- Japan

- /

- Semiconductors

- /

- TSE:6855

Market Cool On Japan Electronic Materials Corporation's (TSE:6855) Earnings Pushing Shares 26% Lower

To the annoyance of some shareholders, Japan Electronic Materials Corporation (TSE:6855) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Still, a bad month hasn't completely ruined the past year with the stock gaining 33%, which is great even in a bull market.

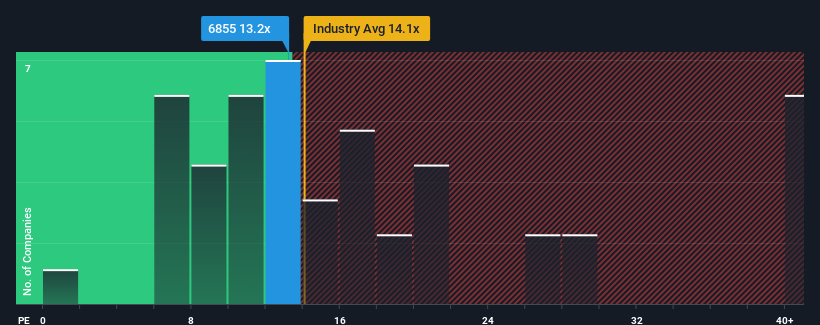

Although its price has dipped substantially, there still wouldn't be many who think Japan Electronic Materials' price-to-earnings (or "P/E") ratio of 13.2x is worth a mention when the median P/E in Japan is similar at about 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Japan Electronic Materials as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Japan Electronic Materials

Is There Some Growth For Japan Electronic Materials?

The only time you'd be comfortable seeing a P/E like Japan Electronic Materials' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 17%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 49% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 36% per annum over the next three years. With the market only predicted to deliver 10% per year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Japan Electronic Materials is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Following Japan Electronic Materials' share price tumble, its P/E is now hanging on to the median market P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Japan Electronic Materials currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Japan Electronic Materials is showing 3 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6855

Japan Electronic Materials

Engages in the manufacture and sale of probe cards and electron tube parts in Japan and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives