- Japan

- /

- Specialty Stores

- /

- TSE:9983

Fast Retailing (TSE:9983) Is Up 6.0% After Raising Dividend and Earnings Guidance Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Fast Retailing Co., Ltd. recently raised its annual dividend guidance for the year ending August 31, 2025 to ¥260 per share and provided similar guidance for 2026, alongside new consolidated earnings forecasts expecting ¥3.75 trillion in revenue and ¥610 billion in operating profit.

- This series of updates highlights management's confidence in the company's ongoing ability to generate strong cash flows and maintain shareholder returns.

- Now, we'll explore how this dividend increase reinforces Fast Retailing's investment narrative by underscoring its commitment to returning value to shareholders.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Fast Retailing's Investment Narrative?

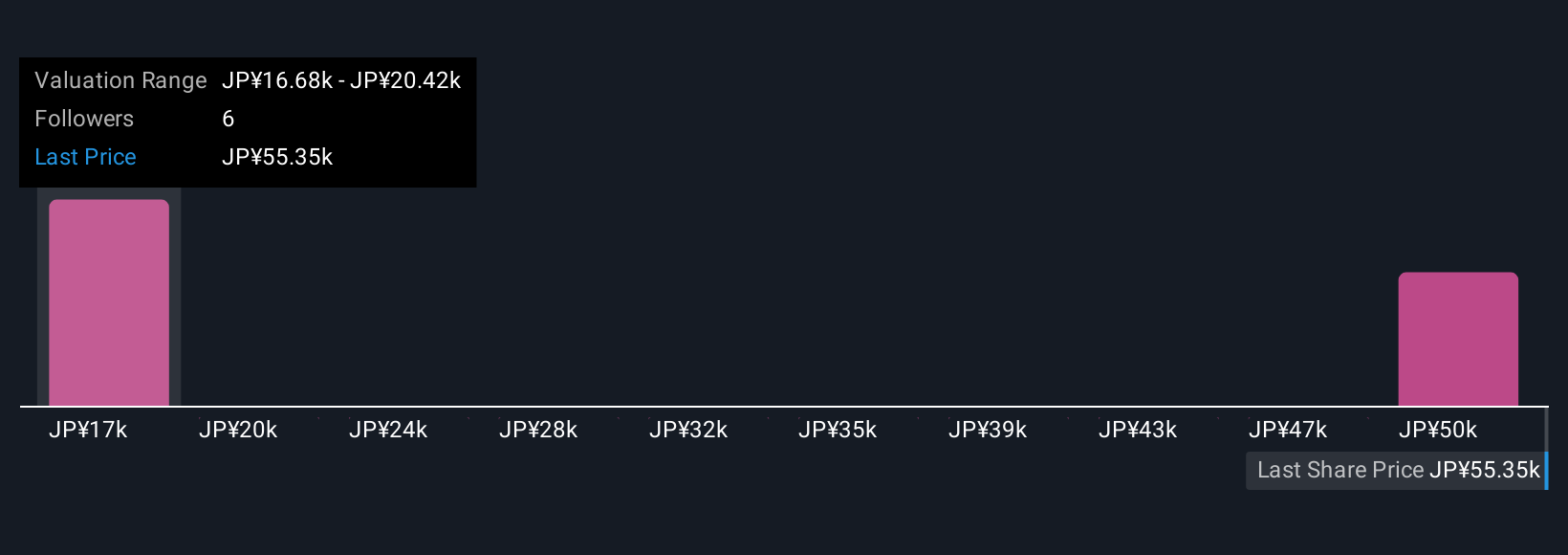

For anyone considering Fast Retailing, the investment story often comes down to believing in the company's ability to keep expanding its global footprint, defend its brand, and deliver on consistent, profit-driven growth, despite its relatively high valuation. The most recent round of dividend increases and upbeat earnings guidance signals management's continued optimism around growth and cash generation, which could reinforce confidence around shareholder returns in the short term. That said, with the stock still trading well above mainstream fair value estimates and relative to peers, these positive developments may not be enough to dramatically shift the key balance of risks. Investors still need to weigh broader questions about premium valuation, slower forecast earnings growth compared to market averages, and whether recent profitability momentum can be sustained amid the industry’s competitive pressures. This dividend move fits neatly into the narrative of shareholder focus, but doesn’t resolve concerns around long-term growth and valuation risk.

On the other hand, premium pricing leaves little margin for error should growth stall. Fast Retailing's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Fast Retailing - why the stock might be worth as much as ¥54084!

Build Your Own Fast Retailing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fast Retailing research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Fast Retailing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fast Retailing's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9983

Fast Retailing

Operates as an apparel designer and retailer in Japan and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion