- Japan

- /

- Specialty Stores

- /

- TSE:7606

Subdued Growth No Barrier To United Arrows Ltd. (TSE:7606) With Shares Advancing 34%

United Arrows Ltd. (TSE:7606) shares have had a really impressive month, gaining 34% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 9.4% isn't as attractive.

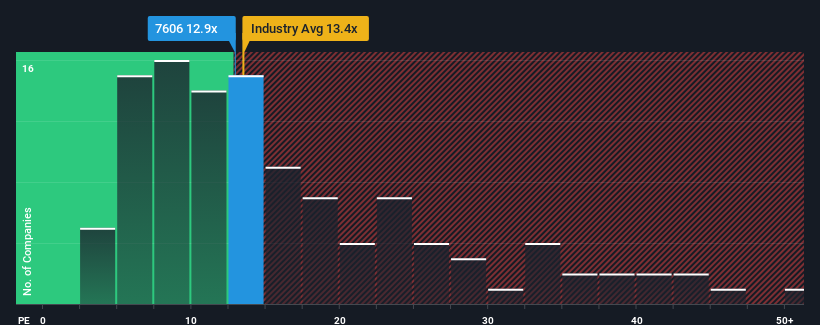

Even after such a large jump in price, there still wouldn't be many who think United Arrows' price-to-earnings (or "P/E") ratio of 12.9x is worth a mention when the median P/E in Japan is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's inferior to most other companies of late, United Arrows has been relatively sluggish. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for United Arrows

How Is United Arrows' Growth Trending?

United Arrows' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.6%. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 6.3% per year over the next three years. That's shaping up to be materially lower than the 9.4% per year growth forecast for the broader market.

With this information, we find it interesting that United Arrows is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From United Arrows' P/E?

Its shares have lifted substantially and now United Arrows' P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of United Arrows' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for United Arrows that you should be aware of.

If these risks are making you reconsider your opinion on United Arrows, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade United Arrows, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7606

United Arrows

Engages in the planning, buying, and sale of men’s and women’s clothing and accessories, and miscellaneous items in Japan.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives