- Japan

- /

- Real Estate

- /

- TSE:8801

How Investors Are Reacting To Mitsui Fudosan (TSE:8801) Issuing ¥118.8 Billion in Green Bonds

Reviewed by Sasha Jovanovic

- Mitsui Fudosan recently announced the issuance of ¥118.8 billion in 2.045% Green Notes due 2035, marking a substantial fixed-income offering focused on climate-related initiatives.

- This move underscores Mitsui Fudosan's increasing integration of sustainable finance into its capital strategy, highlighting the potential to tap into expanding ESG-focused investor demand.

- With this significant green bond issuance, we'll explore how Mitsui Fudosan's sustainability funding approach could influence its investment narrative going forward.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mitsui Fudosan Investment Narrative Recap

Owning Mitsui Fudosan means believing in the strength and resilience of Japan's premium real estate market, especially in Tokyo's high-demand office and residential sectors. The recent issuance of ¥118.8 billion in green bonds supports the company’s integration of sustainable finance, but it does not materially alter the short-term catalyst: continued strong performance and demand in central Tokyo properties. However, the biggest risk, Mitsui Fudosan’s elevated debt levels combined with future interest rate changes, remains an important consideration for shareholders.

Among recent announcements, the new dividend forecast, with both interim and year-end increases, stands out as most relevant. This signals strong confidence in ongoing cash flows and may reassure income-focused investors, but it should be weighed against the potential refinancing pressures highlighted by the recent green bond issue. Investors will want to review these developments closely, especially as future monetary policy uncertainty could impact both debt costs and payout sustainability.

In contrast, investors should not overlook the risk that debt levels and refinancing exposure could significantly impact...

Read the full narrative on Mitsui Fudosan (it's free!)

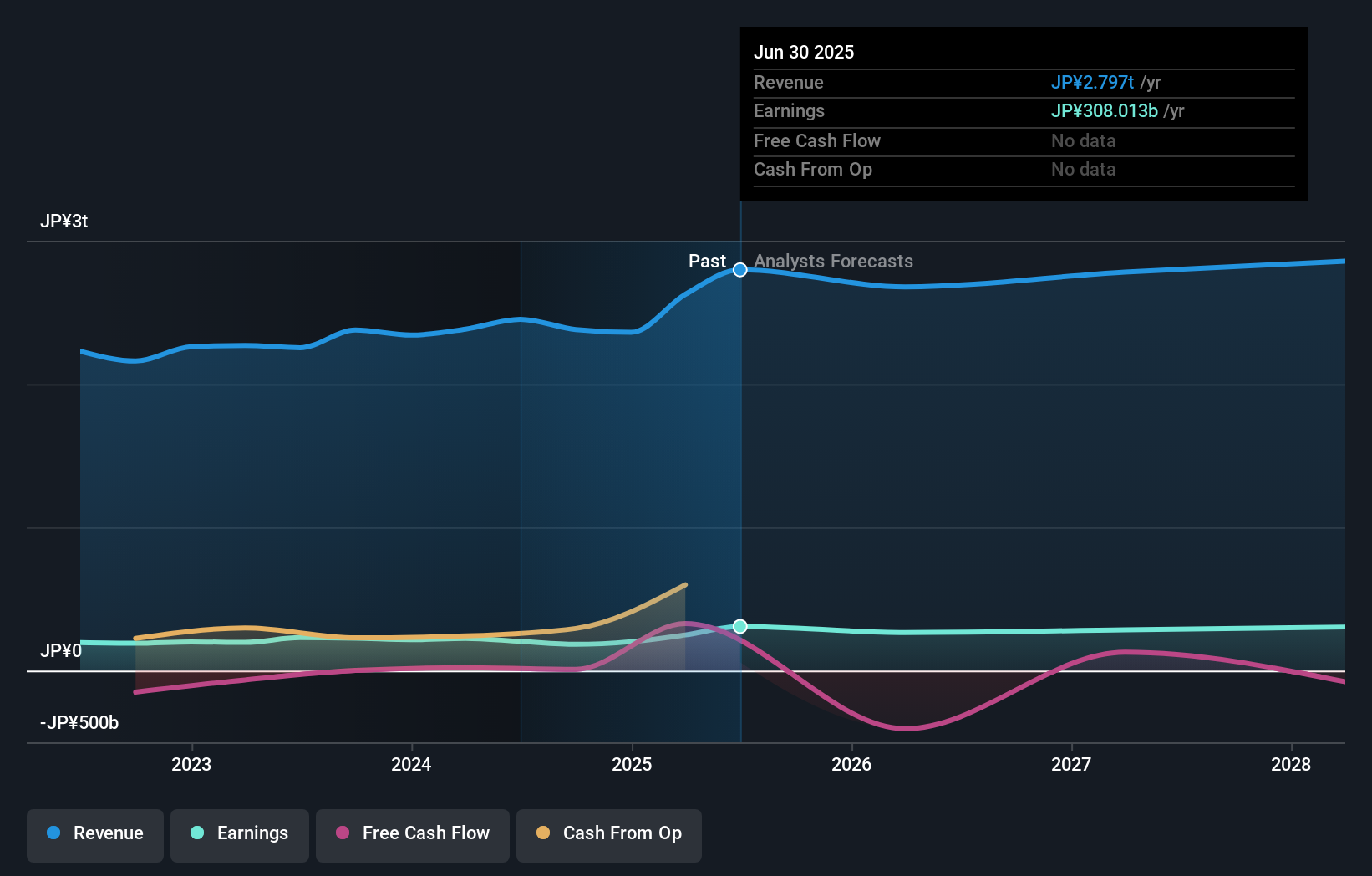

Mitsui Fudosan is projected to reach ¥2,872.2 billion in revenue and ¥304.4 billion in earnings by 2028. This forecast assumes a yearly revenue decline of 0.9% and a decrease in earnings of ¥3.6 billion from the current figure of ¥308.0 billion.

Uncover how Mitsui Fudosan's forecasts yield a ¥1800 fair value, a 11% upside to its current price.

Exploring Other Perspectives

All 1 retail fair value estimate from the Simply Wall St Community puts Mitsui Fudosan’s share price at ¥1,800. The bond issue emphasizes refinancing risk that could influence future performance, explore other views from the community to see how opinions vary.

Explore another fair value estimate on Mitsui Fudosan - why the stock might be worth as much as 11% more than the current price!

Build Your Own Mitsui Fudosan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui Fudosan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mitsui Fudosan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui Fudosan's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8801

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)