- Japan

- /

- Specialty Stores

- /

- TSE:3092

Did Record Gross Merchandise Value and Stock Split Just Shift ZOZO’s (TSE:3092) Investment Narrative?

Reviewed by Sasha Jovanovic

- ZOZO, Inc. recently reported strong second-quarter results, announcing a three-for-one stock split and a second quarter dividend of ¥19 per share for the period ended September 30, 2025, compared to ¥53 per share last year, adjusted for the stock split.

- This combination of higher merchandise volume, expanded AI-driven offerings, and a shareholder-friendly stock split signals the company’s focus on both growth and investor returns despite margin pressures.

- We will examine how the record gross merchandise value and stock split announcement may alter ZOZO’s long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ZOZO Investment Narrative Recap

To be a ZOZO shareholder, you need to believe the company can leverage its leadership in Japanese online fashion retail and technology initiatives to offset margin pressures and sustain growth, even amid ongoing investments in AI and marketing. The recent three-for-one stock split and Q2 results, featuring record merchandise value, reinforce confidence in the business model but do not fundamentally change the primary short-term catalyst of monetizing new digital features, the biggest risk remains margin erosion from higher promotional spending and LYST consolidation.

The most relevant announcement is the execution of the three-for-one stock split alongside the dividend declaration for Q2, which reflects ZOZO’s recent focus on shareholder return while trying to balance capital allocation; both moves come amid significant current and future spending on promotions and platform enhancements, directly tied to the company’s ability to drive sustained profitability through higher user engagement and sales volumes.

However, investors should be aware that if promotional costs continue rising faster than revenue growth…

Read the full narrative on ZOZO (it's free!)

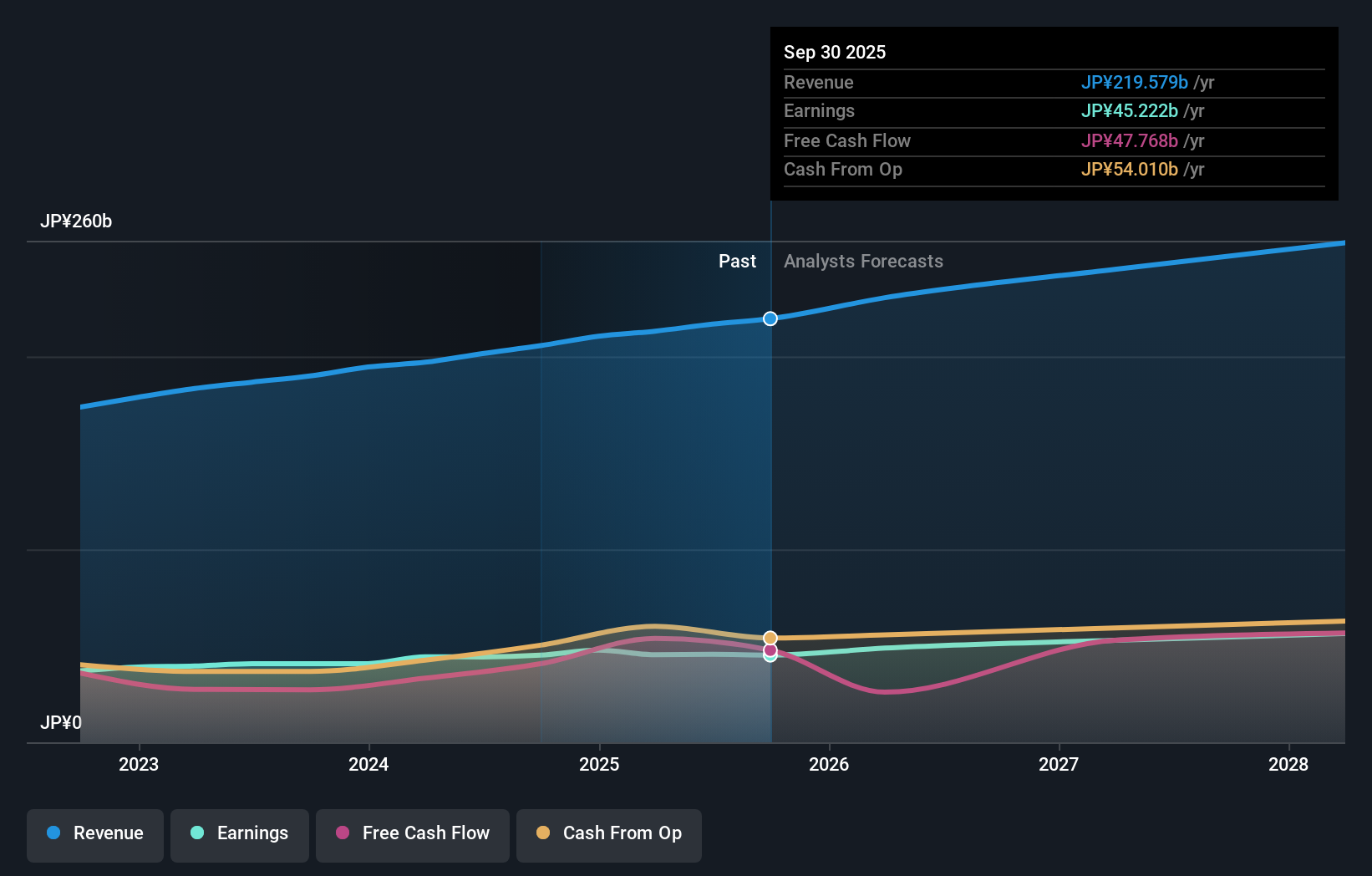

ZOZO's outlook forecasts ¥261.6 billion in revenue and ¥58.5 billion in earnings by 2028. This is based on a 6.5% yearly revenue growth rate and an earnings increase of ¥12.9 billion from the current ¥45.6 billion.

Uncover how ZOZO's forecasts yield a ¥1473 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Just one fair value estimate from the Simply Wall St Community pegs ZOZO’s value at ¥1,238,613, showing no spread of opinion yet. Yet with margin pressures tied to increased promotional spending, multiple viewpoints remain essential as future performance could diverge from consensus estimates.

Explore another fair value estimate on ZOZO - why the stock might be worth 7% less than the current price!

Build Your Own ZOZO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZOZO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ZOZO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZOZO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZOZO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3092

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026