Is Rakuten Group's (TSE:4755) Impairment Charge a Sign of Deeper Profitability Challenges Ahead?

Reviewed by Sasha Jovanovic

- Rakuten Group announced it expects to record an impairment loss of approximately ¥27 billion in its consolidated financial results for the third quarter of the fiscal year ending December 31, 2025.

- This sizable impairment highlights potential ongoing challenges to profitability and cash flow for the group's business segments as it continues to invest in technology and global expansion.

- We'll examine how this expected impairment charge impacts the investment narrative, particularly regarding Rakuten Group's path to sustainable profitability.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Rakuten Group Investment Narrative Recap

To be a shareholder in Rakuten Group, you need to believe in the turnaround potential of its diverse digital ecosystem, driven by subscriber growth, AI efficiencies, and international expansion, despite persistent unprofitability and formidable execution risks. The newly announced ¥27 billion impairment loss for Q3 2025 is unlikely to materially alter the company’s most important near-term catalyst: achieving positive EBITDA in Rakuten Mobile, but it does emphasize the ongoing risks surrounding financial flexibility and asset quality.

Of the recent company updates, the early redemption of subordinated bonds totaling over ¥36 billion stands out as it affects Rakuten’s debt profile and ability to self-fund growth. The combination of asset write-downs and active debt management will be central to how Rakuten balances the push for operational profitability with the risk of heightened financial pressures.

By contrast, investors should keep a close eye on any further signs of strain on Rakuten’s ability to maintain...

Read the full narrative on Rakuten Group (it's free!)

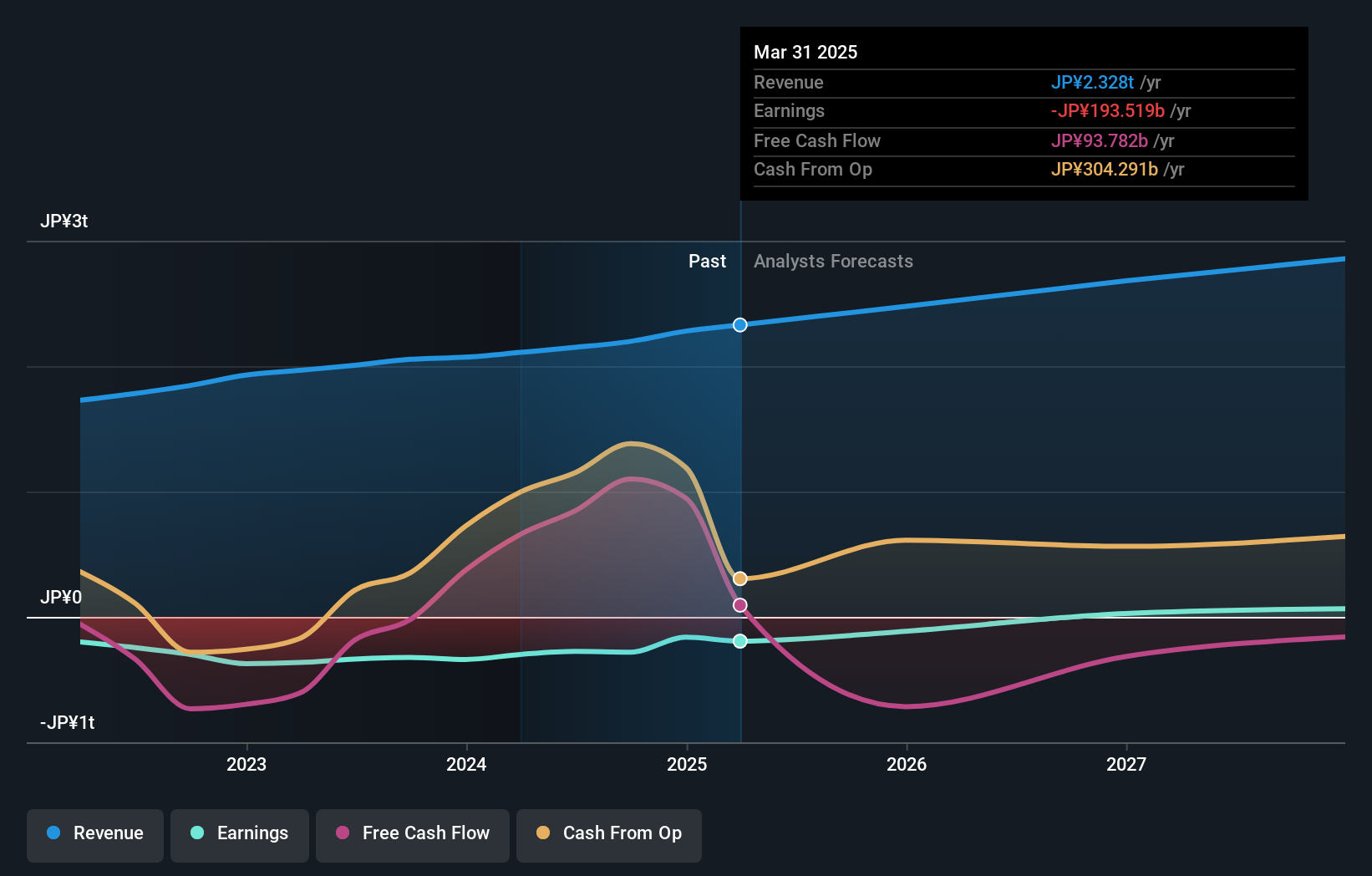

Rakuten Group's outlook anticipates ¥2,965.8 billion in revenue and ¥79.4 billion in earnings by 2028. This projection is based on a 7.5% annual revenue growth rate and an increase in earnings of ¥290.3 billion from the current ¥-210.9 billion.

Uncover how Rakuten Group's forecasts yield a ¥979 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from four Simply Wall St Community members span from ¥979 to ¥3,928 per share, showing strong differences in investor outlooks. Keep in mind, financial flexibility risks remain top of mind for many as you compare these views.

Explore 4 other fair value estimates on Rakuten Group - why the stock might be worth over 3x more than the current price!

Build Your Own Rakuten Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rakuten Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Rakuten Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rakuten Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives