- Japan

- /

- Semiconductors

- /

- TSE:6525

3 Japanese Exchange Stocks Estimated To Be Trading At Up To 30.9% Discount

Reviewed by Simply Wall St

Japan’s stock markets have recently experienced sharp losses, with the Nikkei 225 Index falling 6.0% and the broader TOPIX Index down 5.6%. Despite this downturn, opportunities may exist for discerning investors to find undervalued stocks that could offer significant potential. In the current market environment, a good stock is often characterized by strong fundamentals and a solid business model that can withstand economic fluctuations. Identifying such stocks trading at a discount can provide an attractive entry point for long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CMK (TSE:6958) | ¥543.00 | ¥1082.51 | 49.8% |

| en-japan (TSE:4849) | ¥2709.00 | ¥5364.98 | 49.5% |

| Hottolink (TSE:3680) | ¥372.00 | ¥725.33 | 48.7% |

| BayCurrent Consulting (TSE:6532) | ¥4545.00 | ¥8562.16 | 46.9% |

| Medley (TSE:4480) | ¥4060.00 | ¥8109.66 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1494.00 | ¥2919.18 | 48.8% |

| Asahi Kasei (TSE:3407) | ¥1094.00 | ¥2130.12 | 48.6% |

| Daiichi Kigenso Kagaku Kogyo (TSE:4082) | ¥865.00 | ¥1608.24 | 46.2% |

| CIRCULATIONLtd (TSE:7379) | ¥684.00 | ¥1284.57 | 46.8% |

| PeptiDream (TSE:4587) | ¥2690.00 | ¥5071.62 | 47% |

Let's review some notable picks from our screened stocks.

Chugin Financial GroupInc (TSE:5832)

Overview: Chugin Financial Group, Inc., with a market cap of ¥300.45 billion, offers a range of financial services to both corporate and individual customers in Japan through its subsidiary The Chugoku Bank, Limited.

Operations: Chugin Financial Group, Inc. generates revenue by providing a variety of financial services to corporate and individual clients in Japan through its subsidiary, The Chugoku Bank, Limited.

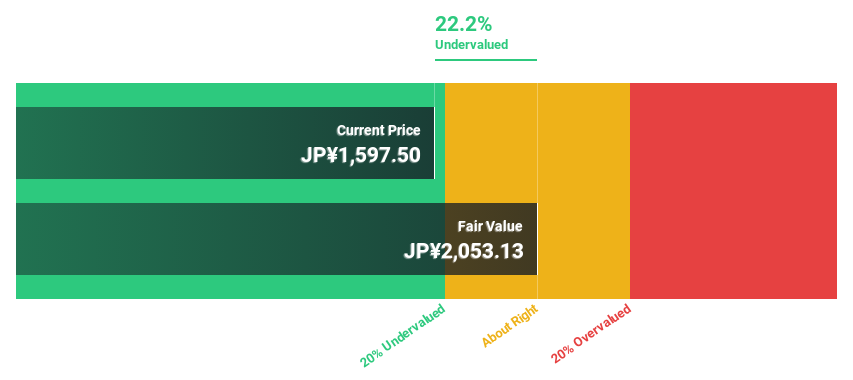

Estimated Discount To Fair Value: 13.5%

Chugin Financial Group Inc. appears undervalued based on cash flows, trading at ¥1660, below its estimated fair value of ¥1919.99. The company has a robust revenue growth forecast of 28.6% annually, outpacing the JP market's 4.3%. Recent buyback activities totaling ¥1,666.47 million for 1,040,300 shares aim to enhance capital efficiency and shareholder returns. However, the allowance for bad loans stands low at 53%, which might require attention in future assessments.

- The analysis detailed in our Chugin Financial GroupInc growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Chugin Financial GroupInc.

Kokusai Electric (TSE:6525)

Overview: Kokusai Electric Corporation develops, manufactures, sells, repairs, and maintains semiconductor manufacturing equipment globally with a market cap of ¥988.50 billion.

Operations: Kokusai Electric's revenue primarily stems from its Semiconductor Manufacturing Equipment Business, which generated ¥180.84 billion.

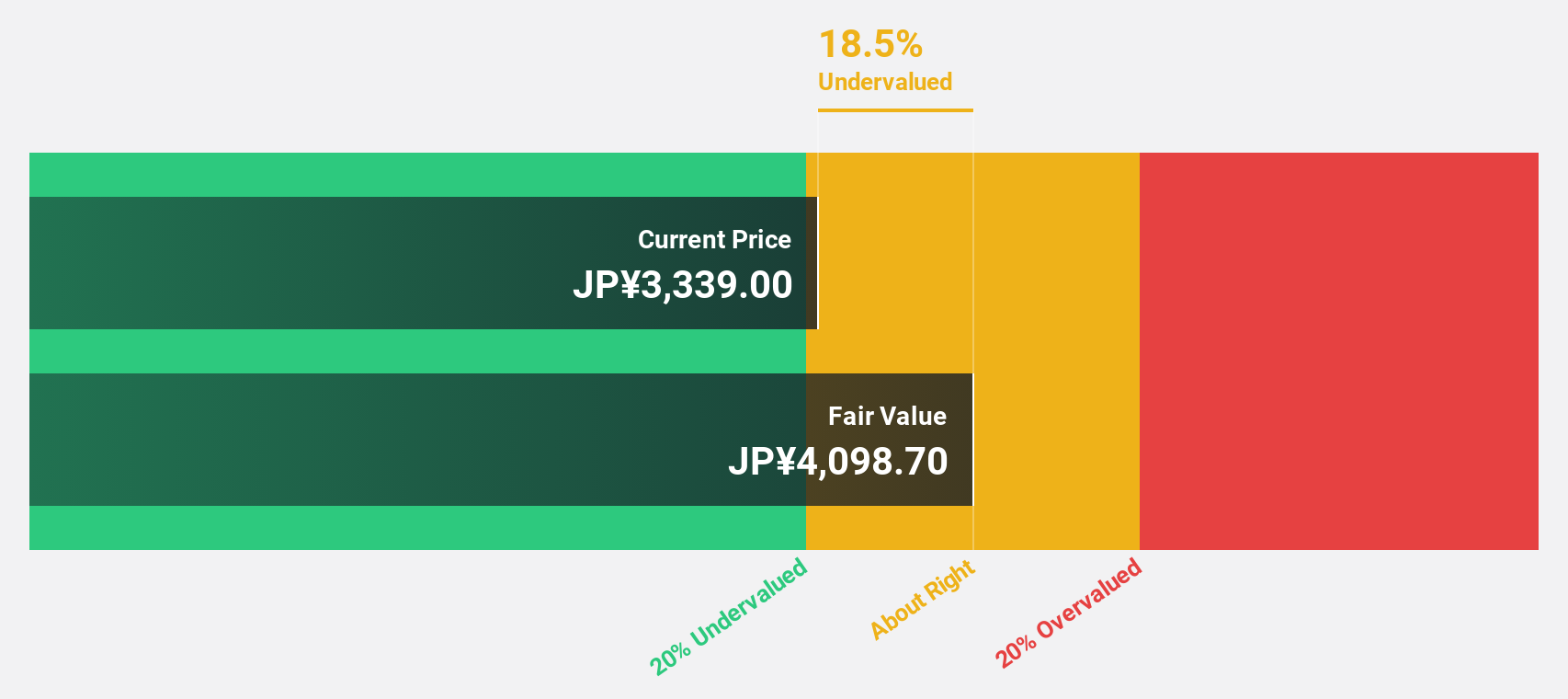

Estimated Discount To Fair Value: 20%

Kokusai Electric is trading at ¥4200, below its estimated fair value of ¥5246.79, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow 22.4% annually, outpacing the JP market's 8.9%. The company announced a share repurchase program worth ¥18 billion and a secondary offering of common stock to enhance shareholder returns and manage supply-demand dynamics. Recent board changes include the appointment of Chizu Sekine as an Outside Director.

- Our growth report here indicates Kokusai Electric may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Kokusai Electric stock in this financial health report.

Taiyo Yuden (TSE:6976)

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally with a market cap of ¥566.55 billion.

Operations: The company generates revenue from various segments including capacitors (¥231.45 billion), ferrite and applied products (¥53.24 billion), integrated modules and devices (¥133.12 billion), and other electronic components (¥10.67 billion).

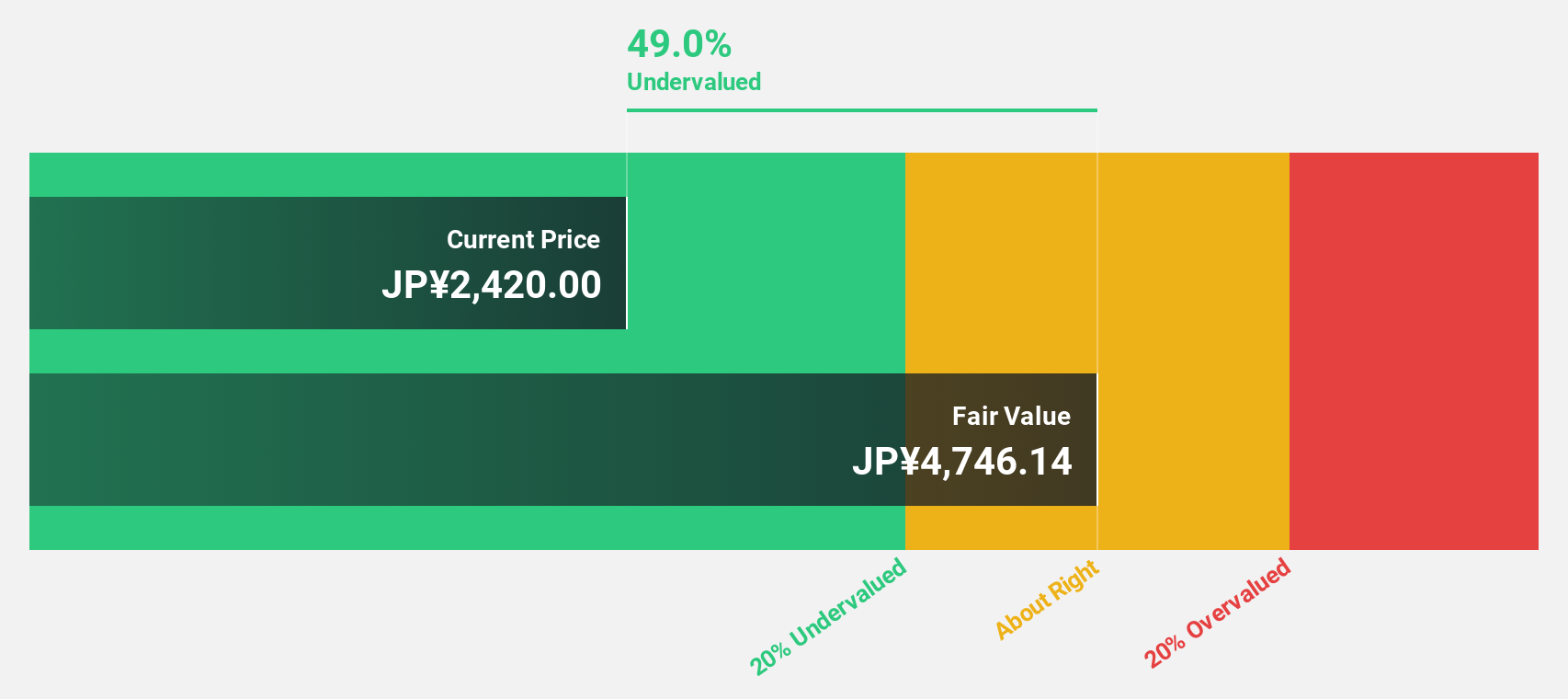

Estimated Discount To Fair Value: 30.9%

Taiyo Yuden is trading at ¥4546, significantly below its estimated fair value of ¥6581.32, indicating it is highly undervalued based on discounted cash flows. Despite a volatile share price, earnings are forecast to grow 29.2% annually, well above the JP market's 8.9%. Recent events include a board decision to dispose of treasury stock as restricted stock remuneration and amendments to the company charter aimed at governance improvements.

- Our earnings growth report unveils the potential for significant increases in Taiyo Yuden's future results.

- Take a closer look at Taiyo Yuden's balance sheet health here in our report.

Make It Happen

- Unlock more gems! Our Undervalued Japanese Stocks Based On Cash Flows screener has unearthed 81 more companies for you to explore.Click here to unveil our expertly curated list of 84 Undervalued Japanese Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kokusai Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6525

Kokusai Electric

Engages in the development, manufacture, sale, repair, and maintenance of semiconductor manufacturing equipment worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives