- Japan

- /

- Semiconductors

- /

- TSE:6525

Why We're Not Concerned Yet About Kokusai Electric Corporation's (TSE:6525) 30% Share Price Plunge

Kokusai Electric Corporation (TSE:6525) shares have had a horrible month, losing 30% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

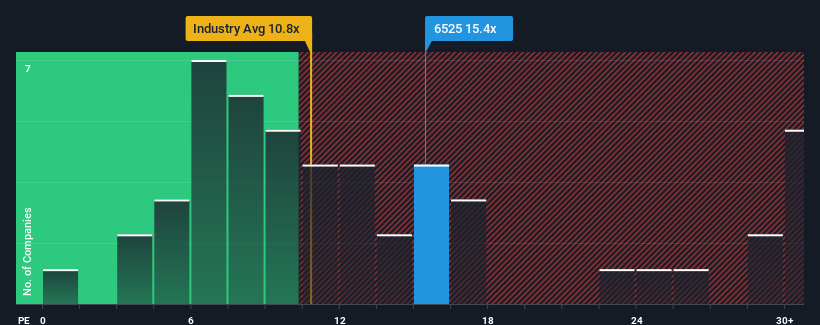

In spite of the heavy fall in price, Kokusai Electric may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.4x, since almost half of all companies in Japan have P/E ratios under 12x and even P/E's lower than 8x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Kokusai Electric as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Kokusai Electric

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Kokusai Electric's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 25% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 39% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 20% per annum over the next three years. That's shaping up to be materially higher than the 9.7% per annum growth forecast for the broader market.

With this information, we can see why Kokusai Electric is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

There's still some solid strength behind Kokusai Electric's P/E, if not its share price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Kokusai Electric maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Kokusai Electric , and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Kokusai Electric. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kokusai Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6525

Kokusai Electric

Engages in the development, manufacture, sale, repair, and maintenance of semiconductor manufacturing equipment worldwide.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)