- China

- /

- Semiconductors

- /

- SHSE:688766

Asian Growth Companies With High Insider Ownership For September 2025

Reviewed by Simply Wall St

As global markets continue to navigate the landscape of interest rate expectations and technological advancements, Asian equity markets have shown resilience amid these evolving dynamics. In this environment, companies with strong growth potential and high insider ownership can be particularly appealing, as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 57.1% |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Tongguan Gold Group (SEHK:340) | 30.1% | 29.5% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Puya Semiconductor (Shanghai) (SHSE:688766)

Simply Wall St Growth Rating: ★★★★★☆

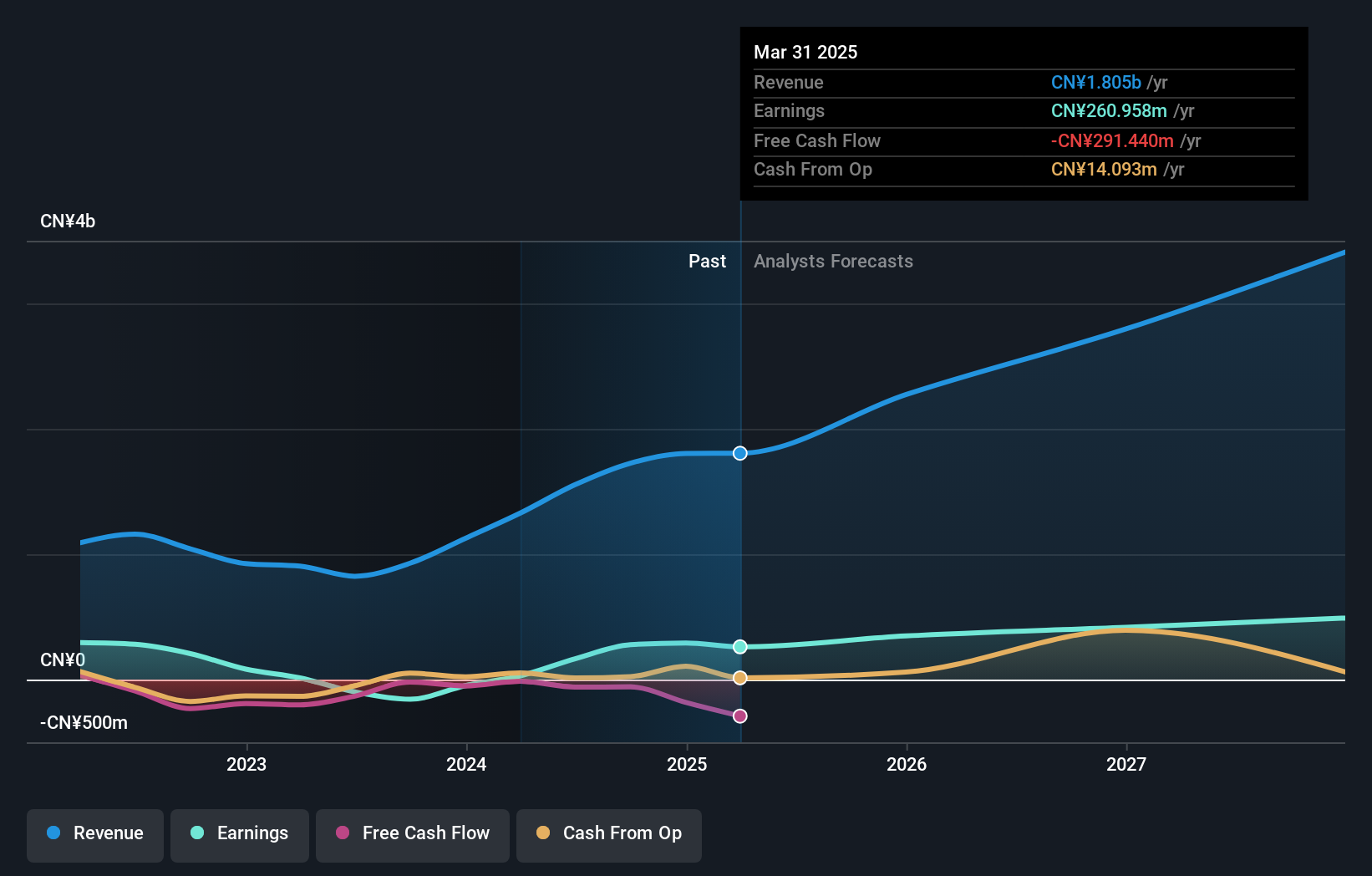

Overview: Puya Semiconductor (Shanghai) Co., Ltd. focuses on the research, development, design, and sale of non-volatile memory chips and memory-based derivative chips both in China and internationally, with a market cap of CN¥12.99 billion.

Operations: The company's revenue is primarily derived from its Integrated Circuit segment, which generated CN¥1.81 billion.

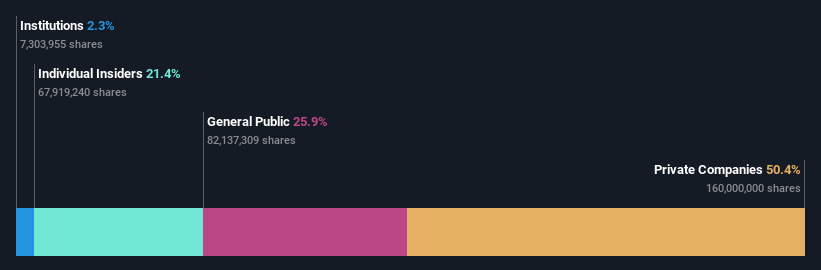

Insider Ownership: 23.7%

Revenue Growth Forecast: 20.9% p.a.

Puya Semiconductor (Shanghai) shows promising growth potential with forecasted revenue and earnings growth outpacing the Chinese market at 20.9% and 34.2% per year, respectively. Despite a low return on equity forecast of 13%, its price-to-earnings ratio of 65.9x is below the industry average, indicating reasonable valuation for investors considering growth prospects. Recent earnings reveal a drop in net income to CNY 40.73 million, highlighting potential profitability challenges amidst strong revenue projections.

- Click to explore a detailed breakdown of our findings in Puya Semiconductor (Shanghai)'s earnings growth report.

- According our valuation report, there's an indication that Puya Semiconductor (Shanghai)'s share price might be on the expensive side.

Aoshikang Technology (SZSE:002913)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aoshikang Technology Co., Ltd. is involved in the research, development, production, and sale of printed circuit boards with a market cap of CN¥13.39 billion.

Operations: The company generates revenue primarily from its printed circuit boards segment, totaling CN¥4.92 billion.

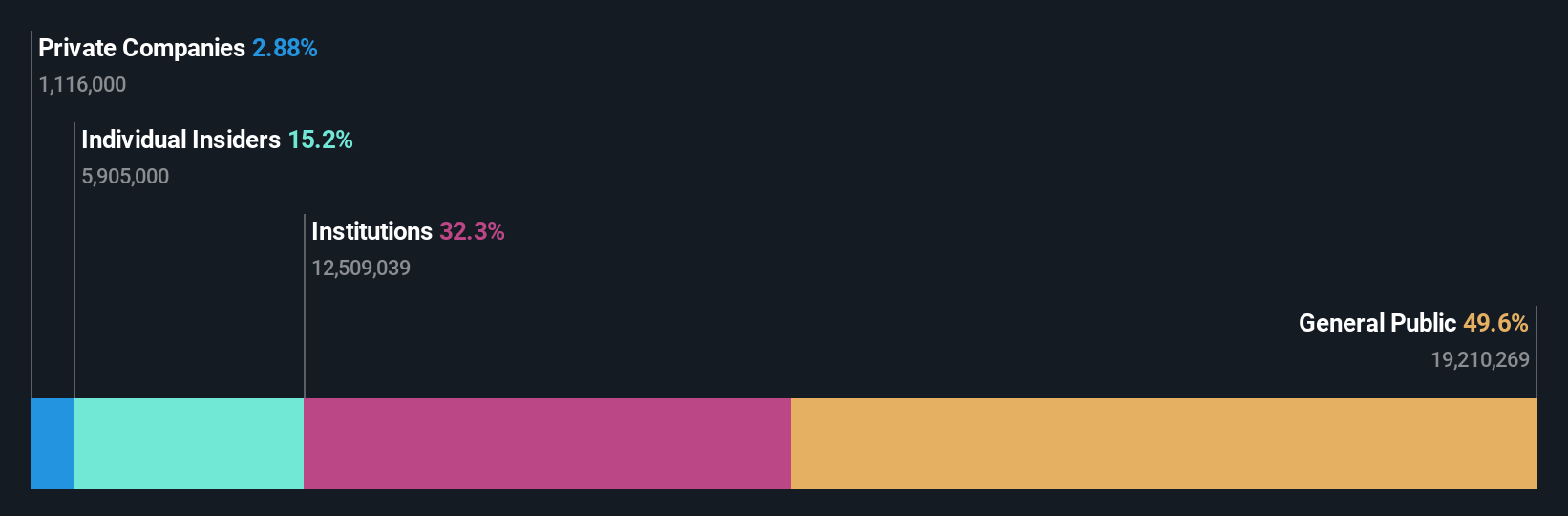

Insider Ownership: 19.8%

Revenue Growth Forecast: 17.6% p.a.

Aoshikang Technology demonstrates growth potential with forecasted earnings growth of 35.6% annually, surpassing the Chinese market average of 26.5%. Despite a lower return on equity forecast at 15.1%, its price-to-earnings ratio of 41x remains attractive compared to the CN market's 45.5x. Recent earnings show increased revenue to CNY 2,564.55 million but reduced net income, indicating profitability challenges amid strong growth forecasts and high insider ownership stability over recent months.

- Take a closer look at Aoshikang Technology's potential here in our earnings growth report.

- Our valuation report here indicates Aoshikang Technology may be undervalued.

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells body measuring instruments as well as semiconductor and liquid crystal display inspection equipment globally, with a market cap of ¥204.29 billion.

Operations: The company's revenue is primarily derived from the Probe Card Business, which accounts for ¥60.71 billion, and the TE Business, contributing ¥1.88 billion.

Insider Ownership: 15.3%

Revenue Growth Forecast: 13.4% p.a.

Micronics Japan exhibits growth potential with forecasted earnings growth of 21.4% annually, outpacing the Japanese market's average. Despite recent volatility and lowered Q3 guidance due to equipment malfunctions, revenue and profit are expected to rise, driven by demand in memory semiconductors. Trading at 17.7% below estimated fair value, it offers an attractive entry point for investors seeking high insider ownership stability amidst significant industry expansion opportunities led by generative AI advancements.

- Delve into the full analysis future growth report here for a deeper understanding of Micronics Japan.

- In light of our recent valuation report, it seems possible that Micronics Japan is trading beyond its estimated value.

Where To Now?

- Get an in-depth perspective on all 618 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688766

Puya Semiconductor (Shanghai)

Engages in research, development, design, and sale of non-volatile memory chips and memory based derivative chips in China and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)