- Japan

- /

- Semiconductors

- /

- TSE:4369

Three Japanese Exchange Stocks Estimated To Be Discounted Between 26.3% And 42.7% From Intrinsic Values

Reviewed by Simply Wall St

Amid a backdrop of global economic fluctuations, Japan's stock markets have recently shown robust performance, with major indices reaching new heights. This surge contrasts with the broader trends observed in some other key markets and sets an interesting stage for investors looking for potentially undervalued opportunities. Identifying stocks that appear discounted relative to their intrinsic values could be particularly compelling in this environment, where discerning value amidst growth is crucial.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hibino (TSE:2469) | ¥2607.00 | ¥5171.77 | 49.6% |

| FP Partner (TSE:7388) | ¥2676.00 | ¥5067.34 | 47.2% |

| Mimaki Engineering (TSE:6638) | ¥2053.00 | ¥3873.43 | 47% |

| Fujibo Holdings (TSE:3104) | ¥4790.00 | ¥9409.75 | 49.1% |

| en-japan (TSE:4849) | ¥2535.00 | ¥4825.56 | 47.5% |

| Cyber Security Cloud (TSE:4493) | ¥2236.00 | ¥4329.21 | 48.4% |

| S-Pool (TSE:2471) | ¥322.00 | ¥620.99 | 48.1% |

| Macromill (TSE:3978) | ¥870.00 | ¥1673.64 | 48% |

| DKS (TSE:4461) | ¥3825.00 | ¥7250.37 | 47.2% |

| Money Forward (TSE:3994) | ¥5443.00 | ¥10388.03 | 47.6% |

Let's dive into some prime choices out of from the screener

Asahi Kasei (TSE:3407)

Overview: Asahi Kasei Corporation, with a market capitalization of ¥1.41 trillion, is engaged in the manufacturing and selling of chemicals.

Operations: The company operates primarily in the chemical manufacturing sector.

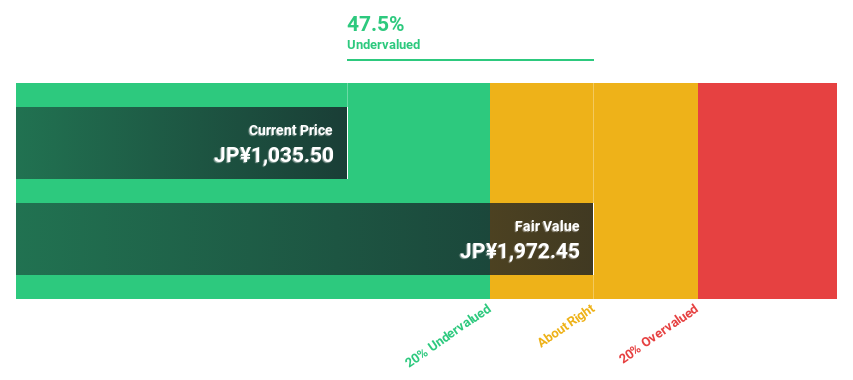

Estimated Discount To Fair Value: 42.7%

Asahi Kasei, trading at ¥1043, is significantly undervalued based on a discounted cash flow valuation with a fair value of ¥1821.38. The company's earnings are expected to grow by 22.3% annually, outpacing the Japanese market average of 8.9%. Despite this growth potential and recent profitability, challenges remain with a low forecasted return on equity at 7.1% and dividends not well covered by earnings. Recent product innovations and expansions in water filtration and semiconductor technologies highlight strategic diversification efforts but also underscore operational risks from high one-off items impacting financial results.

- According our earnings growth report, there's an indication that Asahi Kasei might be ready to expand.

- Click here to discover the nuances of Asahi Kasei with our detailed financial health report.

Tri Chemical Laboratories (TSE:4369)

Overview: Tri Chemical Laboratories Inc., with a market capitalization of ¥137.46 billion, specializes in the production of chemical products used in various applications including semiconductors, coatings, optical fibers, solar cells, and compound semiconductors.

Operations: The company generates revenue from its production of chemical products used in semiconductors, coatings, optical fibers, solar cells, and compound semiconductors.

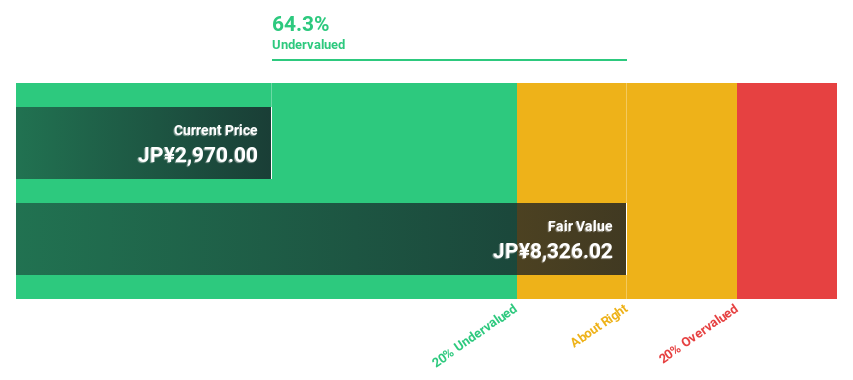

Estimated Discount To Fair Value: 38.4%

Tri Chemical Laboratories, priced at ¥4320, is significantly undervalued with a fair value of ¥7010.77 based on discounted cash flow analysis. Despite a highly volatile share price and lower profit margins year-over-year—20.3% compared to last year's 32.6%—the company's earnings are expected to surge by 37.56% annually over the next three years, outstripping the Japanese market growth forecast of 8.9%. Revenue growth also looks promising at an annual rate of 28.4%, well above the broader market's 4.3%.

- Our earnings growth report unveils the potential for significant increases in Tri Chemical Laboratories' future results.

- Unlock comprehensive insights into our analysis of Tri Chemical Laboratories stock in this financial health report.

Japan Electronic Materials (TSE:6855)

Overview: Japan Electronic Materials Corporation, specializing in the manufacture and sale of probe cards and electron tube parts both domestically and internationally, has a market capitalization of approximately ¥47.49 billion.

Operations: The company generates revenue primarily from the production and sales of probe cards and electron tube parts across global markets.

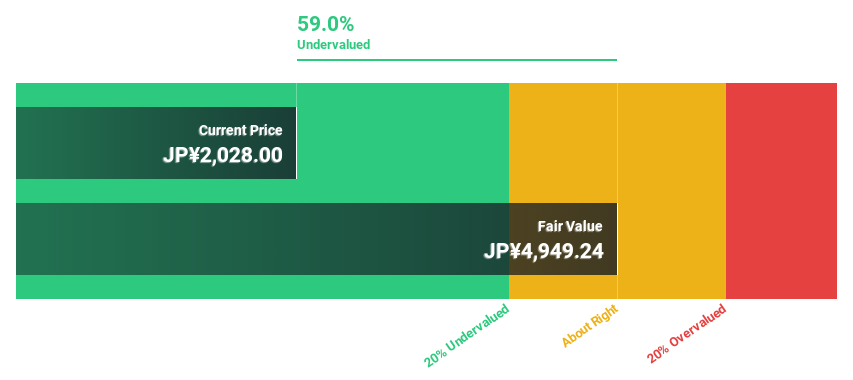

Estimated Discount To Fair Value: 26.3%

Japan Electronic Materials, trading at ¥3950, is valued below its estimated fair value of ¥5359.06, indicating a 26.3% undervaluation based on cash flow analysis. Despite a dip in profit margins to 3.6% from last year's 12.6%, the company's earnings are projected to grow by 44.26% annually, significantly outpacing the Japanese market's growth rate of 8.9%. However, potential investors should be cautious of its highly volatile share price observed over the past three months.

- Insights from our recent growth report point to a promising forecast for Japan Electronic Materials' business outlook.

- Get an in-depth perspective on Japan Electronic Materials' balance sheet by reading our health report here.

Taking Advantage

- Take a closer look at our Undervalued Japanese Stocks Based On Cash Flows list of 91 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tri Chemical Laboratories, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tri Chemical Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4369

Tri Chemical Laboratories

Provides chemical products for semiconductors, coating, optical fibers, solar cells, and compound semiconductors.

Flawless balance sheet with high growth potential.