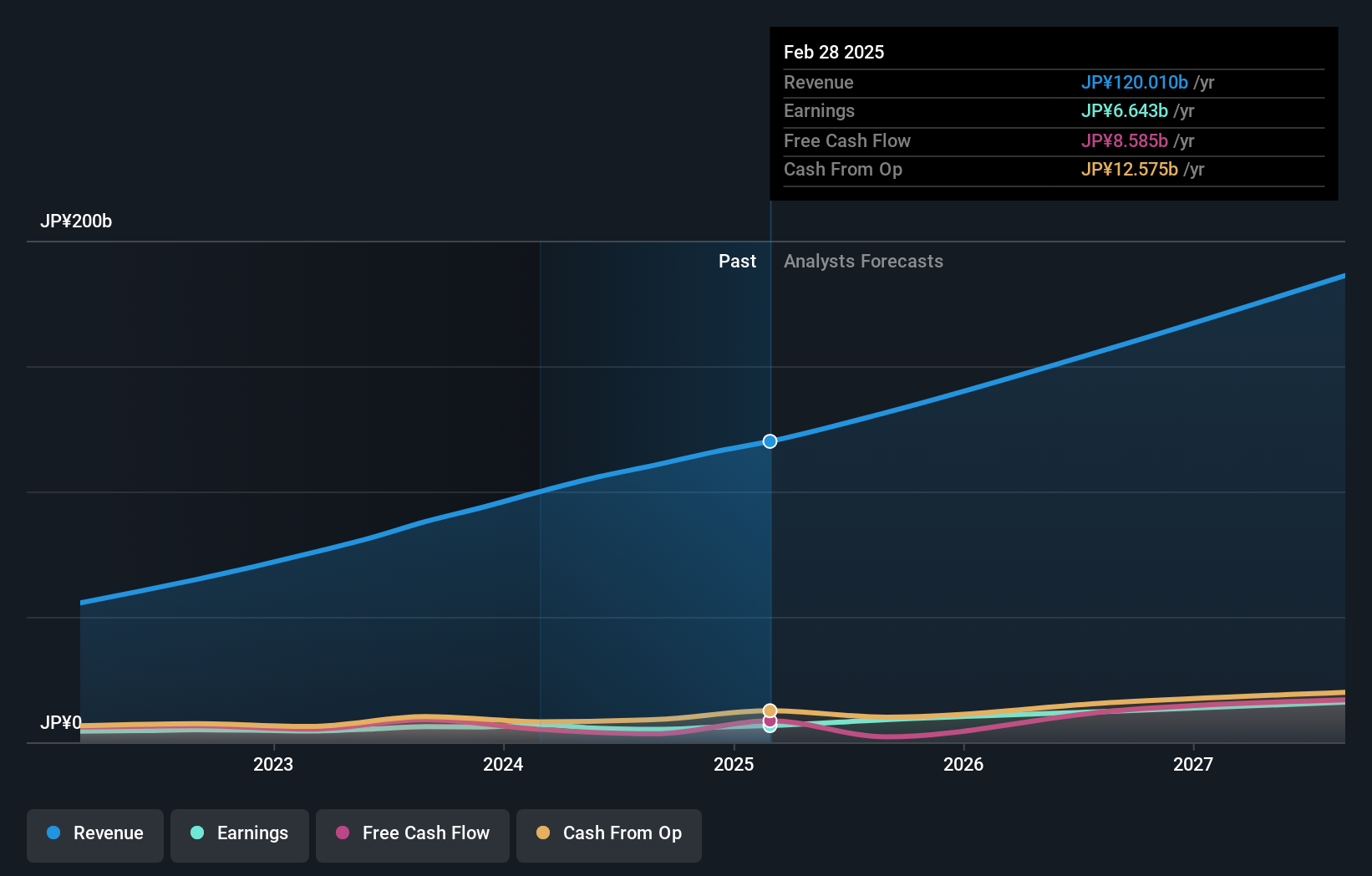

To be a shareholder in SHIFT Inc., you really have to believe in the company’s potential to sustain high earnings and profit growth in a competitive tech sector, despite its recent share price volatility. The addition to the Nikkei 225 is a meaningful milestone, it can amplify SHIFT’s visibility and draw institutional investors, which might support liquidity and valuations in the short term. Still, recent sharp declines in the share price signal that market sentiment has not kept pace with strong underlying fundamentals, such as robust profit margins, significant recent earnings growth, and forecasted outperformance against the broader Japanese IT market. The Nikkei 225 inclusion could shift short-term catalysts, attracting inflows from passive funds and potentially stabilizing the stock, but key risks remain, especially SHIFT’s high price-to-earnings ratio compared to peers, which could limit upside if growth forecasts are not delivered. Yet, a board with solid experience and active management signals a focus on disciplined growth and shareholder value, possibly offsetting some of the valuation concerns for now. On the other hand, the company’s expensive valuation relative to peers is a risk investors should be aware of.

Despite retreating, SHIFT's shares might still be trading 21% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on SHIFT - why the stock might be worth as much as 50% more than the current price!

Build Your Own SHIFT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SHIFT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SHIFT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SHIFT's overall financial health at a glance.

No Opportunity In SHIFT?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3697

SHIFT

Provides software quality assurance and testing solutions in Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)