- Japan

- /

- Healthtech

- /

- TSE:4480

Exploring High Growth Tech Stocks In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing mixed signals with U.S. consumer confidence declining and major stock indexes showing moderate gains, particularly in large-cap growth stocks. In this fluctuating environment, identifying high-growth tech stocks requires a keen understanding of market dynamics and the ability to recognize companies that can thrive despite economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Zhejiang Meorient Commerce Exhibition (SZSE:300795)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Meorient Commerce Exhibition Inc. operates as a company specializing in organizing international trade exhibitions, with a market capitalization of CN¥4.76 billion.

Operations: Zhejiang Meorient Commerce Exhibition Inc. generates revenue primarily through organizing international trade exhibitions. The company focuses on facilitating global business interactions and enhancing trade opportunities for various industries.

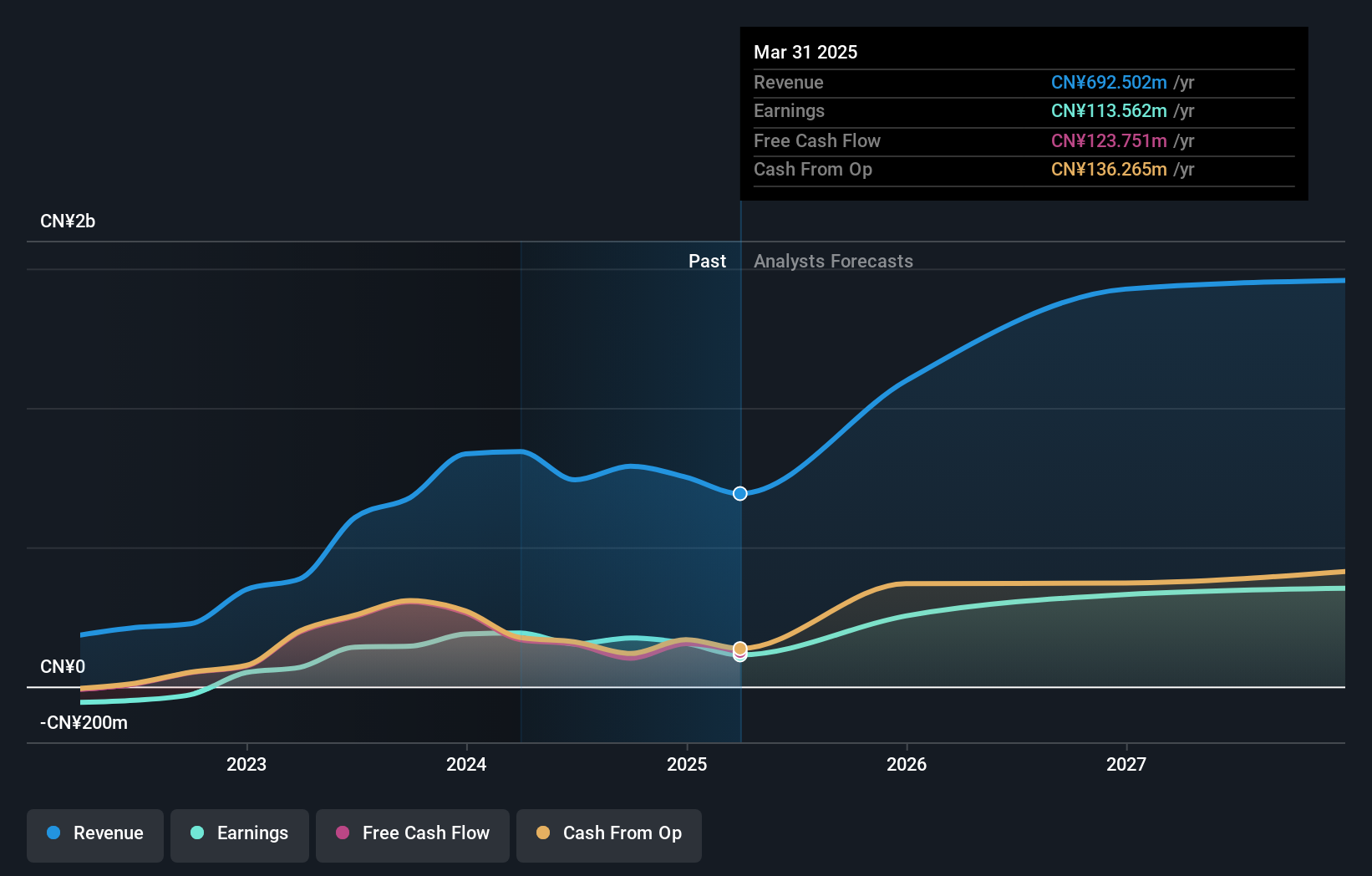

Zhejiang Meorient Commerce Exhibition, despite a recent drop from the S&P Global BMI Index, shows promising financial trends with a robust forecast in earnings growth at 31.87% annually and revenue expected to surge by 26.7% per year. This performance outpaces the broader Chinese market's projections, where average earnings and revenue growths stand at 25.2% and 13.6%, respectively. The company's commitment to innovation is evident from its R&D investments which are crucial for maintaining competitive advantage in the fast-evolving tech landscape. Moreover, Zhejiang Meorient's ability to generate high-quality earnings is underscored by its positive free cash flow status and an impressive return on equity forecast of 30.8% in three years' time, signaling strong managerial efficiency and profitability potential. These financial health indicators combined with significant market outperformance provide a solid foundation for future prospects despite volatility in share price over the past months.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

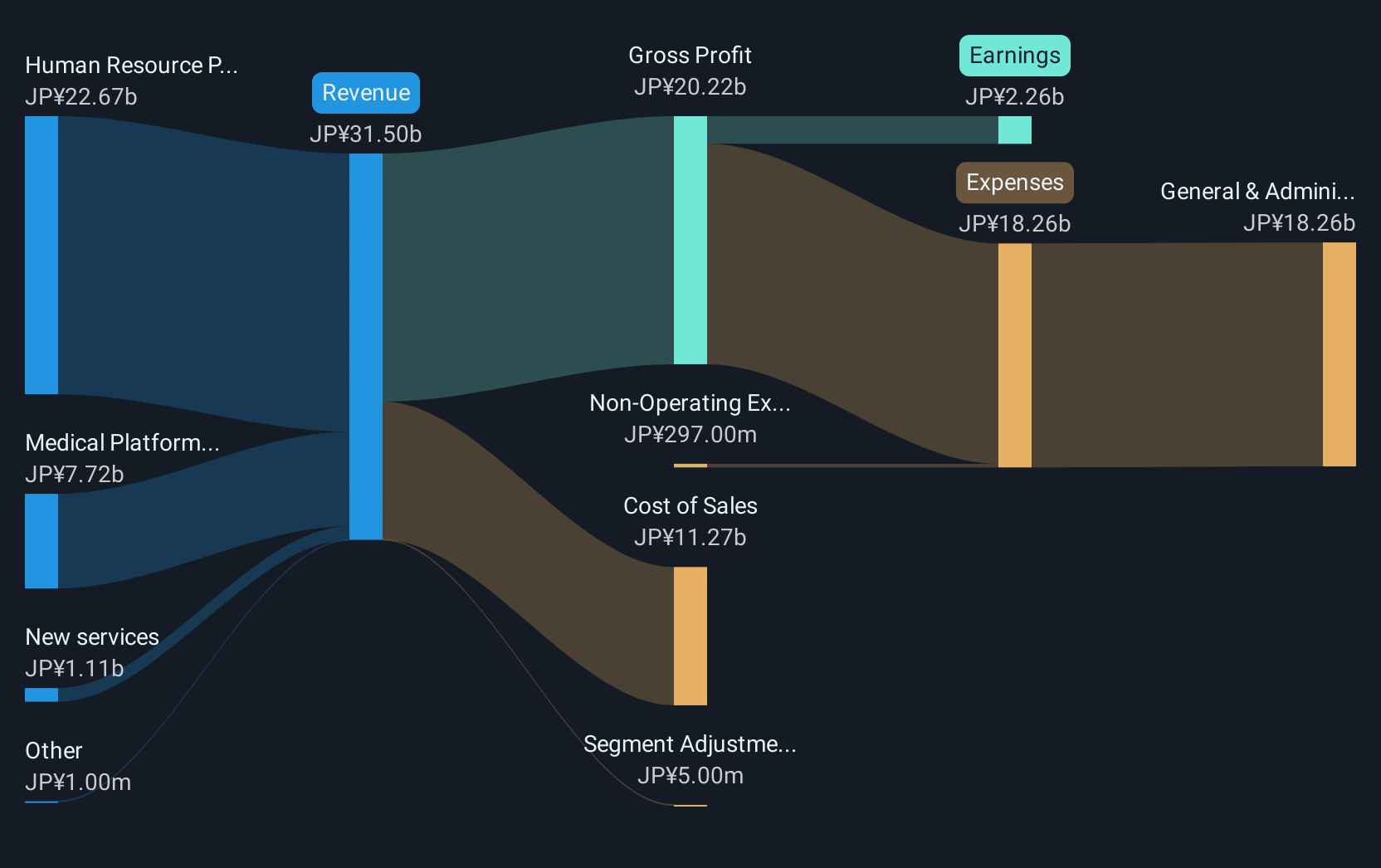

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market capitalization of ¥124.58 billion.

Operations: Medley generates revenue primarily through its Human Resource Platform Business, contributing ¥19.45 billion, followed by the Medical Platform Business at ¥6.52 billion. The New Services segment adds ¥713 million to its revenue streams.

Medley's strategic acquisitions, including the recent addition of ASFON TRUST NETWORK, underscore its aggressive expansion in healthcare technology. The company's revenue and earnings are poised for substantial growth, with projections showing a 22.4% increase in revenue and a 31.7% rise in earnings annually, outstripping Japan's market averages significantly. These figures reflect Medley’s commitment to solidifying its market position through innovation and strategic growth initiatives. Notably, its R&D spending is pivotal in driving these advancements, ensuring Medley remains at the forefront of technological integration within the healthcare sector. This approach not only enhances their service offerings but also secures a competitive edge in an increasingly digital landscape.

- Navigate through the intricacies of Medley with our comprehensive health report here.

Understand Medley's track record by examining our Past report.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

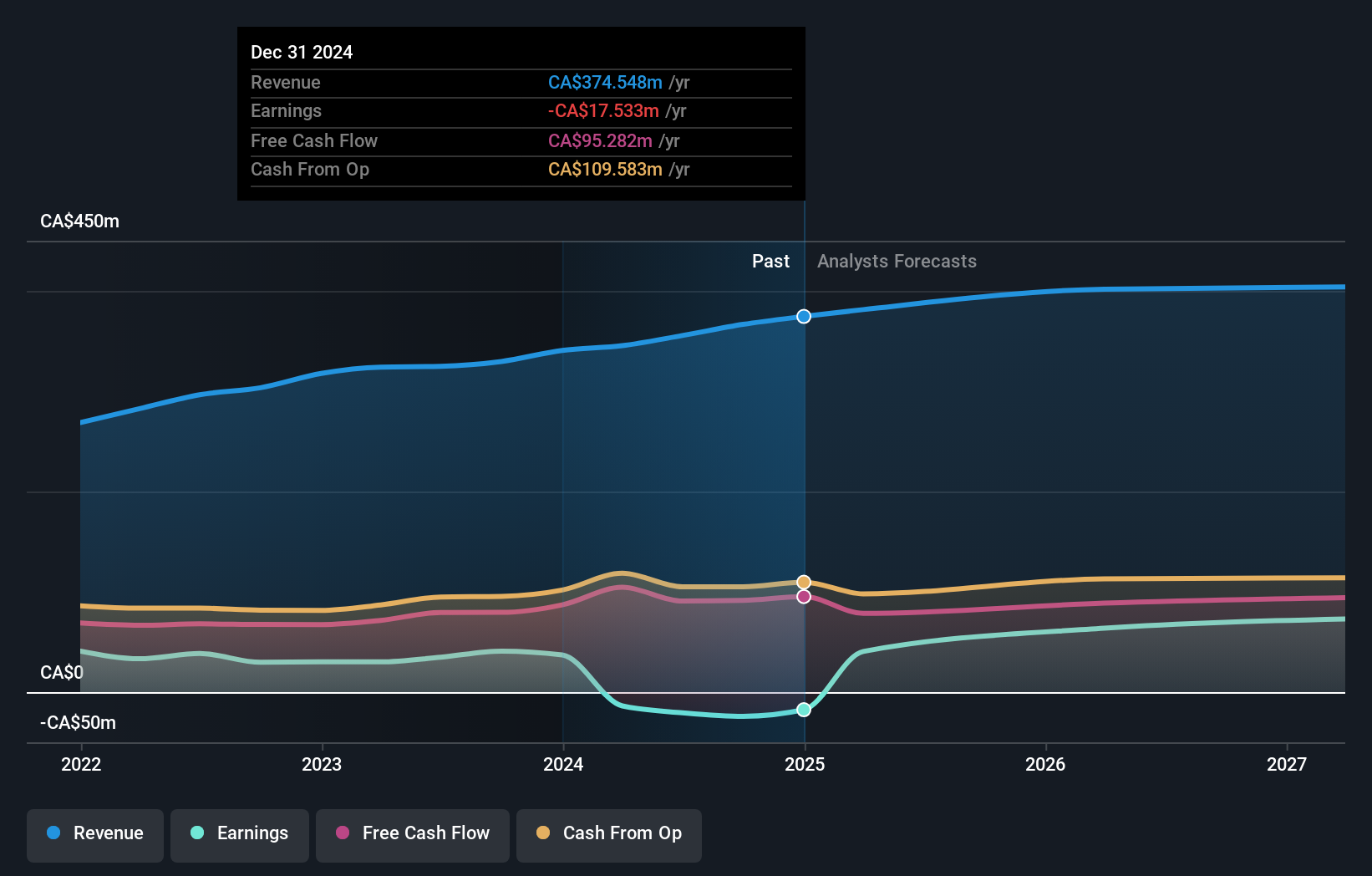

Overview: Stingray Group Inc. is a global music, media, and technology company with a market capitalization of CA$511.79 million.

Operations: Stingray Group generates revenue primarily through its Broadcasting and Commercial Music segment, which accounts for CA$236.80 million, and its Radio segment, contributing CA$129.80 million. The company operates on a global scale in the music, media, and technology sectors.

Stingray Group's recent strategic moves, including the partnership with Sony Honda Mobility and expansion into retail media networks, underscore its adaptability and innovative approach in the entertainment industry. These initiatives are pivotal as they leverage Stingray's extensive digital content libraries to enhance user experiences across diverse platforms, from in-car entertainment to dynamic retail advertising solutions. Notably, the company's R&D investments have facilitated these advancements, ensuring that Stingray remains competitive in a rapidly evolving digital landscape. Moreover, the collaboration with K2 Studios to launch EarthDay 365 channel enhances its content offering significantly, promising new revenue streams and reinforcing its commitment to sustainability through educational programming.

- Get an in-depth perspective on Stingray Group's performance by reading our health report here.

Gain insights into Stingray Group's past trends and performance with our Past report.

Turning Ideas Into Actions

- Explore the 1263 names from our High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4480

Medley

Operates platforms for recruitment and medical businesses in Japan and the United States.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives