- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:BURJEEL

3 Global Stocks That May Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

In the midst of global market fluctuations, with U.S. stocks showing resilience despite a government shutdown and European indices reaching record levels, investors are navigating an environment where "bad news is good news" due to expectations of rate cuts. Amid this complex landscape, identifying stocks that may be trading below their intrinsic value becomes crucial for those looking to capitalize on potential undervaluation opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.69 | 49.7% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.29 | 49.8% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Malee Group (SET:MALEE) | THB5.55 | THB11.01 | 49.6% |

| Kuraray (TSE:3405) | ¥1758.00 | ¥3482.34 | 49.5% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.80 | CN¥79.42 | 49.9% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95869.93 | 49.7% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.87 | ₱7.66 | 49.5% |

| Atea (OB:ATEA) | NOK142.20 | NOK280.38 | 49.3% |

| Allegro.eu (WSE:ALE) | PLN33.615 | PLN66.29 | 49.3% |

Here's a peek at a few of the choices from the screener.

Burjeel Holdings (ADX:BURJEEL)

Overview: Burjeel Holdings PLC, along with its subsidiaries, operates multi-specialty hospitals and medical centers across the United Arab Emirates, the Sultanate of Oman, and the Kingdom of Saudi Arabia, with a market capitalization of AED7.03 billion.

Operations: The company's revenue is primarily derived from its hospitals segment, which generates AED4.92 billion, followed by medical centers at AED427.71 million and pharmacies contributing AED66.70 million.

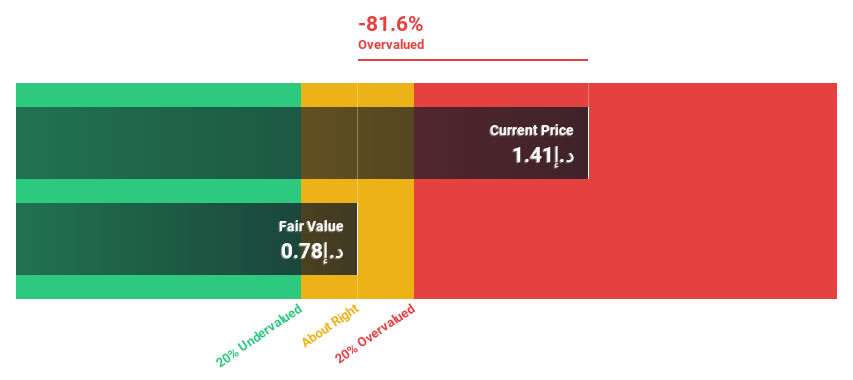

Estimated Discount To Fair Value: 26.6%

Burjeel Holdings is trading at AED1.35, below its estimated fair value of AED1.84, suggesting it may be undervalued based on cash flows. Despite being dropped from the FTSE All-World Index, its earnings are forecast to grow annually by 16.4%, surpassing the AE market's growth rate of 6.6%. However, revenue growth is modest at 8.3% per year and the company carries a high level of debt, which could impact financial flexibility.

- Insights from our recent growth report point to a promising forecast for Burjeel Holdings' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Burjeel Holdings.

SHIFT (TSE:3697)

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥316.60 billion.

Operations: The company's revenue is primarily derived from Software Testing Related Services, which generated ¥80.79 billion, and Software Development Related Services, contributing ¥39.11 billion.

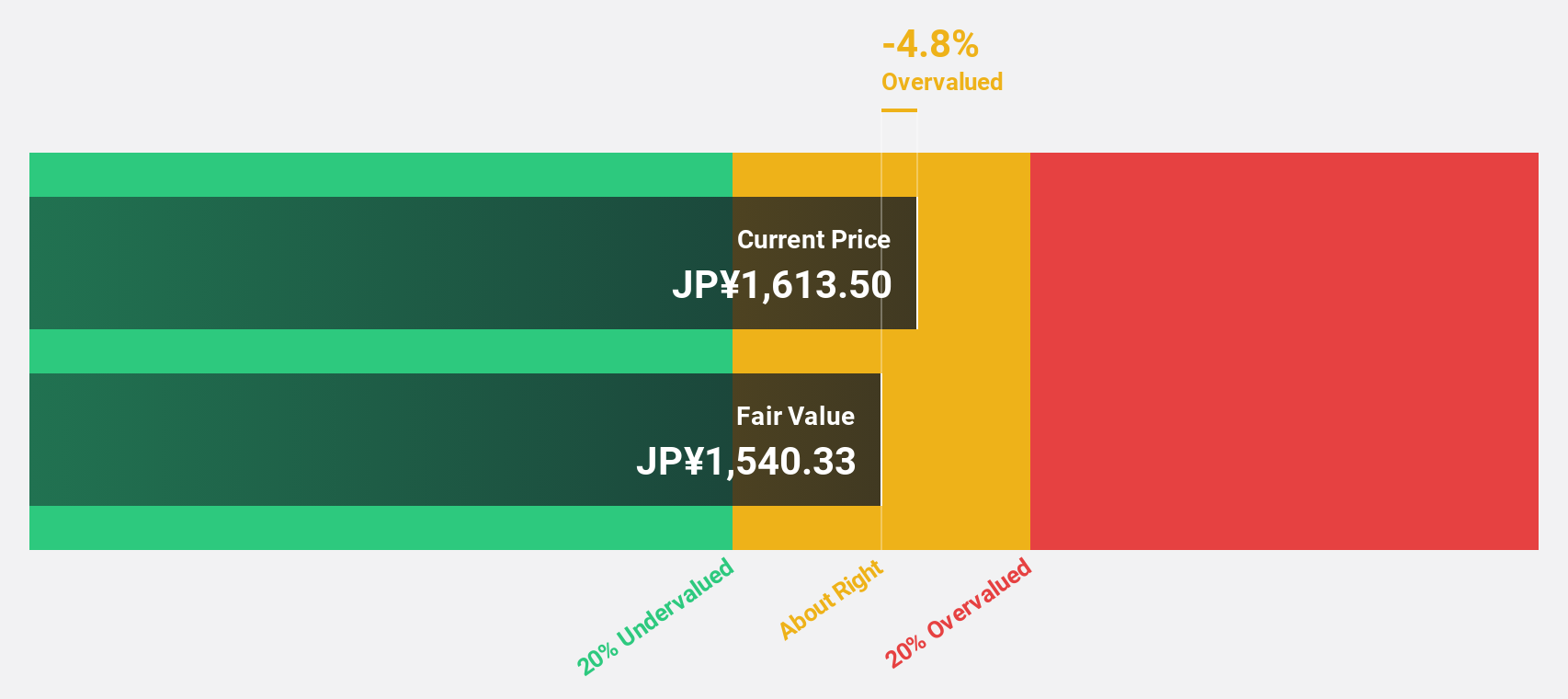

Estimated Discount To Fair Value: 11.5%

SHIFT Inc. is trading at ¥1,268, below its estimated fair value of ¥1,432.1. Earnings are expected to grow significantly at 25% annually over the next three years, outpacing the Japanese market's growth rate of 8.1%. Recent inclusion in the Nikkei 225 and expansion into the Middle East through SHIFT Arabia highlight strategic growth initiatives. However, revenue growth is projected at a slower pace of 16.4% per year compared to earnings expansion.

- According our earnings growth report, there's an indication that SHIFT might be ready to expand.

- Click to explore a detailed breakdown of our findings in SHIFT's balance sheet health report.

COVER (TSE:5253)

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors, with a market cap of ¥120.40 billion.

Operations: The company generates revenue through its virtual platform, VTuber production, and media mix businesses.

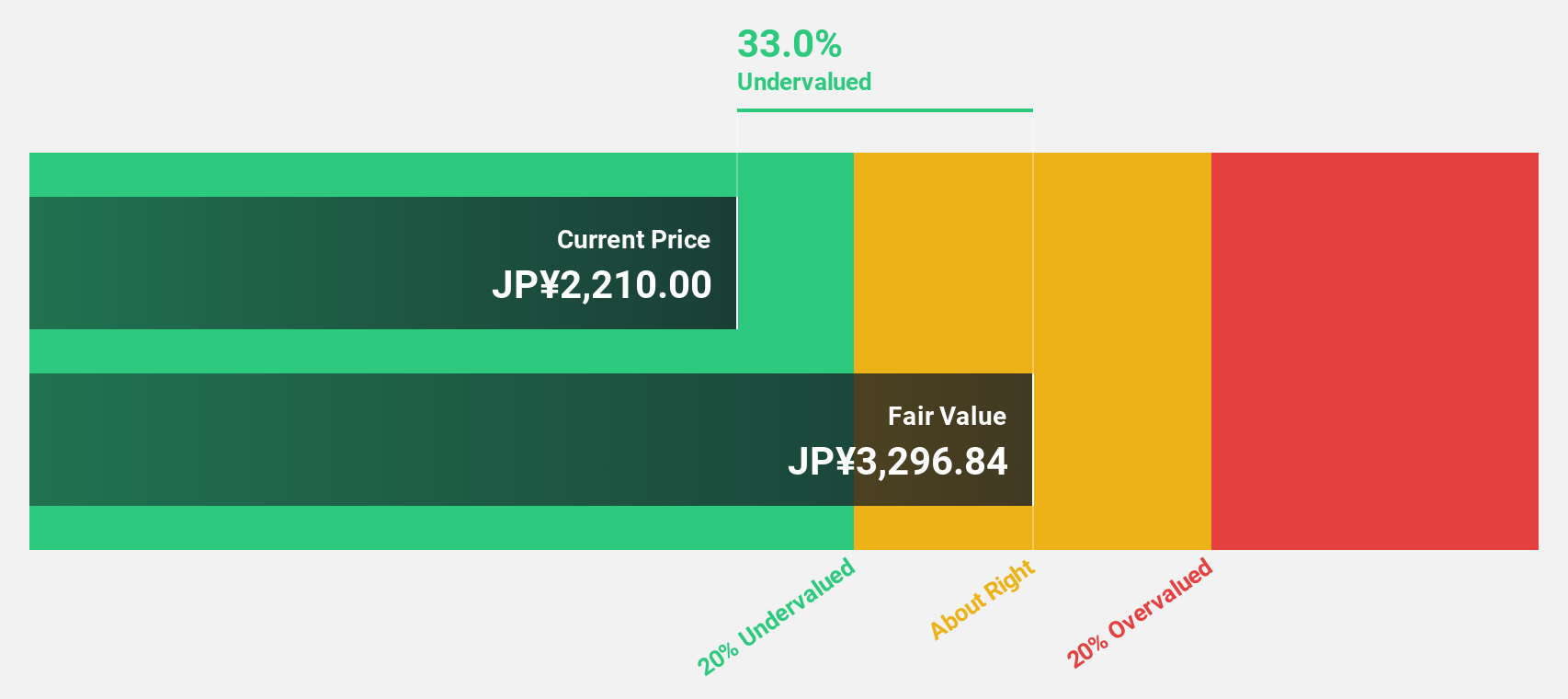

Estimated Discount To Fair Value: 47.2%

COVER is trading at ¥1,943, significantly below its estimated fair value of ¥3,679.27. The stock's earnings are projected to grow at 21.18% annually, surpassing the Japanese market's growth rate of 8.1%. Although revenue is expected to increase by 14.1% per year—faster than the JP market's 4.4%—it remains below the desired threshold for high growth rates (20%). COVER's strong return on equity forecast further underscores its potential as an undervalued investment based on cash flows.

- Upon reviewing our latest growth report, COVER's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of COVER stock in this financial health report.

Make It Happen

- Gain an insight into the universe of 515 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Burjeel Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:BURJEEL

Burjeel Holdings

Owns and operates multi-specialty hospitals and medical centers in the United Arab Emirates, the Sultanate of Oman, and the Kingdom of Saudi Arabia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)