In light of the Federal Reserve's recent interest rate cuts and mixed economic signals, global markets have seen varied performances, with small-cap indices like the Russell 2000 showing resilience amid rate sensitivity. As concerns about technology stock valuations and AI spending impact market sentiment, identifying high-growth tech stocks requires a focus on innovation potential and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Indra Sistemas (BME:IDR)

Simply Wall St Growth Rating: ★★★★☆☆

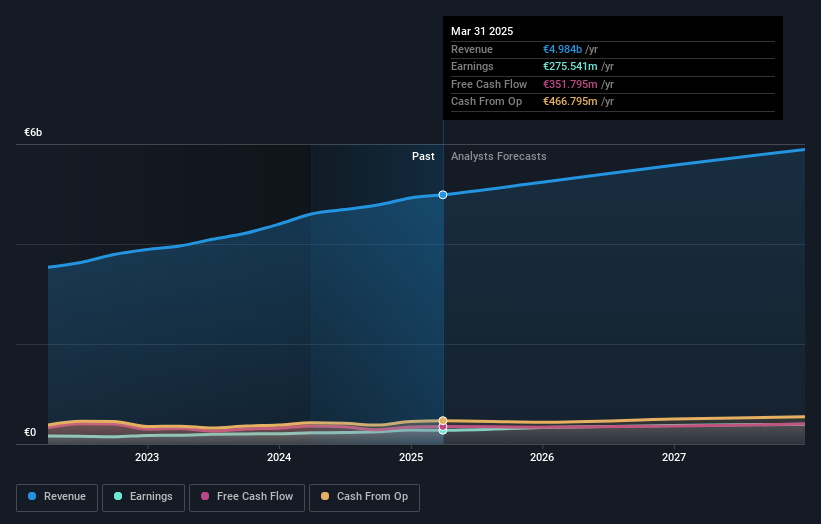

Overview: Indra Sistemas, S.A. is a global technology and consulting company specializing in aerospace, defense, and mobility sectors, with a market cap of €8.54 billion.

Operations: Indra Sistemas, S.A. generates revenue primarily from its Minsait (IT) segment at €3.07 billion and the Defense sector at €1.12 billion, with additional contributions from Air Traffic (€520.38 million) and Mobility (€364.45 million).

Indra Sistemas, a player in the tech sector, demonstrated robust financial growth with third-quarter sales rising to €1.16 billion from €1.10 billion year-over-year and net income increasing to €76.6 million from €70.1 million. This performance is part of a broader trend where annual revenue growth is projected at 12.7%, outpacing the Spanish market's 4.7%. Notably, its earnings have surged by 57.5% over the past year, significantly outperforming the IT industry's growth rate of 1.3%. The firm's commitment to innovation is evident in its strategic acquisitions and leadership adjustments discussed during recent shareholder meetings, positioning it well for sustained advancement in a competitive landscape.

- Click to explore a detailed breakdown of our findings in Indra Sistemas' health report.

Explore historical data to track Indra Sistemas' performance over time in our Past section.

Scantech (HANGZHOU) (SHSE:688583)

Simply Wall St Growth Rating: ★★★★☆☆

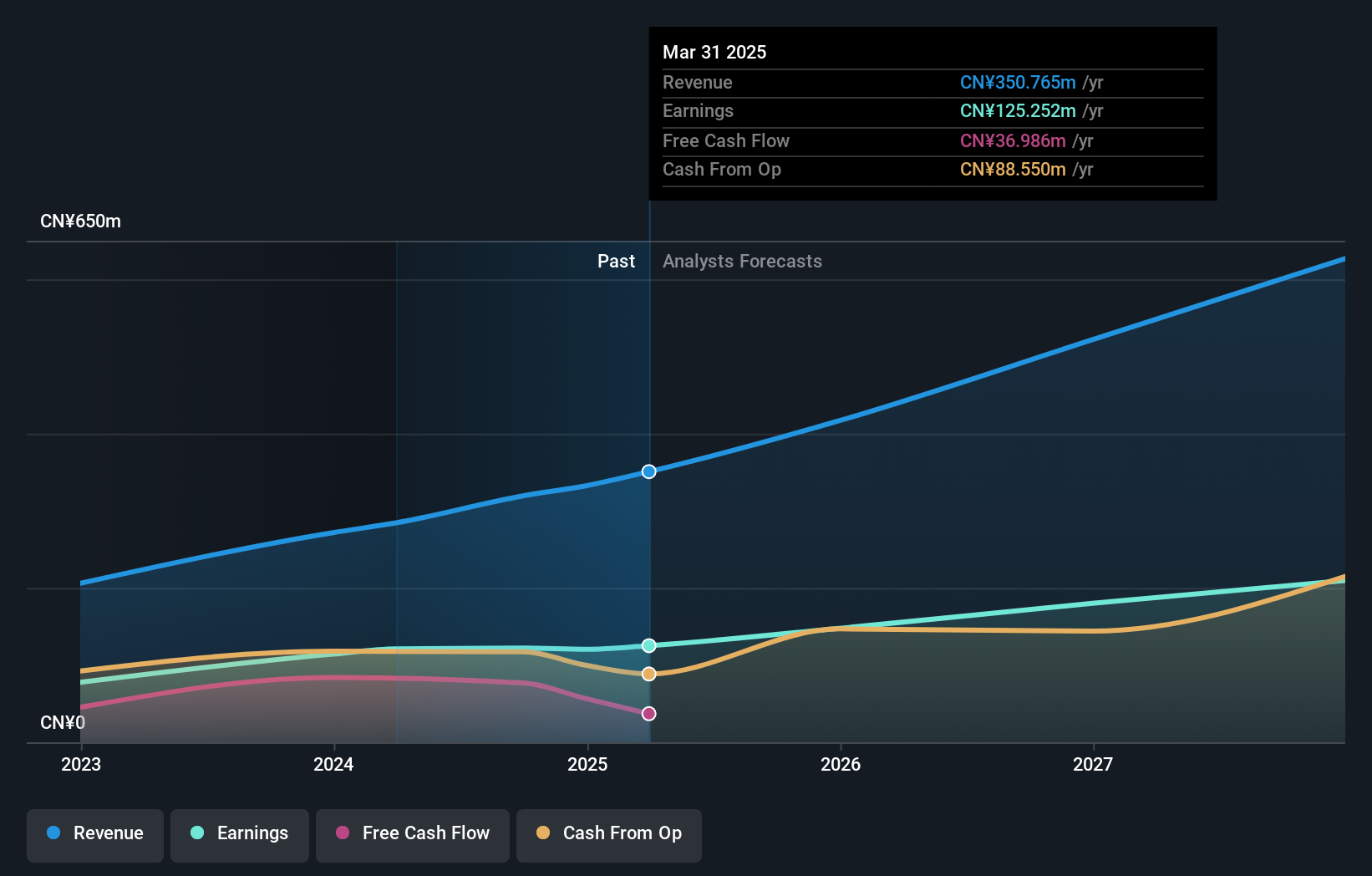

Overview: Scantech (HANGZHOU) Co., Ltd. specializes in providing 3D vision digital products and automated 3D vision inspection systems in China, with a market capitalization of CN¥8.06 billion.

Operations: The company generates revenue through its 3D vision digital products and automated inspection systems.

Scantech (HANGZHOU) has demonstrated resilience with its latest financial performance, reporting a 16% increase in revenue to CNY 268.31 million for the nine months ending September 2025. Despite a slight dip in net income to CNY 79.08 million from CNY 80.1 million year-over-year, the company's commitment to innovation is evident with significant investments in R&D, aligning with industry trends towards enhanced technological capabilities. With earnings expected to grow by approximately 22.7% annually over the next three years, Scantech is strategically positioning itself within China's competitive tech landscape, leveraging robust revenue growth forecasts of 23% per year that outpace the broader market's projection of 14.6%.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

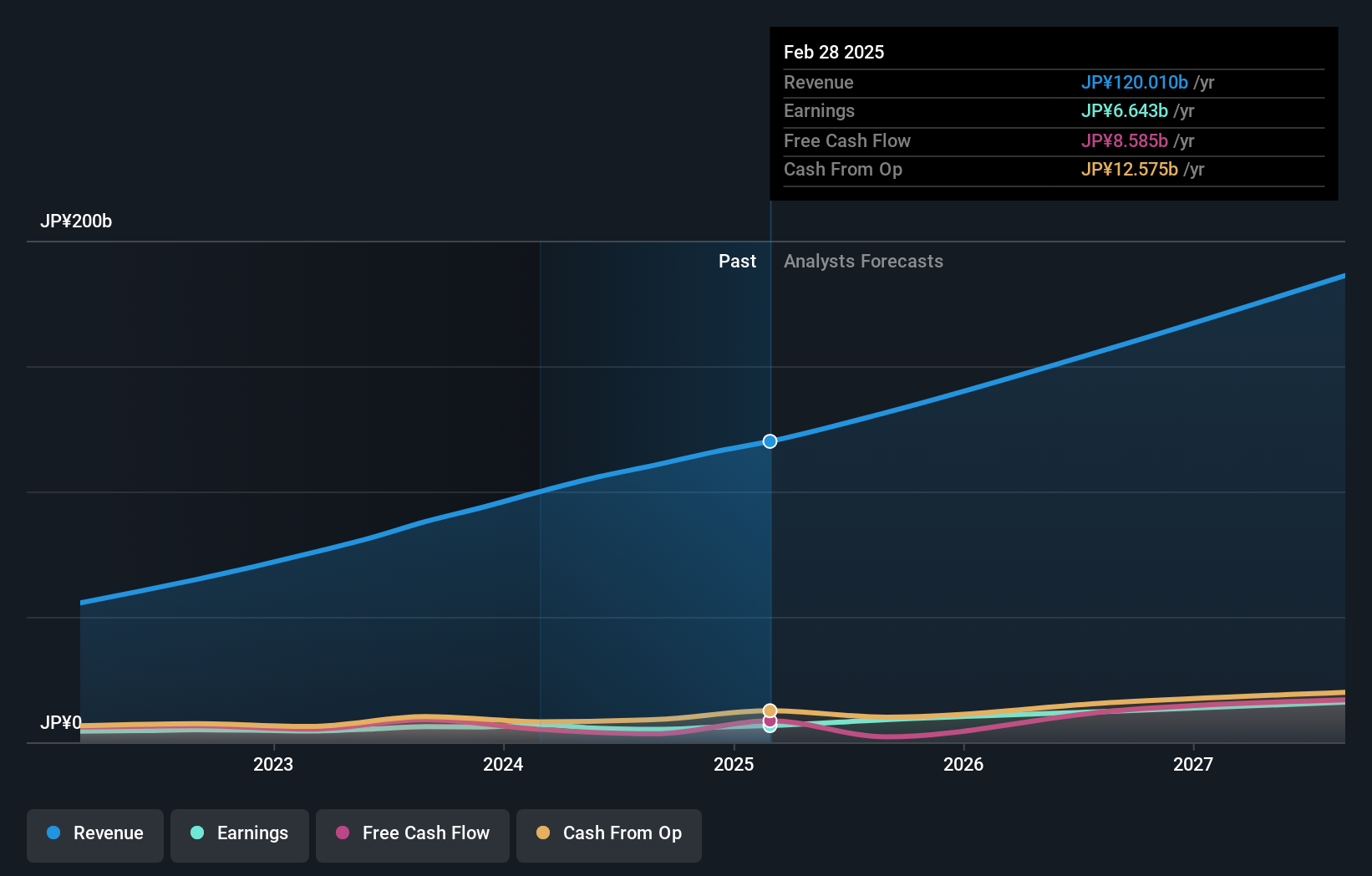

Overview: SHIFT Inc. provides software quality assurance and testing solutions in Japan with a market capitalization of ¥243.54 billion.

Operations: SHIFT Inc. generates revenue primarily through software testing related services, contributing ¥84.30 billion, and software development related services, which add ¥40.13 billion.

Amidst a flurry of strategic moves, SHIFT Inc. has shown a keen focus on enhancing its technology consulting capabilities, notably through the recent absorption-type company split with Airitech. This restructuring aims to bolster services in system performance and AI utilization—a move reflecting SHIFT's commitment to staying at the forefront of technological advancements and meeting its ambitious SHIFT3000 sales target of ¥300 billion. Furthermore, the company's inclusion in the Nikkei 225 Index underscores its growing influence in the tech sector. With a robust annual revenue growth rate of 16.3% and an even more impressive earnings growth forecast at 22% per year, SHIFT is not just expanding its operational scope but also solidifying its financial foundations, positioning itself as a formidable player in high-growth tech arenas.

- Delve into the full analysis health report here for a deeper understanding of SHIFT.

Assess SHIFT's past performance with our detailed historical performance reports.

Key Takeaways

- Discover the full array of 244 Global High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3697

SHIFT

Provides software quality assurance and testing solutions in Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)