- Japan

- /

- Commercial Services

- /

- TSE:9768

3 Top Dividend Stocks Offering Up To 3.8% Yield

Reviewed by Simply Wall St

As global markets react to recent political developments and economic indicators, U.S. stocks have been buoyed by optimism surrounding potential trade deals and AI investments, with major indices reaching new highs. Amid this backdrop of fluctuating market dynamics, dividend stocks stand out as a compelling option for investors seeking steady income streams; these stocks offer the dual benefits of regular payouts and potential capital appreciation in an environment where growth stocks are currently outperforming value shares.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

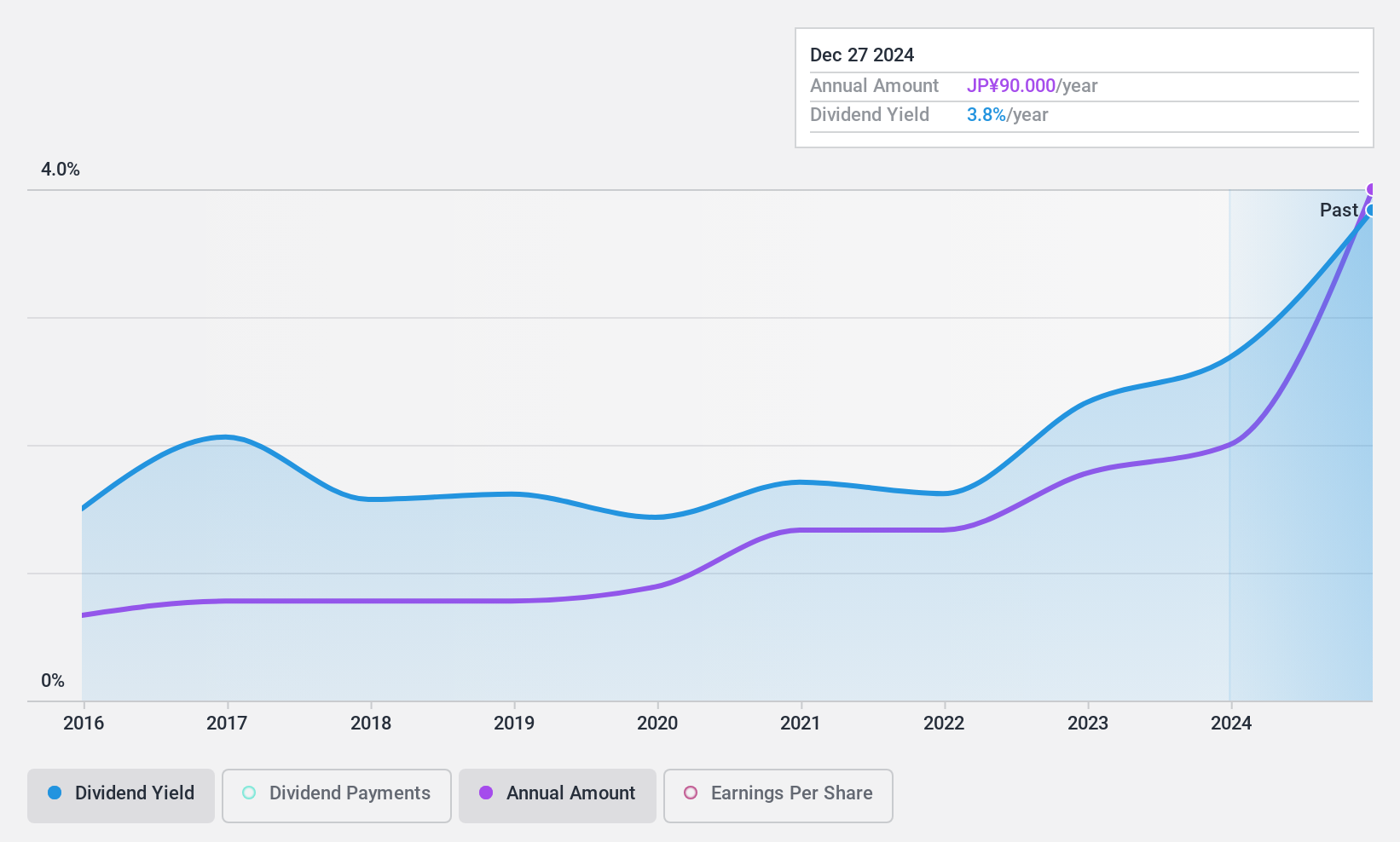

Cube System (TSE:2335)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cube System Inc. offers a range of technological services both in Japan and internationally, with a market cap of ¥15.96 billion.

Operations: Cube System Inc.'s revenue segments include providing technological services across different markets, both domestically and internationally.

Dividend Yield: 3.8%

Cube System offers a mixed dividend profile. While its dividend yield of 3.86% ranks in the top 25% of the JP market, stability is an issue due to past volatility and unreliability over the last decade. Despite a reasonable payout ratio of 49.2%, dividends are not well covered by free cash flows, with a high cash payout ratio of 240.9%. The company's earnings growth has been strong at 12.5% annually over five years, but non-cash earnings remain significant.

- Click to explore a detailed breakdown of our findings in Cube System's dividend report.

- According our valuation report, there's an indication that Cube System's share price might be on the expensive side.

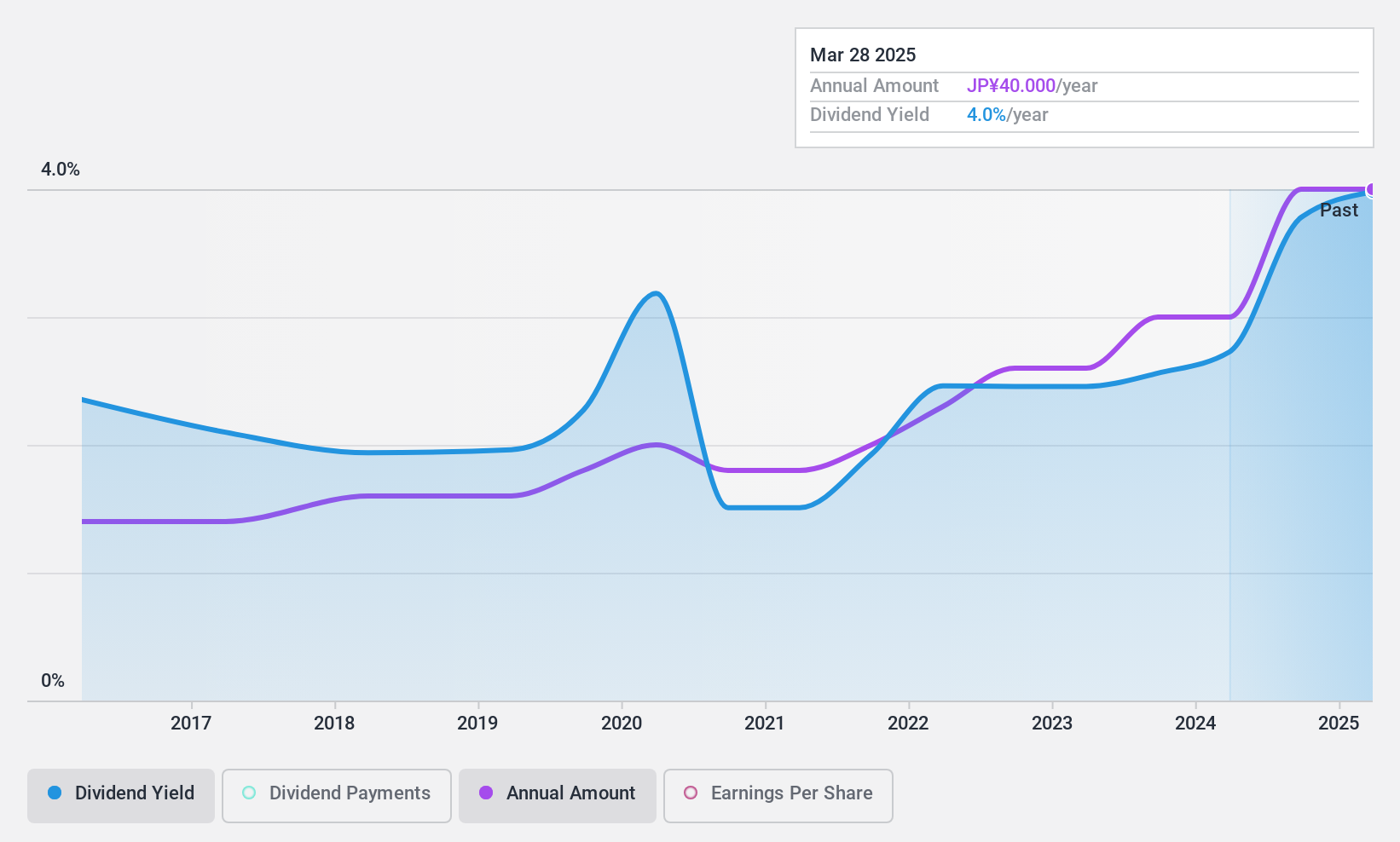

ITFOR (TSE:4743)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITFOR Inc. offers support services for implementing information technology in Japan and has a market cap of ¥39.50 billion.

Operations: ITFOR Inc.'s revenue is primarily derived from its System Development and Sales segment, accounting for ¥11.97 billion, followed by its Recurring Business segment at ¥8.86 billion.

Dividend Yield: 3.4%

ITFOR's dividend profile is characterized by stability and reliability over the past decade, with consistent growth in dividend payments. Despite a recent decrease in annual dividends to ¥25 per share from ¥40, payouts remain well-covered by earnings (66.6% payout ratio) and cash flows (48.1% cash payout ratio). Although its 3.43% yield is below the top quartile of JP market payers, ITFOR trades at a good value relative to peers, bolstered by steady earnings growth projections.

- Dive into the specifics of ITFOR here with our thorough dividend report.

- Our valuation report here indicates ITFOR may be undervalued.

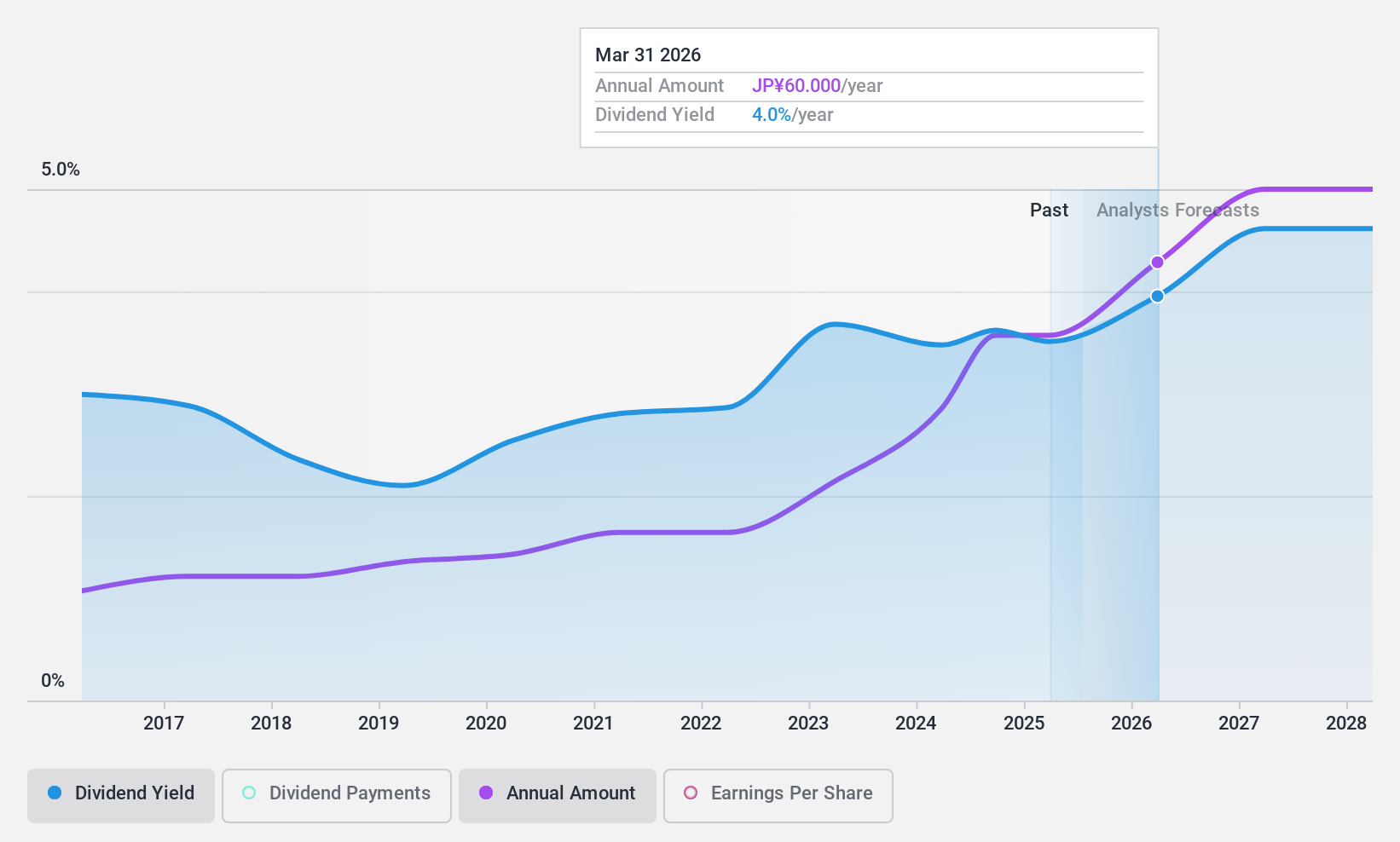

IDEA ConsultantsInc (TSE:9768)

Simply Wall St Dividend Rating: ★★★★★★

Overview: IDEA Consultants, Inc. offers integrated consultancy services focused on social infrastructure development and environmental conservation both in Japan and internationally, with a market cap of ¥16.88 billion.

Operations: IDEA Consultants, Inc.'s revenue is derived from its consultancy services in social infrastructure development and environmental conservation projects, serving both domestic and international markets.

Dividend Yield: 3.8%

IDEA Consultants Inc. offers a compelling dividend profile, characterized by a high yield of 3.87%, placing it in the top 25% of JP market payers. The company has maintained stable and reliable dividends over the past decade, with payments growing consistently. With a low payout ratio of 18.3% and cash payout ratio of 33.6%, dividends are well-covered by earnings and cash flows, ensuring sustainability amidst robust earnings growth of ¥33 billion in the past year.

- Delve into the full analysis dividend report here for a deeper understanding of IDEA ConsultantsInc.

- According our valuation report, there's an indication that IDEA ConsultantsInc's share price might be on the cheaper side.

Summing It All Up

- Discover the full array of 1964 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9768

IDEA ConsultantsInc

Provides integrated consultancy services on social infrastructure development and environmental conservation projects in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives