Assessing MORI TRUST REIT (TSE:8961) Valuation After Its Semi‑Annual Dividend Increase

Reviewed by Simply Wall St

MORI TRUST REIT (TSE:8961) just raised its upcoming semi annual dividend to JPY 1,791 per share, signaling management’s confidence in cash flows and putting the REIT back on income investors’ radar.

See our latest analysis for MORI TRUST REIT.

That confidence is already reflected in the market, with the latest ¥76,400 share price sitting on a strong year to date share price return of 22.44 percent and an even more impressive 33.40 percent total shareholder return over the past year. This suggests momentum in investors’ appetite for MORI TRUST REIT’s income and assets.

If this dividend move has you thinking more broadly about income ideas, it could be worth scanning pharma stocks with solid dividends as another way to discover resilient, yield focused opportunities.

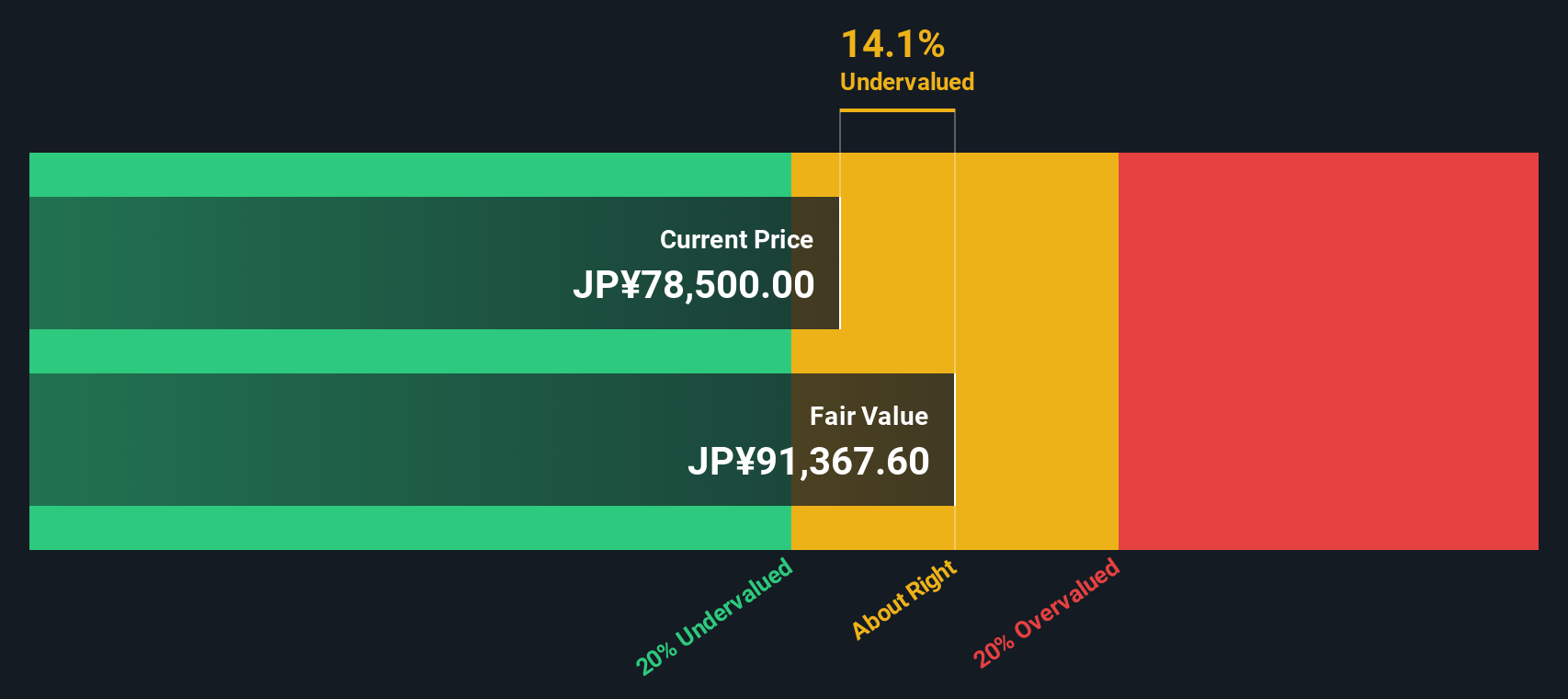

Yet with the share price now close to analyst targets but still trading at a notable discount to intrinsic value, is MORI TRUST REIT a rare mispriced income play, or are markets already baking in years of growth ahead?

Price-to-Earnings of 20.2x: Is it justified?

MORI TRUST REIT trades on a price-to-earnings ratio of 20.2x at a last close of ¥76,400, a modest premium to both peers and the wider REITs industry.

The price-to-earnings multiple compares the current share price with per share earnings. It is a key shorthand for what investors are willing to pay for each unit of profit. For a mature, income focused REIT like MORI TRUST REIT, it helps signal whether the market is expecting steady, modest growth or something more aggressive.

On one hand, our analysis indicates 8961 is good value versus its estimated fair price-to-earnings ratio of 23.7x, suggesting room for the multiple to expand from here. On the other hand, the stock screens as expensive compared both to the peer average of 18.8x and the broader JP REITs industry on 19.5x, implying investors are already assigning it a quality or growth premium relative to many rivals.

The gap between the current 20.2x and the higher fair multiple of 23.7x marks out a valuation level the market could plausibly move toward if sentiment and fundamentals stay supportive.

Explore the SWS fair ratio for MORI TRUST REIT

Result: Price-to-Earnings of 20.2x (ABOUT RIGHT)

However, slowing net income, modest revenue growth, and a share price already slightly above analyst targets could quickly cap further valuation upside.

Find out about the key risks to this MORI TRUST REIT narrative.

Another Take Using Our DCF Model

While the 20.2x earnings multiple makes MORI TRUST REIT look only slightly rich versus peers, our DCF model tells a different story. It points to fair value around ¥96,995 per unit, roughly 21 percent above today’s price. Is the market underestimating long term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MORI TRUST REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MORI TRUST REIT Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your MORI TRUST REIT research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Kick start your next move with hand picked opportunities from our screeners, so you are not leaving potential returns and smart diversification on the table.

- Explore evolving digital finance trends by reviewing these 80 cryptocurrency and blockchain stocks that are shaping payments, infrastructure, and new forms of value across global markets.

- Review potential income opportunities by scanning these 12 dividend stocks with yields > 3% that offer yields supported by underlying business strength.

- Track developments in innovation by assessing these 25 AI penny stocks focused on artificial intelligence, automation, and data driven technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8961

MORI TRUST REIT

MORI TRUST REIT, Inc. ("MTR") was established on October 2, 2001, with Mori Trust Asset Management Co., Ltd.

Average dividend payer and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion