- Japan

- /

- Real Estate

- /

- TSE:3498

Does Kasumigaseki Capital (TSE:3498)’s New Dividend Plan Reflect Shifting Priorities in Capital Allocation?

Reviewed by Sasha Jovanovic

- Kasumigaseki Capital Co.,Ltd. announced a dividend of ¥240.00 per share for the fiscal year ended August 31, 2025, up from ¥170.00 the previous year, with updated guidance forecasting a dividend of ¥165.00 per share for the year ending August 31, 2026.

- Alongside the dividend news, the company released consolidated earnings forecasts for 2026, targeting net sales of ¥150 billion, operating profit of ¥26.5 billion, and basic earnings per share of ¥834.86.

- We'll explore how the new dividend policy and earnings guidance may influence Kasumigaseki Capital's broader investment case.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Kasumigaseki CapitalLtd's Investment Narrative?

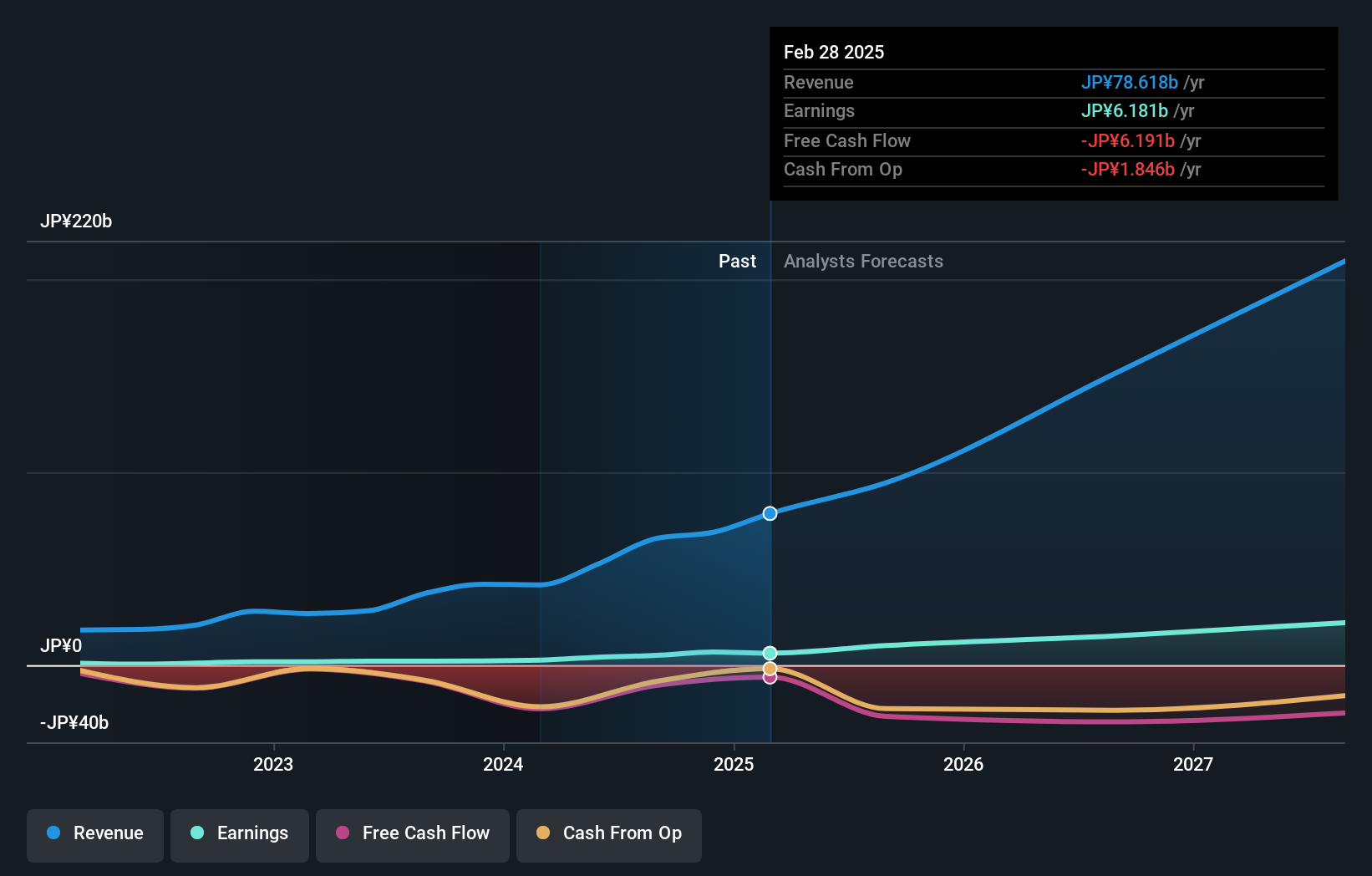

At its core, Kasumigaseki Capital’s investment case rests on whether you see ongoing double-digit growth in sales and earnings as sustainable, given the company’s rapid expansion and past performance. The sharp increase in the fiscal 2025 dividend, followed by a pullback in guidance for 2026, may shift short-term focus onto questions about earnings quality, cash flow strength, and how much future growth is already priced in. With the latest numbers pointing to a significant jump in projected revenue and profit for 2026, market attention could now pivot to whether these forecasts can be achieved as competition and debt obligations intensify. Previously, debate centered around high valuation metrics versus expected growth; now, the dividend cut and strong forecasts could either heighten scrutiny on execution risk or encourage optimism for continued momentum, depending on which catalyst prevails.

But risks around cash flow coverage deserve a closer look as you weigh the outlook. Kasumigaseki CapitalLtd's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Kasumigaseki CapitalLtd - why the stock might be worth less than half the current price!

Build Your Own Kasumigaseki CapitalLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kasumigaseki CapitalLtd research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kasumigaseki CapitalLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kasumigaseki CapitalLtd's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kasumigaseki CapitalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3498

Kasumigaseki CapitalLtd

Engages in real estate consulting businesses in Japan.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives