In a week marked by the U.S.-China tariff suspension, global markets experienced a notable rally, with major indices like the Nasdaq Composite and S&P 500 posting significant gains. Amidst this positive sentiment and cooling inflation figures, small-cap stocks have shown resilience as evidenced by the continued positive returns of the S&P MidCap 400 Index and Russell 2000 Index. In such an environment, identifying promising small-cap stocks involves looking for those with strong fundamentals that can capitalize on easing trade tensions and consumer trends.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 13.81% | -0.34% | -27.47% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Xilong Scientific (SZSE:002584)

Simply Wall St Value Rating: ★★★★★★

Overview: Xilong Scientific Co., Ltd. engages in the research, development, manufacturing, and sale of chemical reagents in China with a market cap of CN¥5.85 billion.

Operations: The company generates revenue primarily through the sale of chemical reagents. Its cost structure includes expenses related to research, development, and manufacturing processes. The net profit margin shows fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

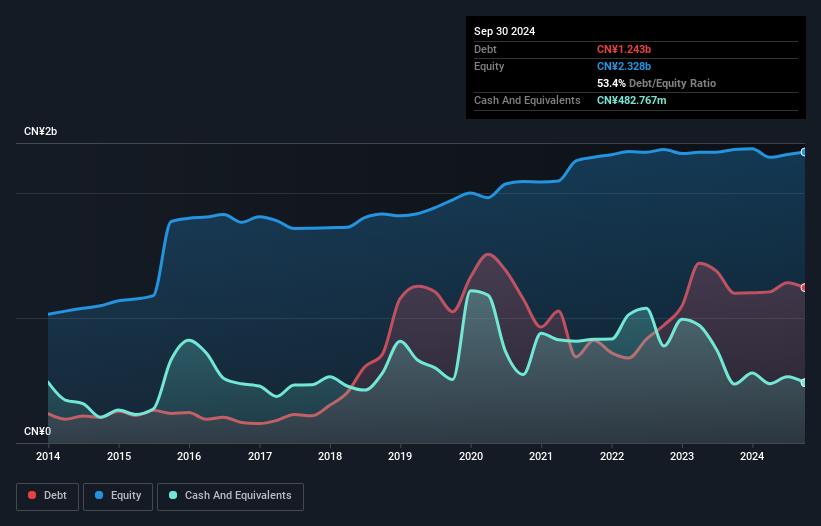

Xilong Scientific, a notable player in the chemicals sector, has shown impressive earnings growth of 108.7% over the past year, outpacing industry averages. Despite a CN¥38.9 million one-off loss impacting recent results, their net debt to equity ratio stands at a satisfactory 20.9%, reflecting sound financial management. The company reported revenue of CN¥7.82 billion for 2024, up from CN¥7.09 billion the previous year, with net income rising to CN¥61.77 million from CN¥33.35 million in 2023 and basic earnings per share increasing to CNY 0.11 from CNY 0.06 last year, showcasing its resilience amidst market volatility.

Shandong Sanyuan BiotechnologyLtd (SZSE:301206)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Sanyuan Biotechnology Co., Ltd. focuses on the R&D, production, and sale of erythritol and compound sugar products in China, with a market cap of CN¥6.18 billion.

Operations: The company's primary revenue stream is from its Food Additives Business, generating CN¥671.21 million.

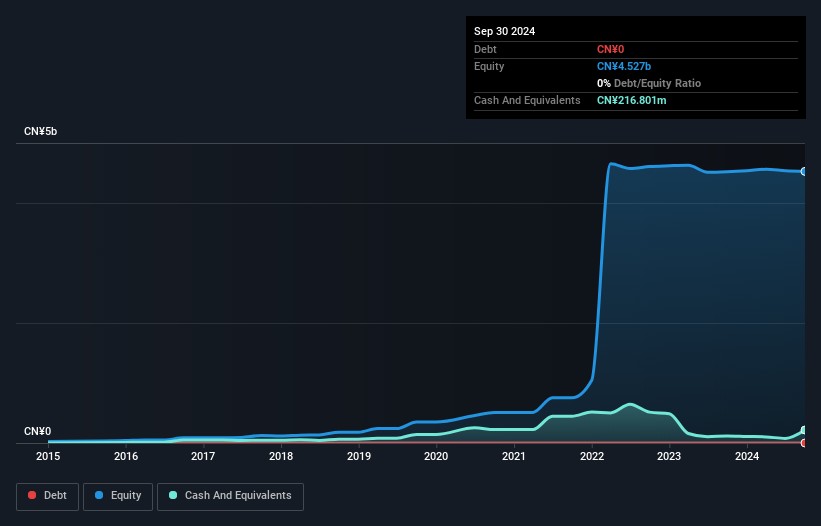

Shandong Sanyuan Biotechnology, a small cap company, showcases a mix of strengths and challenges. Despite the volatile share price recently, it remains debt-free with high-quality earnings. Over the past year, its earnings grew by 45.8%, surpassing the food industry's -5.5% performance, although there's been a 24% annual decline over five years. In Q1 2025, sales dropped to CNY 150.2 million from CNY 191.89 million last year; however, net income slightly increased to CNY 24.91 million from CNY 24.25 million previously reported. The company repurchased shares worth CNY 41.48 million as part of its buyback program initiated in July 2024.

Leopalace21 (TSE:8848)

Simply Wall St Value Rating: ★★★★★★

Overview: Leopalace21 Corporation operates in the construction, leasing, and sale of apartments, condominiums, and residential housing in Japan with a market capitalization of approximately ¥168.38 billion.

Operations: Leopalace21 generates significant revenue from its Leasing Business, including development activities, amounting to ¥416.94 billion. The Elderly Care Business contributes ¥13.73 billion to the company's revenue streams.

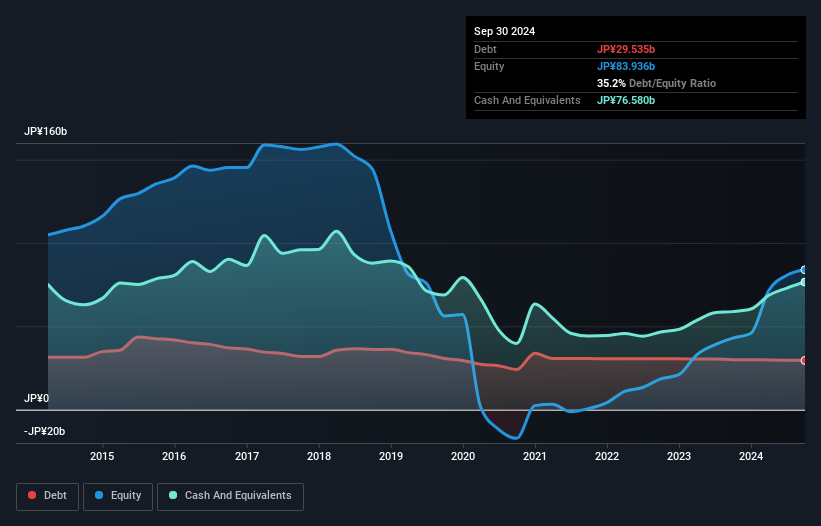

Leopalace21, a notable player in the real estate sector, has faced challenges with a negative earnings growth of 57.5% over the past year, contrasting sharply with the industry average of 17.2%. Despite this setback, it trades at an attractive 65% below its estimated fair value and shows promise with forecasted earnings growth of 7.73% annually. The company's debt situation has improved significantly, reducing its debt-to-equity ratio from a staggering 1716.6% to just 34% over five years. With interest payments well covered by EBIT at 22 times coverage and positive free cash flow, Leopalace21 is positioned for potential recovery and stability in its operations.

Summing It All Up

- Get an in-depth perspective on all 3193 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002584

Xilong Scientific

Researches and develops, manufactures, and sells chemical reagents in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives