- Japan

- /

- Semiconductors

- /

- TSE:6323

Asian Market Insights: Shenzhen New Industries Biomedical Engineering And 2 Other Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

Amidst global economic uncertainties and fluctuating indices, the Asian markets have shown resilience, with China's stimulus hopes driving a recent uptick in mainland stock exchanges. As investors navigate these complex conditions, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Guizhou Space Appliance (SZSE:002025) | CN¥58.35 | CN¥115.75 | 49.6% |

| APAC Realty (SGX:CLN) | SGD0.43 | SGD0.85 | 49.5% |

| Takara Bio (TSE:4974) | ¥853.00 | ¥1686.88 | 49.4% |

| Food & Life Companies (TSE:3563) | ¥4349.00 | ¥8695.25 | 50% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$131.50 | NT$262.21 | 49.8% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.67 | SGD1.33 | 49.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩38200.00 | ₩75949.64 | 49.7% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.53 | CN¥16.91 | 49.6% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.60 | CN¥37.18 | 50% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15880.00 | ₩31498.51 | 49.6% |

We're going to check out a few of the best picks from our screener tool.

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. focuses on the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals both in China and internationally, with a market cap of CN¥47.09 billion.

Operations: The company generates revenue primarily from its in vitro diagnostic segment, amounting to CN¥4.44 billion.

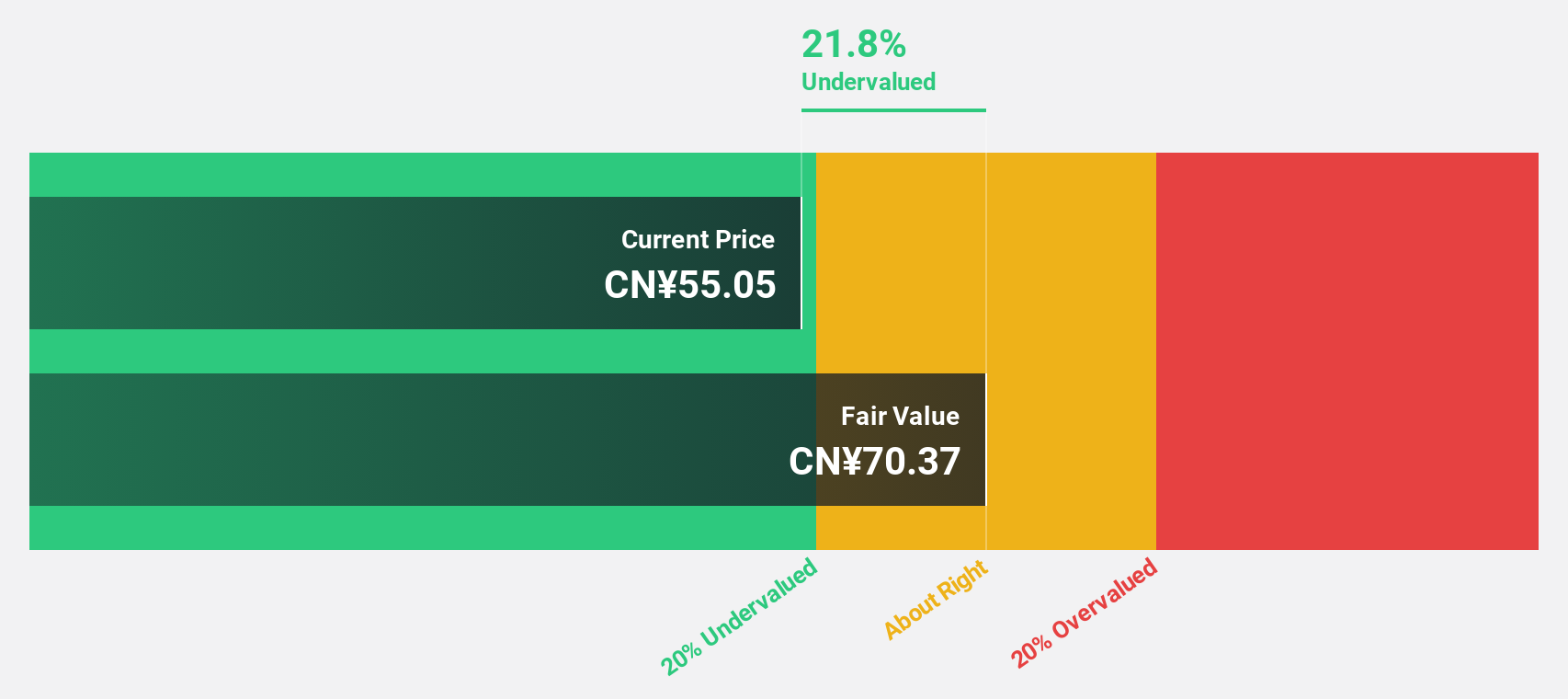

Estimated Discount To Fair Value: 16.1%

Shenzhen New Industries Biomedical Engineering is trading at CN¥59.93, approximately 16.1% below its estimated fair value of CN¥71.44, indicating it may be undervalued based on cash flows. Despite earnings forecasted to grow slower than the Chinese market at 21.1% annually, revenue is expected to rise faster than the market at 20.7% per year. However, its unstable dividend track record may concern income-focused investors despite a high future return on equity of 23.6%.

- Our comprehensive growth report raises the possibility that Shenzhen New Industries Biomedical Engineering is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Shenzhen New Industries Biomedical Engineering.

Food & Life Companies (TSE:3563)

Overview: Food & Life Companies Ltd. operates a chain of sushi restaurants with a market cap of ¥491.99 billion.

Operations: The company's revenue segments include the Domestic Sushiro Business at ¥242.76 billion, Overseas Sushiro Business at ¥100.83 billion, and Kyotaru Business at ¥23.88 billion.

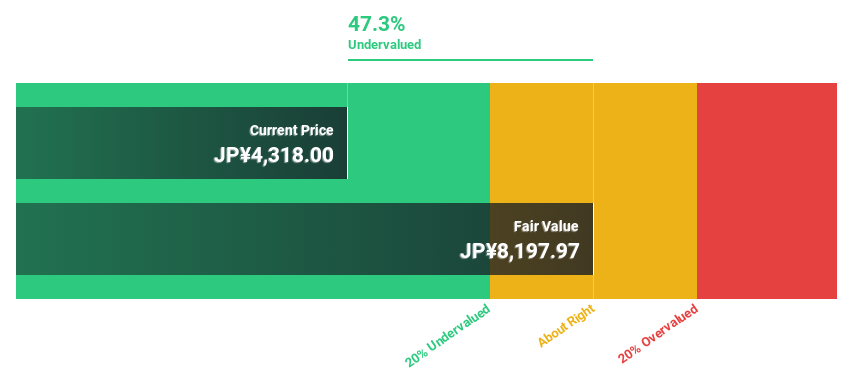

Estimated Discount To Fair Value: 50%

Food & Life Companies is trading at ¥4,349, significantly below its estimated fair value of ¥8,695.25, suggesting undervaluation based on cash flows. Despite a high debt level and recent dividend decrease to ¥27.50 per share from ¥30.00, earnings are forecasted to grow 10.1% annually—outpacing the Japanese market—and revenue is expected to increase by 9.6% per year. Recent guidance sets sales at JPY 408 billion and operating profit at JPY 26 billion for fiscal year-end September 2025.

- According our earnings growth report, there's an indication that Food & Life Companies might be ready to expand.

- Get an in-depth perspective on Food & Life Companies' balance sheet by reading our health report here.

Rorze (TSE:6323)

Overview: Rorze Corporation designs, develops, manufactures, and sells automation systems for semiconductor and flat panel display production globally with a market cap of ¥294.96 billion.

Operations: Rorze Corporation's revenue segments are focused on automation systems for the semiconductor and flat panel display industries.

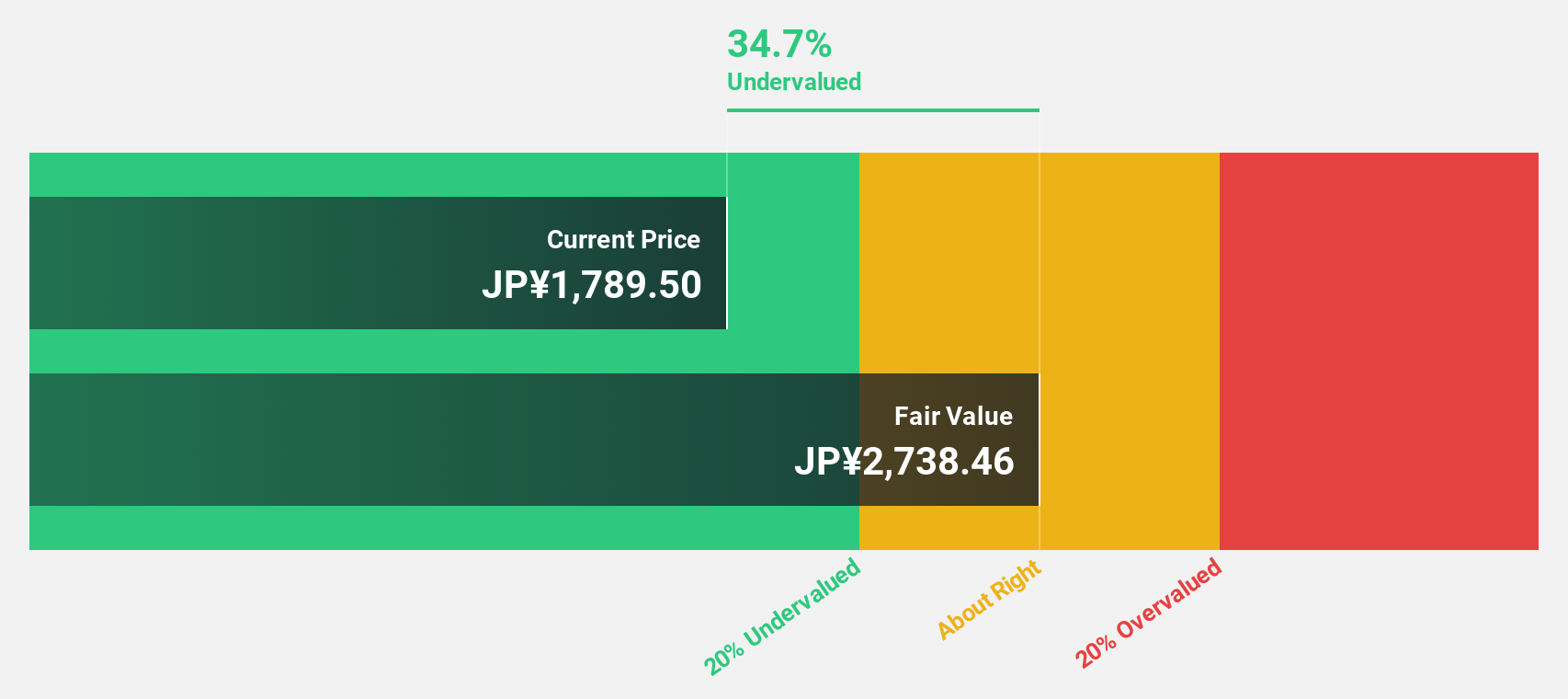

Estimated Discount To Fair Value: 36.2%

Rorze is trading at ¥1,672.5, well below its estimated fair value of ¥2,623.39, highlighting undervaluation based on cash flows. Despite recent share price volatility, the company shows promising growth prospects with earnings projected to rise 9.32% annually and revenue expected to grow 8% per year—both outpacing the Japanese market averages. The stock offers good relative value compared to industry peers and maintains a high forecasted return on equity of 20.9%.

- Insights from our recent growth report point to a promising forecast for Rorze's business outlook.

- Click here to discover the nuances of Rorze with our detailed financial health report.

Taking Advantage

- Unlock our comprehensive list of 275 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6323

Rorze

Engages in the design, development, manufacture, and sale of automation systems for the semiconductor and flat panel display production worldwide.

Outstanding track record with flawless balance sheet.