- Japan

- /

- Real Estate

- /

- TSE:3299

MUGEN ESTATE Co.,Ltd. (TSE:3299) Surges 27% Yet Its Low P/E Is No Reason For Excitement

MUGEN ESTATE Co.,Ltd. (TSE:3299) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 67%.

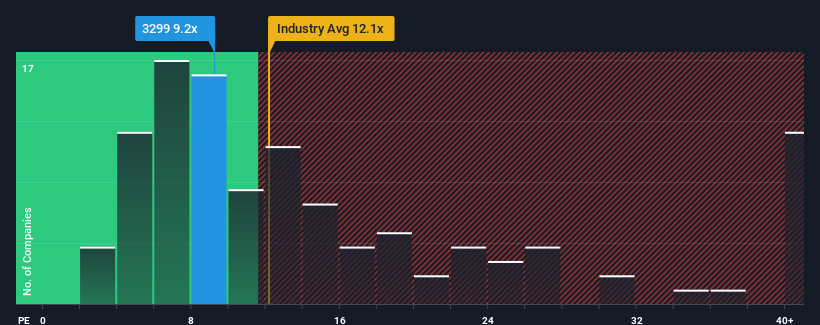

Even after such a large jump in price, MUGEN ESTATELtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.2x, since almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for MUGEN ESTATELtd as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for MUGEN ESTATELtd

How Is MUGEN ESTATELtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as MUGEN ESTATELtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 45%. The strong recent performance means it was also able to grow EPS by 216% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 14% over the next year. Meanwhile, the broader market is forecast to expand by 12%, which paints a poor picture.

In light of this, it's understandable that MUGEN ESTATELtd's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On MUGEN ESTATELtd's P/E

Despite MUGEN ESTATELtd's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that MUGEN ESTATELtd maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for MUGEN ESTATELtd (2 make us uncomfortable) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3299

MUGEN ESTATELtd

MUGEN ESTATE Co.,Ltd. purchases and resells pre-owned properties in Japan.

Undervalued established dividend payer.

Market Insights

Community Narratives