Renesas Electronics Corporation's (TSE:6723) investors are due to receive a payment of ¥28.00 per share on 31st of March. The dividend yield will be 1.4% based on this payment which is still above the industry average.

Renesas Electronics' Long-term Dividend Outlook appears Promising

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. While Renesas Electronics is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

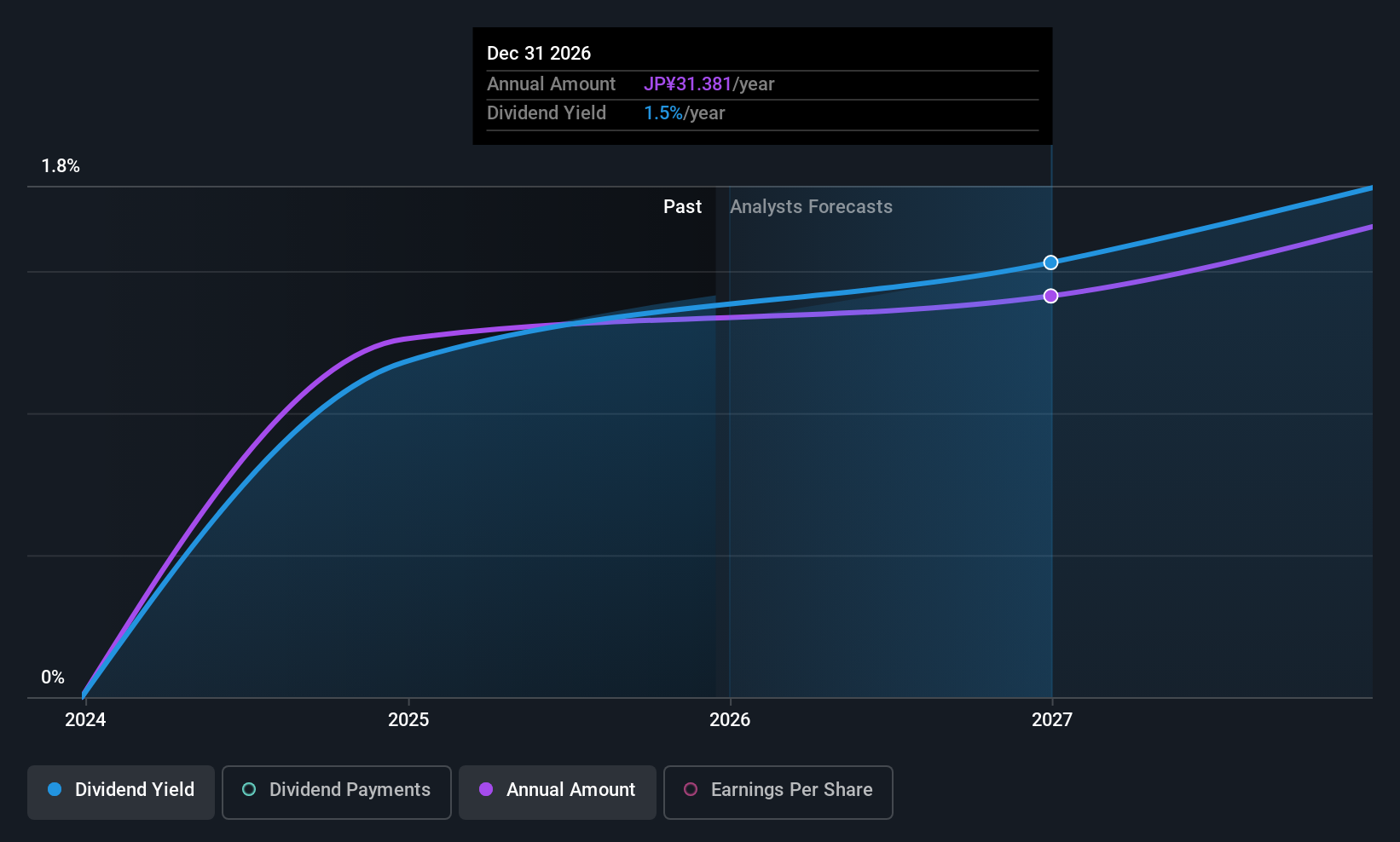

According to analysts, EPS should be several times higher next year. If the dividend continues along recent trends, we estimate the payout ratio will be 67%, so there isn't too much pressure on the dividend.

See our latest analysis for Renesas Electronics

Renesas Electronics Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. There hasn't been much of a change in the dividend over the last 2 years. Renesas Electronics hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

Renesas Electronics Could Grow Its Dividend

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see that Renesas Electronics has been growing its earnings per share at 8.9% a year over the past five years. Unprofitable companies aren't normally our pick for a dividend stock, but we like the growth that we have been seeing. If the company can become profitable soon, continuing on this trajectory would bode well for the future of the dividend.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Renesas Electronics has 2 warning signs (and 1 which is significant) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6723

Renesas Electronics

Researches, develops, designs, manufactures, sells, and services semiconductors in Japan, China, rest of Asia, Europe, North America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)