Investing in Rakuten Group (TSE:4755) five years ago would have delivered you a 30% gain

Rakuten Group, Inc. (TSE:4755) shareholders have seen the share price descend 12% over the month. On the bright side the share price is up over the last half decade. However we are not very impressed because the share price is only up 28%, less than the market return of 128%.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Rakuten Group

Rakuten Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years Rakuten Group saw its revenue grow at 11% per year. That's a pretty good long term growth rate. The annual gain of 5% over five years is better than nothing, but falls short of the market. Arguably, that means, the market (previously) expected stronger growth from the company.

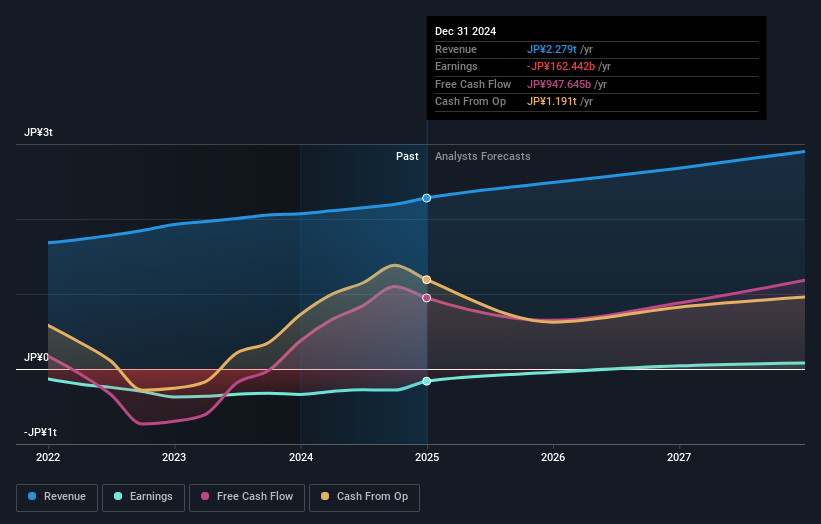

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Rakuten Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Rakuten Group stock, you should check out this free report showing analyst consensus estimates for future profits.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Rakuten Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Rakuten Group shareholders, and that cash payout contributed to why its TSR of 30%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Rakuten Group shareholders have received a total shareholder return of 17% over the last year. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Rakuten Group better, we need to consider many other factors. Take risks, for example - Rakuten Group has 1 warning sign we think you should be aware of.

Of course Rakuten Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in Japan and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives