- Japan

- /

- Specialty Stores

- /

- TSE:3186

Assessing NEXTAGE (TSE:3186) Valuation Following Strong Earnings Growth and Efficiency Gains

Reviewed by Kshitija Bhandaru

NEXTAGE (TSE:3186) just posted impressive numbers for the nine months ending August 2025, with net sales up 19% and operating profit climbing 27%. These results point to strong momentum in both market reach and internal efficiency.

See our latest analysis for NEXTAGE.

NEXTAGE has ridden this wave of strong results with subtle yet consistent price momentum, as seen in its positive year-to-date and one-year share price returns. While not a dramatic surge, investor sentiment appears to be turning more optimistic after the company’s robust earnings update. Long-term total shareholder returns continue to build at a steady pace.

If you're curious where else opportunity is building, it’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership.

But after such a strong run, the key question is whether NEXTAGE’s current share price reflects all this momentum or if there is still room for investors to benefit from future upside. Is NEXTAGE undervalued, or has the market already priced in its growth trajectory?

Price-to-Earnings of 22.7x: Is it Justified?

At a last close price of ¥2,619, NEXTAGE finds itself trading at a significant premium with a price-to-earnings (P/E) ratio of 22.7x. This positions the stock well above both its estimated fair P/E and the averages of similar companies.

The price-to-earnings ratio measures how much investors are willing to pay today for a yen of current earnings. For specialty retail companies like NEXTAGE, this multiple often reflects not only current profitability but also anticipated growth and quality of management.

Here, the market seems to be pricing in robust future earnings, potentially due to NEXTAGE’s positive earnings momentum and management’s track record. However, the P/E of 22.7x outpaces the Specialty Retail industry average of 14.3x, and even exceeds the stock’s estimated “fair” level of 21.6x. This suggests that optimism about future performance may have escalated valuations beyond sector norms.

Should the market re-align with the fair ratio, there could be a meaningful correction in valuation. Keep a close watch on how sentiment and fundamentals evolve.

Explore the SWS fair ratio for NEXTAGE

Result: Price-to-Earnings of 22.7x (OVERVALUED)

However, any slowdown in earnings growth or shifts in investor sentiment could quickly trigger a pullback from these premium valuation levels.

Find out about the key risks to this NEXTAGE narrative.

Another View: What Does the DCF Say?

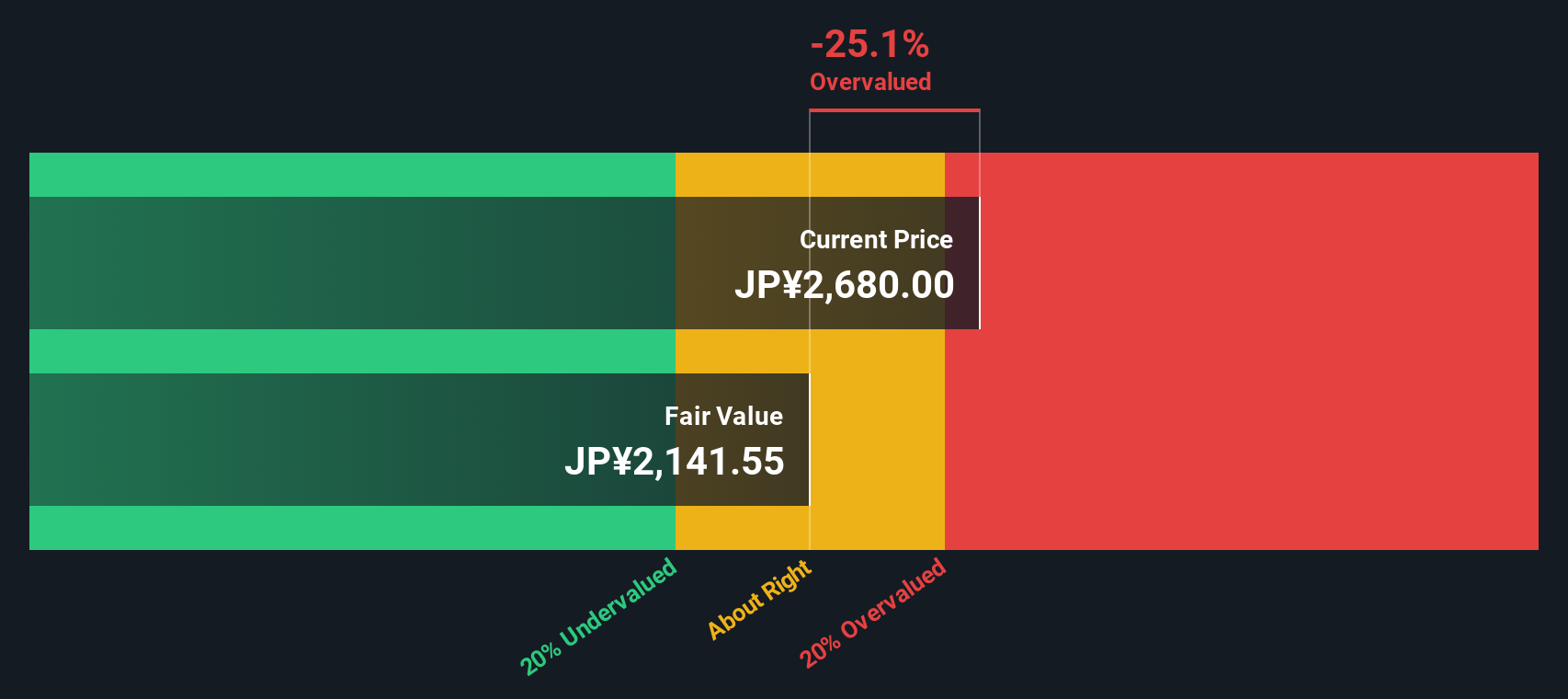

Looking beyond earnings multiples, our DCF model values NEXTAGE at ¥2,110 per share. This suggests the current price is about 24% over fair value. This method points to a potential downside if market expectations shift. Does this mean investors are getting ahead of themselves, or is growth being underestimated?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NEXTAGE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NEXTAGE Narrative

If this perspective does not quite fit your view, or you prefer independent analysis, you can quickly build your own conclusions from the data in just a few minutes. Do it your way.

A great starting point for your NEXTAGE research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize your edge in the market now. Don’t let unique growth stories and game-changers slip away when powerful stock screens are just a click away.

- Capture the potential of robust income streams by checking out these 19 dividend stocks with yields > 3%, which features companies offering yields above 3%.

- Jump ahead of the crowd with these 25 AI penny stocks, a resource that highlights innovative businesses transforming industries with artificial intelligence breakthroughs.

- Boost your portfolio with value picks by using these 897 undervalued stocks based on cash flows to identify companies trading below their intrinsic worth today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXTAGE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3186

Proven track record with adequate balance sheet.

Market Insights

Community Narratives