- Japan

- /

- Semiconductors

- /

- TSE:6920

Lasertec (TSE:6920) Valuation: Is the Recent Momentum Aligned With Its True Value?

Reviewed by Kshitija Bhandaru

Lasertec (TSE:6920) has caught the attention of investors following a stretch of strong monthly gains, with its stock up 22% over the past month. The company continues to draw interest as broader semiconductor demand trends remain in focus.

See our latest analysis for Lasertec.

Lasertec’s rally over the past month has helped recover some ground after a challenging year, but momentum is still building rather than fully restored. While the recent 21.8% one-month share price return stands out, the total shareholder return over the past year is still down more than 14%, which highlights that investors are balancing renewed optimism with lingering caution from earlier declines.

If strong moves in tech stocks have you thinking bigger, this is a great chance to discover See the full list for free.

The big question for investors now is whether Lasertec’s shares offer a compelling entry at current levels, or if the recent rally signals that the market has already priced in much of the company’s future growth potential.

Price-to-Earnings of 21.5x: Is it justified?

Lasertec trades at a price-to-earnings (P/E) ratio of 21.5x, slightly above its estimated fair P/E ratio of 21.4x. This suggests its current price is a touch higher than what models would predict as 'fair.' At the last close of ¥20,225, Lasertec is roughly in line with its calculated fair value, but this does raise questions about whether the current premium is justified given company and market dynamics.

The P/E ratio measures how much investors are willing to pay for each unit of earnings, making it a commonly used gauge of value in the technology and semiconductor sectors. For Lasertec, the P/E being almost equal to its fair benchmark implies that the market is closely tracking the stock's earnings power. Even a small premium can signal lofty expectations for continued growth or profitability.

Compared to its industry peers, Lasertec stands out by trading above the JP Semiconductor industry average P/E of 16.5x. This indicates the market sees it as more valuable and is pricing in more optimism for its future. Against the estimated fair ratio of 21.4x, this also suggests little margin of safety for buyers at current levels.

Explore the SWS fair ratio for Lasertec

Result: Price-to-Earnings of 21.5x (ABOUT RIGHT)

However, slower revenue and net income growth may limit Lasertec’s upside if semiconductor demand softens or if competition intensifies in coming quarters.

Find out about the key risks to this Lasertec narrative.

Another View: SWS DCF Model Weighs In

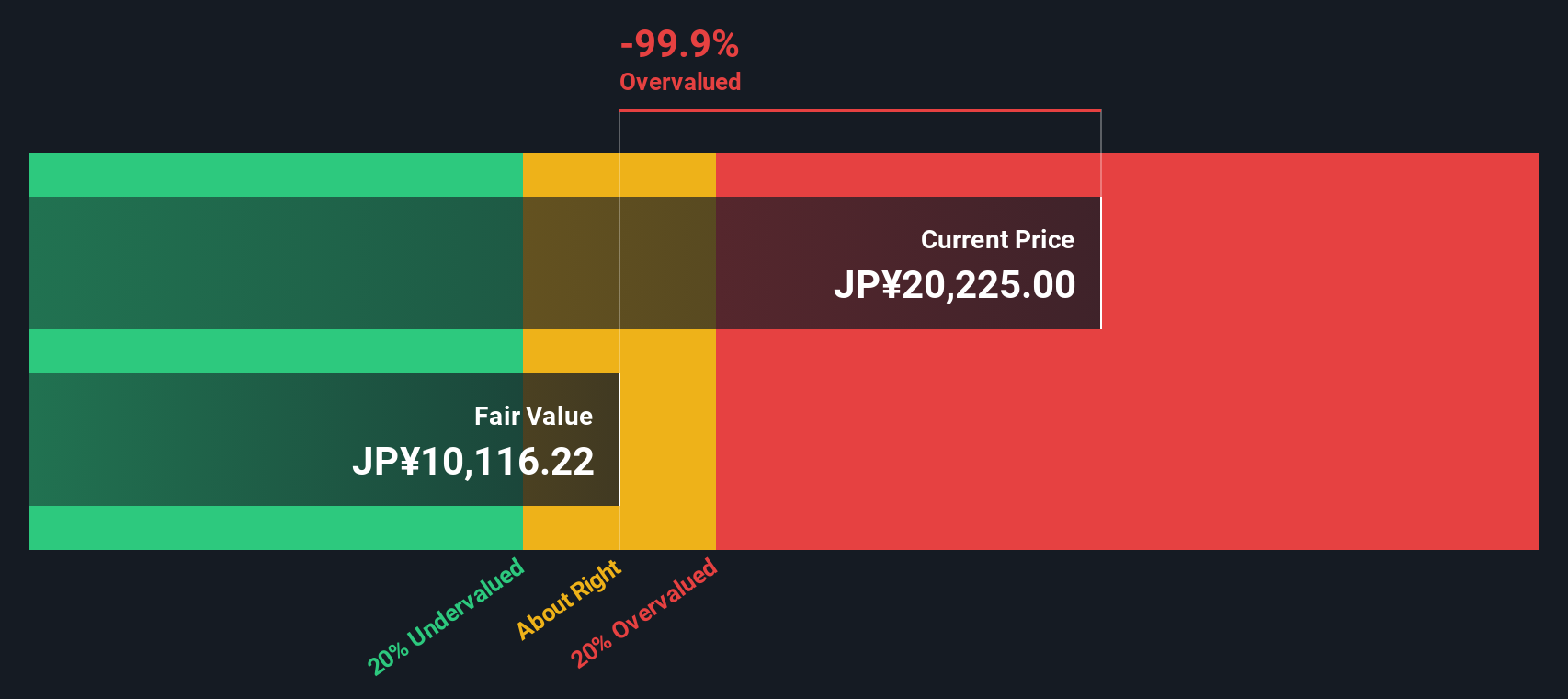

While Lasertec's price-to-earnings ratio suggests it is trading close to its fair value, our SWS DCF model presents a different perspective. This method values Lasertec at ¥10,085.09 per share, which is well below its current price and points to possible overvaluation. However, could the market be pricing in something the model is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lasertec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lasertec Narrative

If you see the data differently or wish to form your own perspective, you can create a personalized analysis quickly. It takes less than three minutes. Do it your way

A great starting point for your Lasertec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make the most of today’s momentum by searching for stocks with unique potential. Waiting could mean missing tomorrow’s standout movers. Here’s where you should look next:

- Spot emerging trends early and tap into growth with these 24 AI penny stocks, which are reshaping entire industries through advances in artificial intelligence.

- Maximize your income strategy as you scan for these 19 dividend stocks with yields > 3%, offering attractive yields and robust, reliable returns.

- Position yourself at the frontier of finance by reviewing these 79 cryptocurrency and blockchain stocks, where you can find opportunities that capitalize on breakthroughs in digital assets and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives