Market Might Still Lack Some Conviction On RenetJapanGroup,Inc. (TSE:3556) Even After 44% Share Price Boost

The RenetJapanGroup,Inc. (TSE:3556) share price has done very well over the last month, posting an excellent gain of 44%. The last 30 days bring the annual gain to a very sharp 25%.

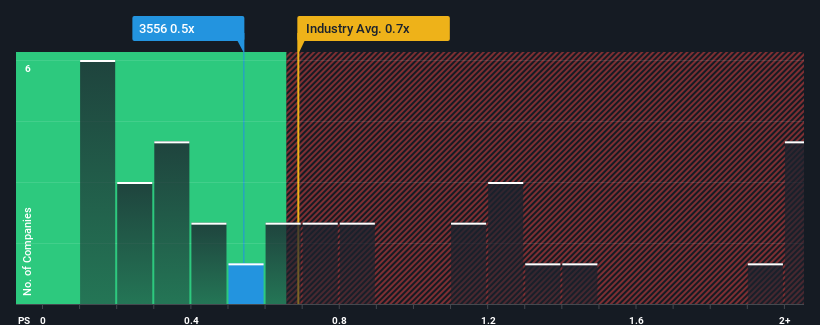

Even after such a large jump in price, you could still be forgiven for feeling indifferent about RenetJapanGroupInc's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Multiline Retail industry in Japan is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 3 warning signs about RenetJapanGroupInc. View them for free.See our latest analysis for RenetJapanGroupInc

How RenetJapanGroupInc Has Been Performing

As an illustration, revenue has deteriorated at RenetJapanGroupInc over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on RenetJapanGroupInc will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

RenetJapanGroupInc's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.7%. Still, the latest three year period has seen an excellent 37% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 8.2% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that RenetJapanGroupInc's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On RenetJapanGroupInc's P/S

RenetJapanGroupInc's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To our surprise, RenetJapanGroupInc revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for RenetJapanGroupInc (1 shouldn't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3556

RenetJapanGroupInc

Engages in internet reuse, recycling, and social care businesses in Japan and internationally.

Slight with mediocre balance sheet.

Market Insights

Community Narratives