Evaluating Izumi (TSE:8273): Is the Current Valuation Justified After the Latest Profit Dip and Strategic Update?

Reviewed by Kshitija Bhandaru

Izumi (TSE:8273) recently updated its financial outlook following ongoing inflation and higher costs, and also finalized accounting for a business combination. While revenue rose, net profit declined. The company is introducing new measures to improve performance.

See our latest analysis for Izumi.

Izumi’s share price has softened over the past year, mirroring the company’s updated financial forecast and the impact of higher operating costs. The 1-year total shareholder return is -11.9%. The recent dip suggests investor caution remains as operational adjustments work their way through the business. However, the three-year total return is still positive.

If busy retail headlines have you curious about what else is worth watching, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets, the key question now is whether Izumi’s challenges have been fully factored into the current valuation. Investors may also be considering whether a fresh buying opportunity is being overlooked as future growth unfolds.

Price-to-Earnings of 17.9x: Is it justified?

Izumi's shares trade at a price-to-earnings (P/E) ratio of 17.9x, which is higher than the peer average of 16.7x. This suggests the market currently assigns a premium relative to similar companies.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. In the retail sector, this can indicate confidence in future earnings growth and stability. A higher-than-average P/E means the market expects stronger growth or more consistent profitability compared to competitors.

Given the current P/E, investors appear to expect more robust performance going forward, despite recent profit declines. However, compared to the peer average, this premium may signal that expectations could be stretched if growth does not materialize. The estimated fair P/E ratio for Izumi is 18.1x, which suggests the market's current pricing is actually reasonable and could move closer to this fair level if fundamentals support it.

Explore the SWS fair ratio for Izumi

Result: Price-to-Earnings of 17.9x (ABOUT RIGHT)

However, sustained inflation or further cost increases could pressure margins and limit Izumi’s ability to deliver the growth investors are hoping for.

Find out about the key risks to this Izumi narrative.

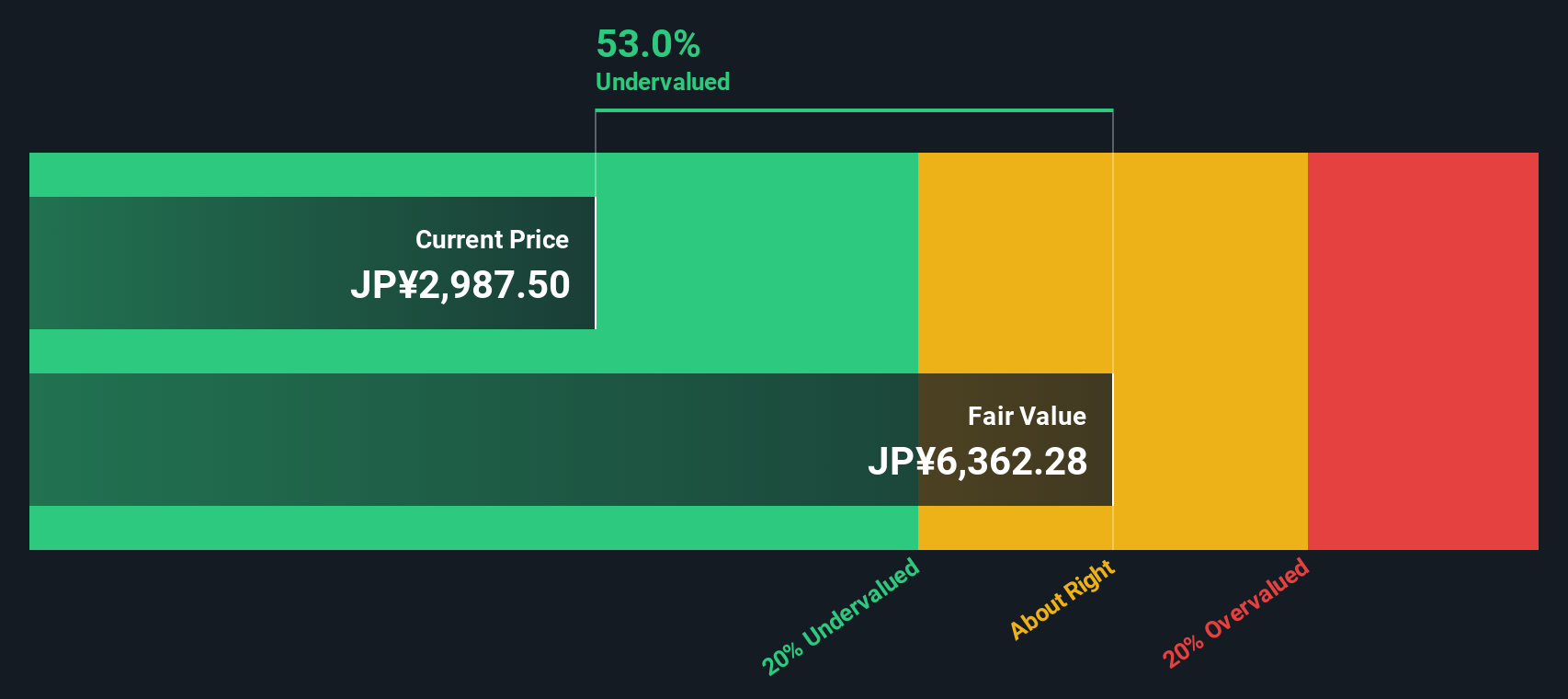

Another View: SWS DCF Model Sees Significant Undervaluation

While the market currently values Izumi in line with earnings expectations, our DCF model presents a starkly different story. It suggests that shares are trading more than 50% below their estimated fair value. This large discount raises a key question: Has the market underestimated Izumi’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Izumi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Izumi Narrative

If you see the story differently, or would rather shape your own outlook, you can examine the figures and build your own perspective in just minutes using Do it your way.

A great starting point for your Izumi research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great opportunities often hide in plain sight. Let the Simply Wall Street Screener help you uncover stocks that fit your favorite themes and financial goals, all in one place.

- Capture impressive passive income streams by checking out these 18 dividend stocks with yields > 3%, which offers consistently strong yields above 3%.

- Scout timely bargains by reviewing these 891 undervalued stocks based on cash flows, priced well below their intrinsic cash flow values.

- Ride the AI revolution by filtering for market leaders among these 25 AI penny stocks that are transforming industries with smart technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8273

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives