Amid a backdrop of mixed performances in global markets, Japan's stock market displayed resilience with the Nikkei 225 Index seeing modest gains. This context sets the stage for evaluating Japanese dividend stocks, which can be appealing for investors looking for potential stability and income in a fluctuating economic environment.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.90% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.61% | ★★★★★★ |

| Nihon Tokushu Toryo (TSE:4619) | 3.93% | ★★★★★★ |

| Globeride (TSE:7990) | 3.67% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.52% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.05% | ★★★★★★ |

| Japan Pulp and Paper (TSE:8032) | 4.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.14% | ★★★★★★ |

| Innotech (TSE:9880) | 4.05% | ★★★★★★ |

Click here to see the full list of 393 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Fujitec (TSE:6406)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fujitec Co., Ltd. specializes in the R&D, production, and servicing of elevators, escalators, and related systems across regions including Japan, East Asia, Europe, the Middle East, South Asia, South America, and North America with a market cap of approximately ¥347.24 billion.

Operations: Fujitec Co., Ltd. generates revenues primarily from Japan (¥88.07 billion), East Asia (¥79.38 billion), South Asia (¥31.00 billion), and the Americas and Europe combined (¥45.78 billion).

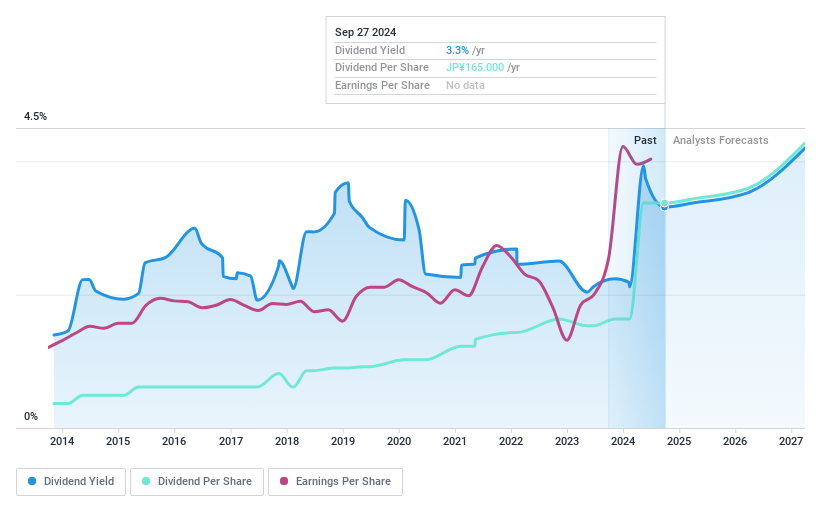

Dividend Yield: 3.7%

Fujitec has demonstrated a consistent increase in dividend payments over the past decade, with a recent rise to ¥50.00 per share for FY 2024, supplemented by a special dividend of ¥70.00. Despite its dividends being well-covered by earnings with a payout ratio of 37.2%, the cash flow coverage is weak at 285.2%, indicating potential sustainability issues under current financial structures. The company forecasts growth with expected net sales reaching ¥245 billion and profits of ¥16 billion for FY 2025.

- Dive into the specifics of Fujitec here with our thorough dividend report.

- The valuation report we've compiled suggests that Fujitec's current price could be inflated.

Kyodo Printing (TSE:7914)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyodo Printing Co., Ltd. operates a printing business in Japan, with a market capitalization of approximately ¥27.89 billion.

Operations: Kyodo Printing Co., Ltd. generates revenue primarily through three segments: the Information Security Division (¥29.36 billion), the Information and Communication Department (¥35.87 billion), and the Lifestyle/Industrial Materials Department (¥31.91 billion).

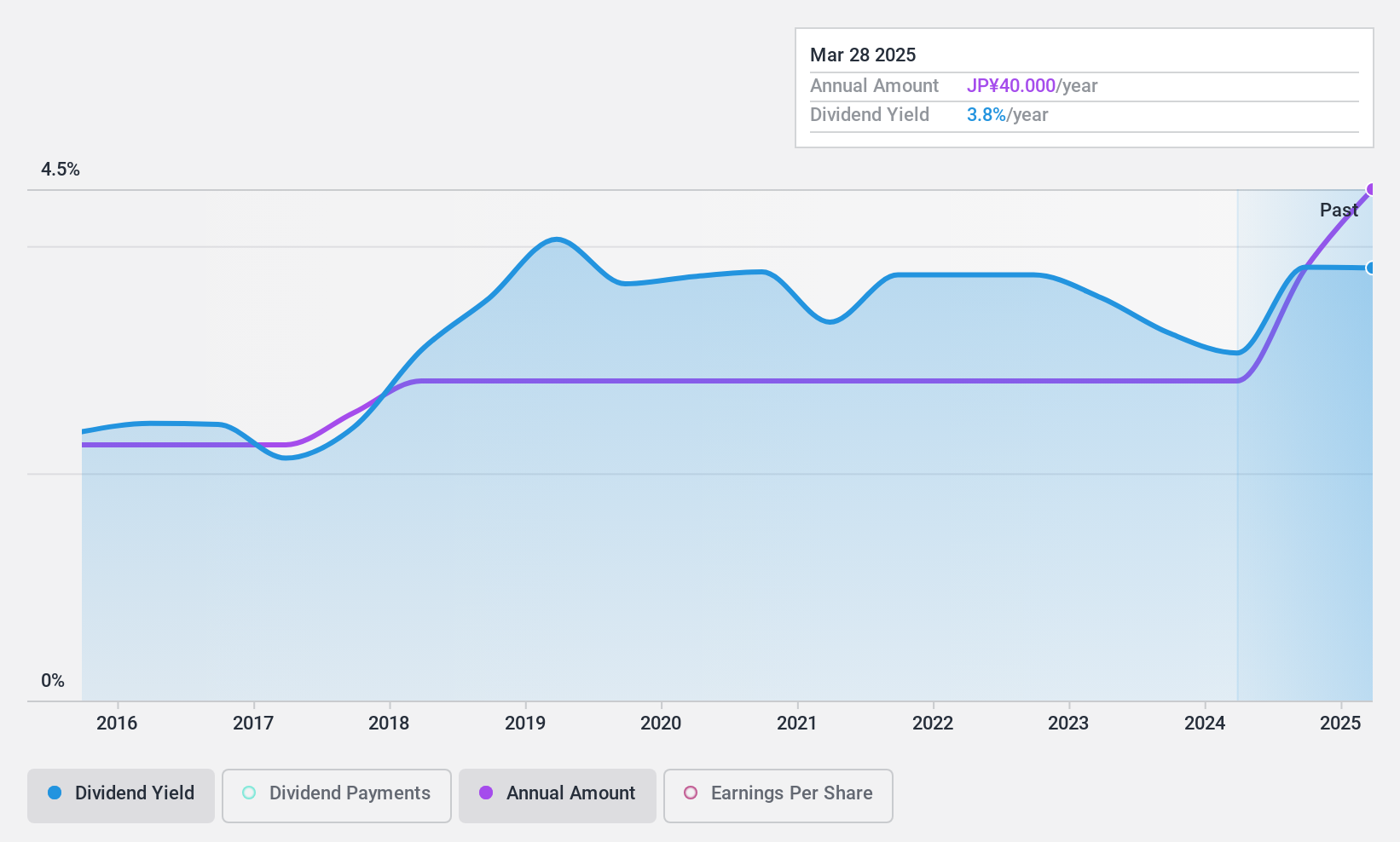

Dividend Yield: 3.5%

Kyodo Printing has shown a stable dividend history over the past decade, with dividends per share maintaining consistency and a current yield of 3.52%, ranking in the top 25% in Japan. Despite this, there are concerns about sustainability; its dividend coverage is weak with a payout ratio at 50.2%, and it lacks sufficient free cash flow to support ongoing payments, which could pose risks to future distributions.

- Get an in-depth perspective on Kyodo Printing's performance by reading our dividend report here.

- Our valuation report unveils the possibility Kyodo Printing's shares may be trading at a premium.

Aoyama Zaisan Networks CompanyLimited (TSE:8929)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aoyama Zaisan Networks Company Limited operates in Japan, offering property consulting solutions to individual asset owners and business owners, with a market capitalization of approximately ¥36.32 billion.

Operations: Aoyama Zaisan Networks Company Limited generates its revenue primarily through property consulting services for individual and business asset owners in Japan.

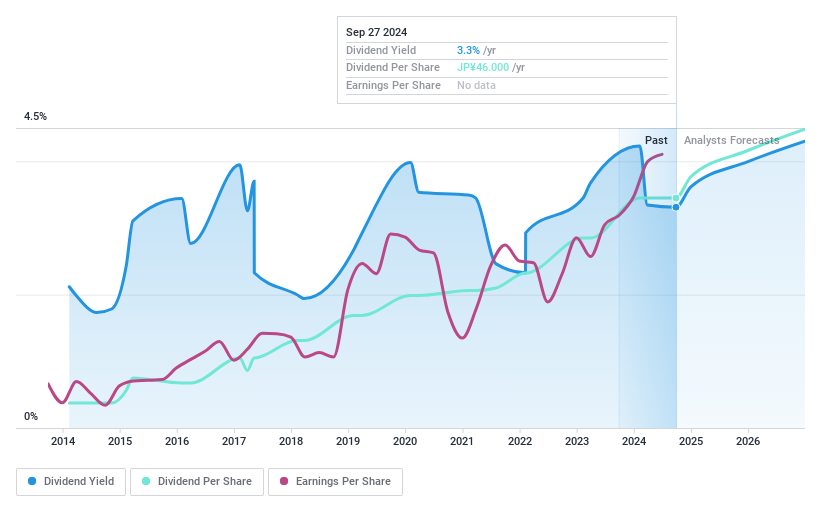

Dividend Yield: 3.1%

Aoyama Zaisan Networks has demonstrated solid financial prudence with a cash payout ratio of 45.9%, ensuring that dividends are well-supported by cash flows. Its earnings have seen a significant rise, growing by 55.8% over the past year, and dividends are sustainably covered by both earnings and cash flows, with respective payout ratios of 41.9% and 45.9%. However, its dividend yield of 3.09% is slightly lower than the top quartile of Japanese dividend stocks at 3.44%.

- Take a closer look at Aoyama Zaisan Networks CompanyLimited's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Aoyama Zaisan Networks CompanyLimited shares in the market.

Next Steps

- Delve into our full catalog of 393 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6406

Fujitec

Engages in the research, development, manufacture, marketing, installation, and maintenance of elevators, escalators, moving walks, and transportation systems in Japan, East Asia, Europe, the Middle East, South Asia, South America, and North America.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives