- Japan

- /

- Semiconductors

- /

- TSE:6963

ROHM (TSE:6963) Valuation in Focus After Automotive Smart Switch Launch and Manufacturing Restructuring

Reviewed by Kshitija Bhandaru

See our latest analysis for ROHM.

After a steady stream of innovation and its recent restructuring plans, ROHM has seen momentum build in its share price, posting a 49.6% year-to-date gain and a 34.1% total shareholder return over the last twelve months, far outpacing its longer-term numbers. Investors seem increasingly optimistic, likely factoring in both product launches and efficiency moves as signs of growth potential being unlocked.

If the latest wave of automotive tech caught your attention, you might want to check out what’s happening across the sector. See the full lineup via See the full list for free.

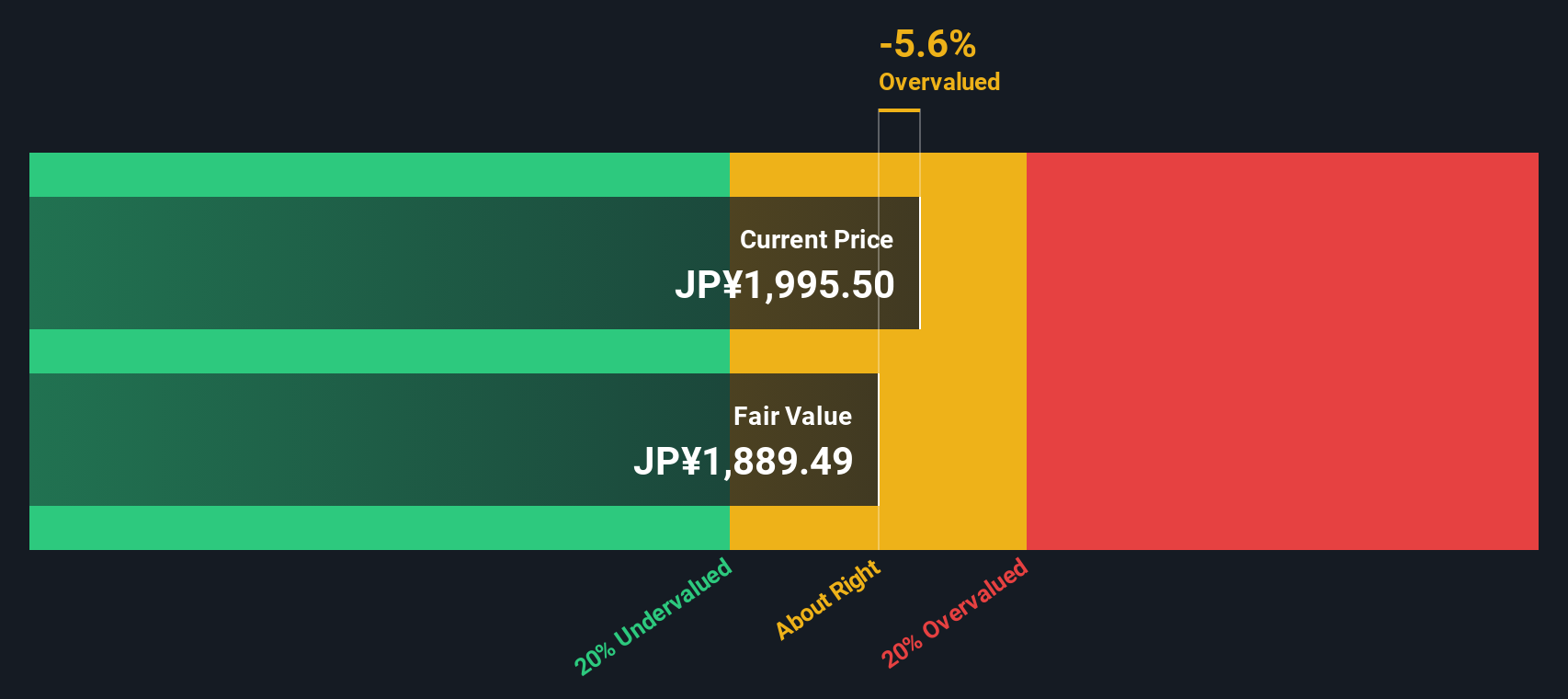

But with shares rallying nearly 50% this year and optimism running high, investors may question whether ROHM’s current valuation is justified or if the market has already priced in its future growth potential, leaving little room for upside from this point.

Most Popular Narrative: 4.5% Overvalued

ROHM's last close of ¥2,246 puts it slightly above the narrative's consensus fair value of ¥2,149, leaving little margin for upside according to this widely followed view. The following quote reveals a major catalyst driving this perspective.

Significant cost reduction measures are being implemented, including a plan to decrease annual fixed costs by ¥20 to 30 billion over the next three years and increased outsourcing, which is expected to improve net margins and profitability.

What powers this narrative’s fair value? Three-year growth targets, ambitious margin expansion, and return assumptions well above sector norms. The real surprise lies in the size of the projected turnaround and just how bullish the future profit runway appears. What numbers are bold enough to support this price? Find out what makes the narrative’s valuation so provocative.

Result: Fair Value of ¥2,149 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, market risks remain, particularly if ongoing inventory adjustments continue or if anticipated cost reductions do not occur as quickly as expected.

Find out about the key risks to this ROHM narrative.

Another View: SWS DCF Model Shows a Stark Contrast

Taking a step back from analyst targets, our DCF model paints a sharply different picture by estimating ROHM’s fair value at just ¥1,177. This result suggests shares may be significantly overvalued at present, raising questions about whether optimism has pushed valuations ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ROHM Narrative

If you see things differently or want to chart your own path, it’s quick and easy to build your own narrative using the available data. Do it your way Do it your way.

A great starting point for your ROHM research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take advantage of innovative investment screens designed to help you find your next winning idea before the crowd. Don’t let standout potential pass you by.

- Lock in powerful income streams as you scan for companies offering strong yield and growth potential with these 19 dividend stocks with yields > 3%.

- Fuel your portfolio’s growth by tapping into cutting-edge breakthroughs through these 24 AI penny stocks, which are leading the AI revolution.

- Capitalize on tomorrow’s financial leaders by seeking out undervalued opportunities others might miss using these 898 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6963

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives