- Japan

- /

- Real Estate

- /

- TSE:5078

CEL (TSE:5078) Profit Margins Improve, Challenging Bearish Narratives on Earnings Rebound

Reviewed by Simply Wall St

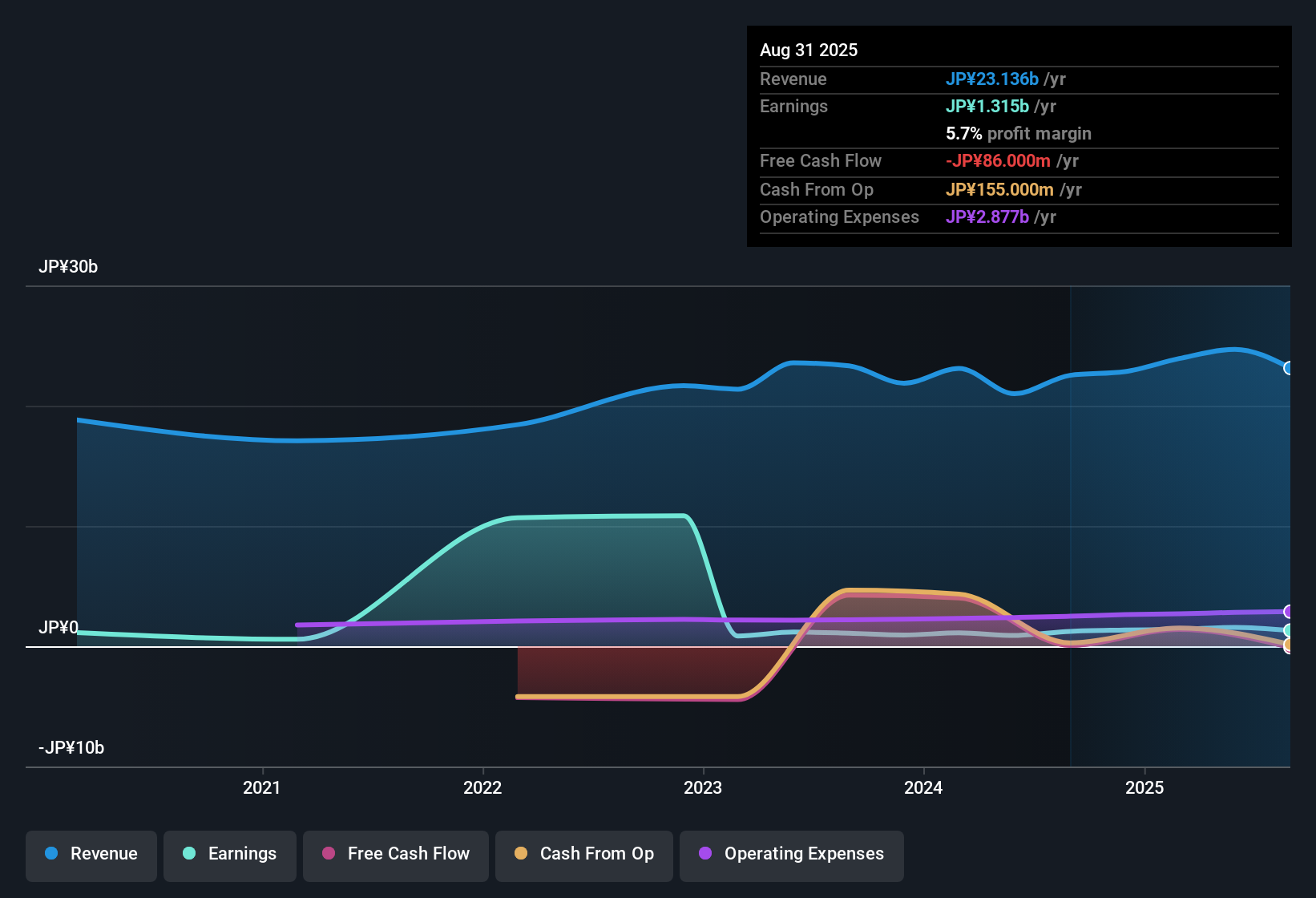

CEL (TSE:5078) posted net profit margins of 5.7%, edging out last year's 5.5%, and turned in a 6% earnings growth after years of declines averaging 43.5% per year. Investors may take note that the stock trades at a 15.8x P/E, below peers but above the Japanese real estate industry’s average, and is priced at ¥6,140, still under its estimated fair value of ¥6,751.78. While the return to growth and high-quality earnings are bright spots, concerns remain around share price stability and the sustainability of this upward momentum.

See our full analysis for CEL.Next up, let’s see how these latest numbers compare with the broader narratives shaping market sentiment, highlighting where the data confirms or disrupts expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Up, Yet Growth Track Is Unproven

- Net profit margins rose to 5.7%, slightly above last year's 5.5%. However, there is no breakout in revenue expansion or clear sign that margin improvement will continue based on the latest data.

- What is notable in the prevailing market view is that CEL’s return to positive 6% annual earnings growth after years of harsh declines is seen as a potential turning point.

- The only concrete operational shift, though, is this modest margin uptick and not a broader or sustained growth surge.

- This could drive cautious optimism, but without more data on revenues or segment gains, it may not fully address the concerns of longer-term skeptics.

Peer P/E Discount Raises Value Question

- CEL’s P/E ratio is 15.8x, significantly below its peer average of 46.9x and still above the wider Japanese real estate industry average of 11x. This emphasizes the company’s intermediate position in market pricing.

- The prevailing market view highlights that this valuation gap could attract value-focused investors who are wary of overhyped sectors.

- The current share price of ¥6,140 is below CEL’s DCF fair value of ¥6,751.78, which increases the appeal if profitability proves durable.

- However, the discount relative to peers is tempered by lingering doubts about whether recent positive metrics represent the start of a re-rating or just a temporary improvement.

Recent Gains Face Share Price Stability Test

- Despite operational improvements, there is no evidence from the report to verify stable share price performance over the past three months. The risk note specifically flags this uncertainty for investors.

- The prevailing market view contends that upbeat earnings alone may not stabilize the stock’s trajectory.

- This is especially important because the longer-term average annual earnings decline (-43.5%) still influences market participants’ perspectives.

- Even as momentum appears to shift, share price volatility and the lack of confirmed growth forecasts remain important considerations for those weighing CEL against steadier sector players.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CEL's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

CEL’s short record of earnings growth, lack of sustained revenue expansion, and ongoing share price volatility raise questions about long-term consistency and stability.

If reliable performance matters to you, use stable growth stocks screener (2090 results) to focus on companies delivering consistent growth and steadier returns through all market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5078

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives