- Japan

- /

- Specialty Stores

- /

- TSE:2726

3 High Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In the wake of recent global market developments, U.S. stocks have rallied to record highs, buoyed by expectations of favorable economic policies following a "red sweep" in the elections. This optimism is further supported by a Federal Reserve rate cut and robust service sector activity, painting a positive picture for growth prospects. In such an environment, identifying high-growth companies with strong insider ownership can be particularly appealing as these firms often signal confidence from those closest to the business and may be well-positioned to capitalize on favorable economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of ¥263.07 billion.

Operations: Revenue segments for TSE:2726 include the planning, manufacture, wholesale, and retail of clothing products, encompassing men's and women's apparel and accessories in Japan.

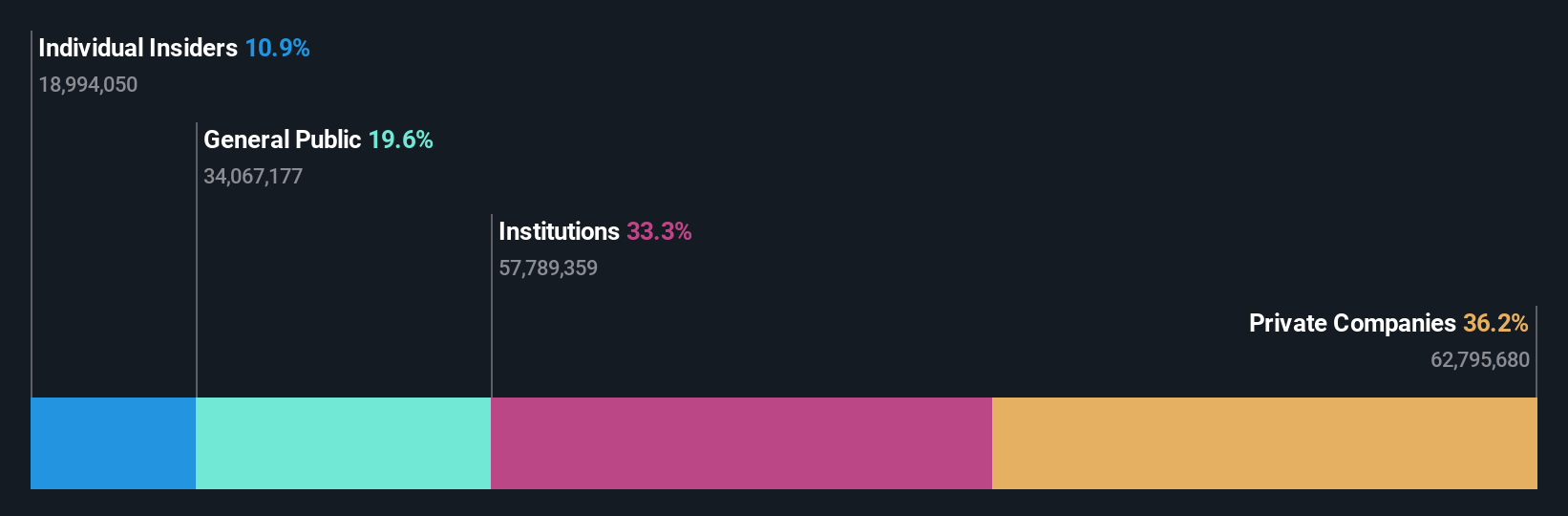

Insider Ownership: 10.9%

Earnings Growth Forecast: 11.9% p.a.

PAL GROUP Holdings forecasts net sales of ¥209.22 billion and an operating profit of ¥22.96 billion for the fiscal year ending February 2025, with earnings expected to grow faster than the Japanese market at 11.9% annually. Despite high share price volatility, it trades at a discount to its estimated fair value and shows no recent insider trading activity. The company maintains stable dividends, paying ¥50 per share this fiscal year, matching last year's payout.

- Navigate through the intricacies of PAL GROUP Holdings with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that PAL GROUP Holdings' share price might be on the expensive side.

World (TSE:3612)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: World Co., Ltd. operates through its subsidiaries to plan, manufacture, retail, sell, and import/export apparel and fashion products both in Japan and internationally, with a market cap of ¥65.35 billion.

Operations: World Co., Ltd. generates revenue through the planning, manufacturing, retailing, selling, and importing/exporting of apparel and fashion products across domestic and international markets.

Insider Ownership: 13.9%

Earnings Growth Forecast: 23.6% p.a.

World Co., Ltd. demonstrates promising growth potential, with earnings projected to grow significantly at 23.6% annually, outpacing the Japanese market average of 9.1%. Recent sales data shows mixed results; October online sales increased by 102.1% year on year, while overall domestic sales declined slightly. The company trades at a substantial discount to its estimated fair value but faces challenges with high debt levels and an unstable dividend history despite recent increases in payouts to ¥37 per share.

- Click here and access our complete growth analysis report to understand the dynamics of World.

- Insights from our recent valuation report point to the potential undervaluation of World shares in the market.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★★

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan, with a market cap of ¥273.51 billion.

Operations: The company's revenue is primarily derived from its Platform Services Business, which generated ¥38.47 billion.

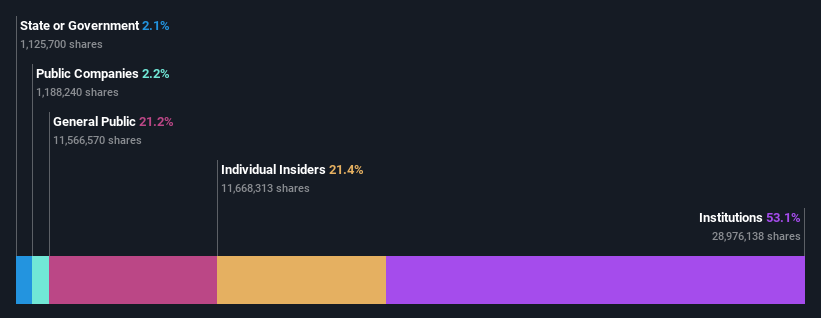

Insider Ownership: 21.4%

Earnings Growth Forecast: 70.3% p.a.

Money Forward is forecasted to achieve significant revenue growth of 21.2% annually, surpassing the Japanese market average. Despite trading at a large discount to its estimated fair value, it faces challenges with expected operating losses for the fiscal year ending November 2024. The company aims to become profitable within three years, supported by strategic moves such as transferring fintech business rights and considering partnerships with Sumitomo Mitsui Card Company.

- Unlock comprehensive insights into our analysis of Money Forward stock in this growth report.

- In light of our recent valuation report, it seems possible that Money Forward is trading behind its estimated value.

Where To Now?

- Gain an insight into the universe of 1524 Fast Growing Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2726

PAL GROUP Holdings

Engages in the planning, manufacture, wholesale, and retail of clothing products, including men’s and women’s clothing and accessories in Japan.

Flawless balance sheet with solid track record and pays a dividend.