- Japan

- /

- Real Estate

- /

- TSE:3276

Phoenix Mecano And Two Other Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are increasingly seeking stability through dividend stocks. In this environment, companies like Phoenix Mecano offer potential appeal due to their consistent dividend payouts, which can provide a reliable income stream amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

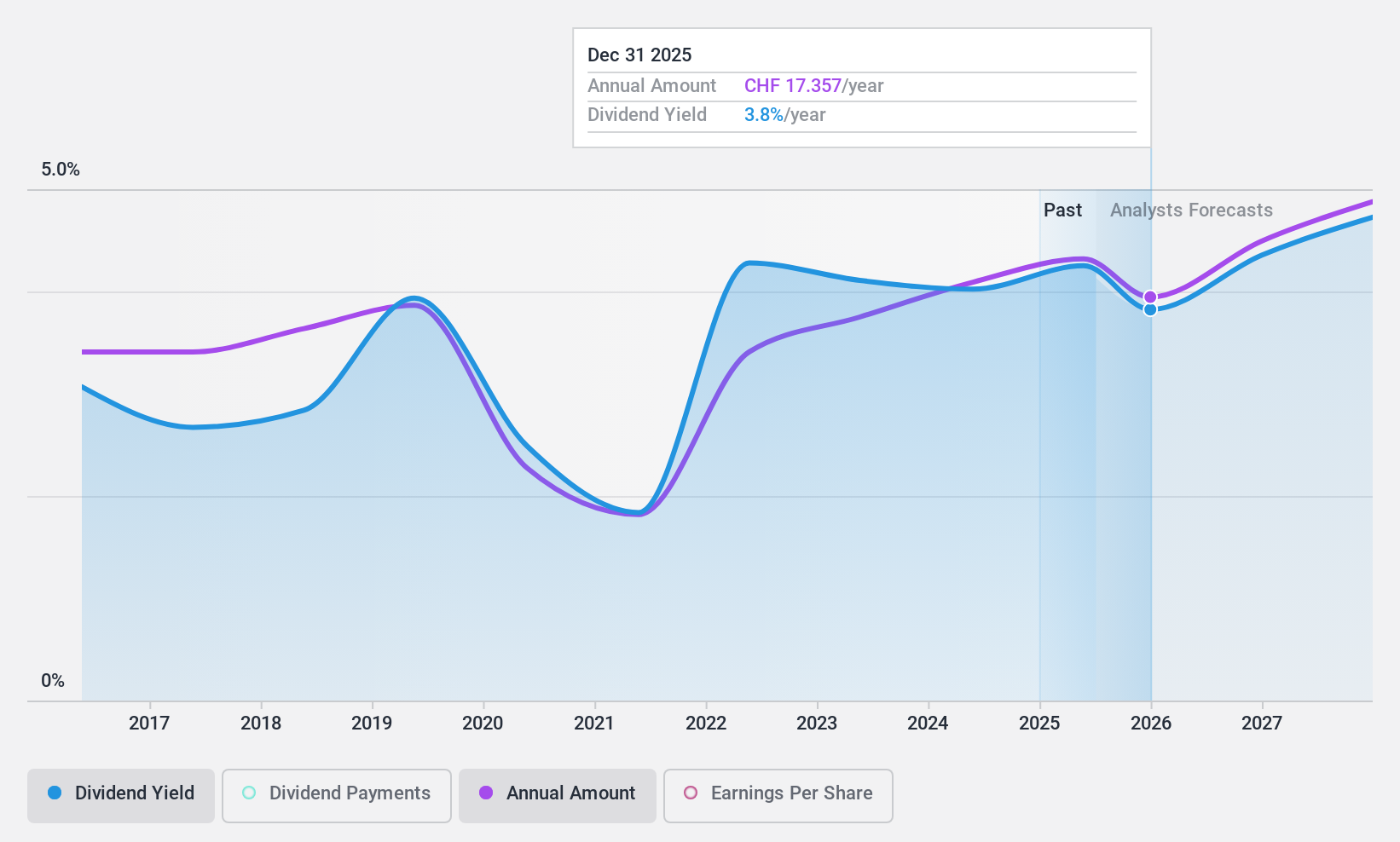

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Phoenix Mecano AG, with a market cap of CHF405.89 million, manufactures and sells components for industrial customers globally through its subsidiaries.

Operations: Phoenix Mecano AG generates its revenue from three main segments: Enclosure Systems (€218.16 million), Industrial Components (€197.28 million), and Dewertokin Technology Group (€348.00 million).

Dividend Yield: 6.6%

Phoenix Mecano's dividend yield of 6.59% places it in the top 25% of Swiss dividend payers, yet its sustainability is questionable. The company's dividends have been volatile over the past decade and are not well-covered by free cash flows, with a high cash payout ratio of 118.5%. However, they are covered by earnings with a payout ratio of 72.4%. Despite these concerns, it trades at good value compared to peers and industry standards.

- Click here and access our complete dividend analysis report to understand the dynamics of Phoenix Mecano.

- Our valuation report here indicates Phoenix Mecano may be undervalued.

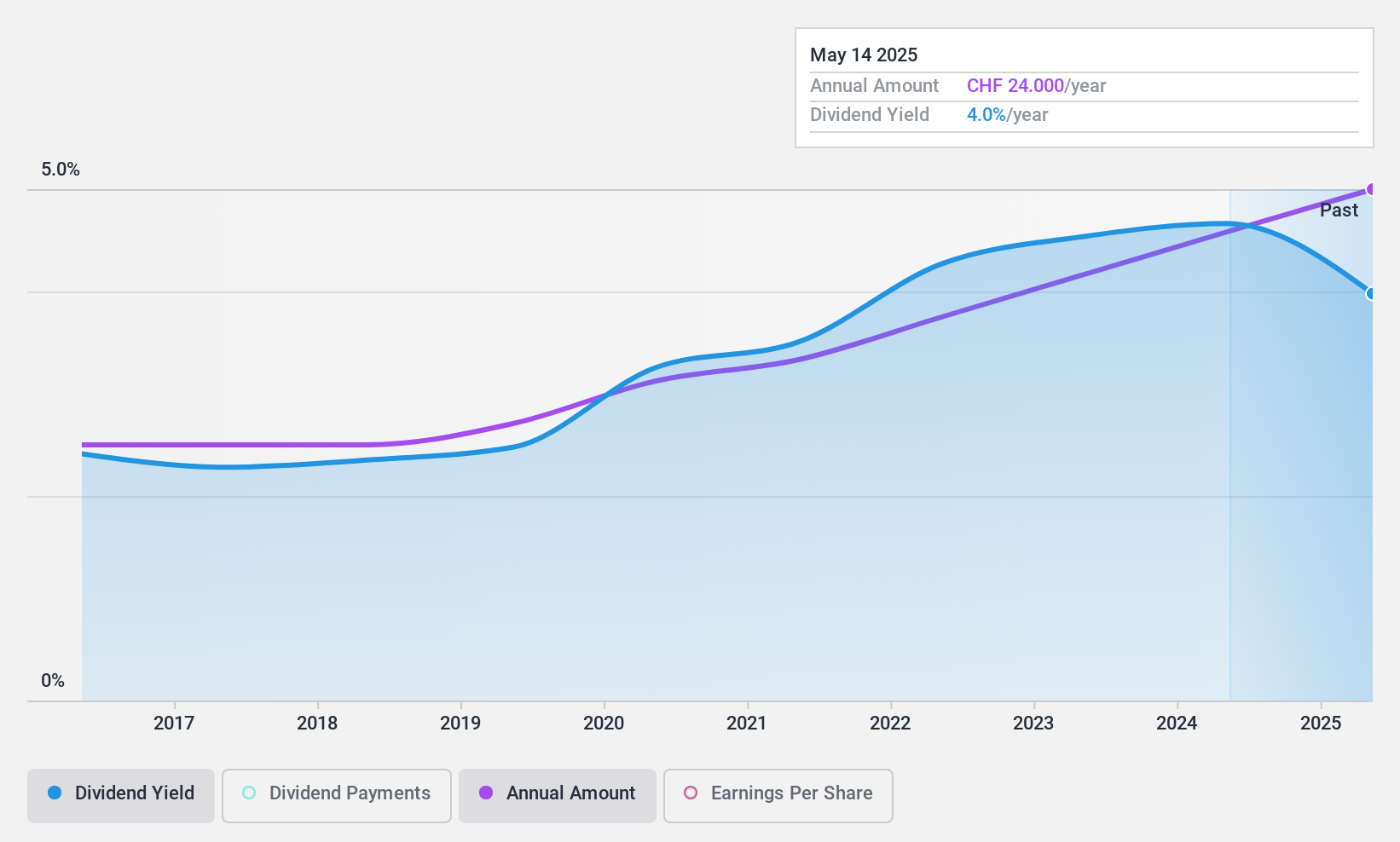

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland with a market cap of CHF1.43 billion.

Operations: Vaudoise Assurances Holding SA's revenue is derived from its insurance products and services offered predominantly in Switzerland.

Dividend Yield: 4.4%

Vaudoise Assurances Holding offers a compelling dividend profile with a yield of 4.4%, placing it among the top 25% of Swiss dividend payers. Its dividends have been stable and growing over the past decade, supported by a low payout ratio of 44.3% from earnings and 30.3% from cash flows, indicating sustainability. Additionally, the stock is trading at approximately 60.5% below its estimated fair value, suggesting potential for capital appreciation alongside income generation.

- Click here to discover the nuances of Vaudoise Assurances Holding with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Vaudoise Assurances Holding is priced lower than what may be justified by its financials.

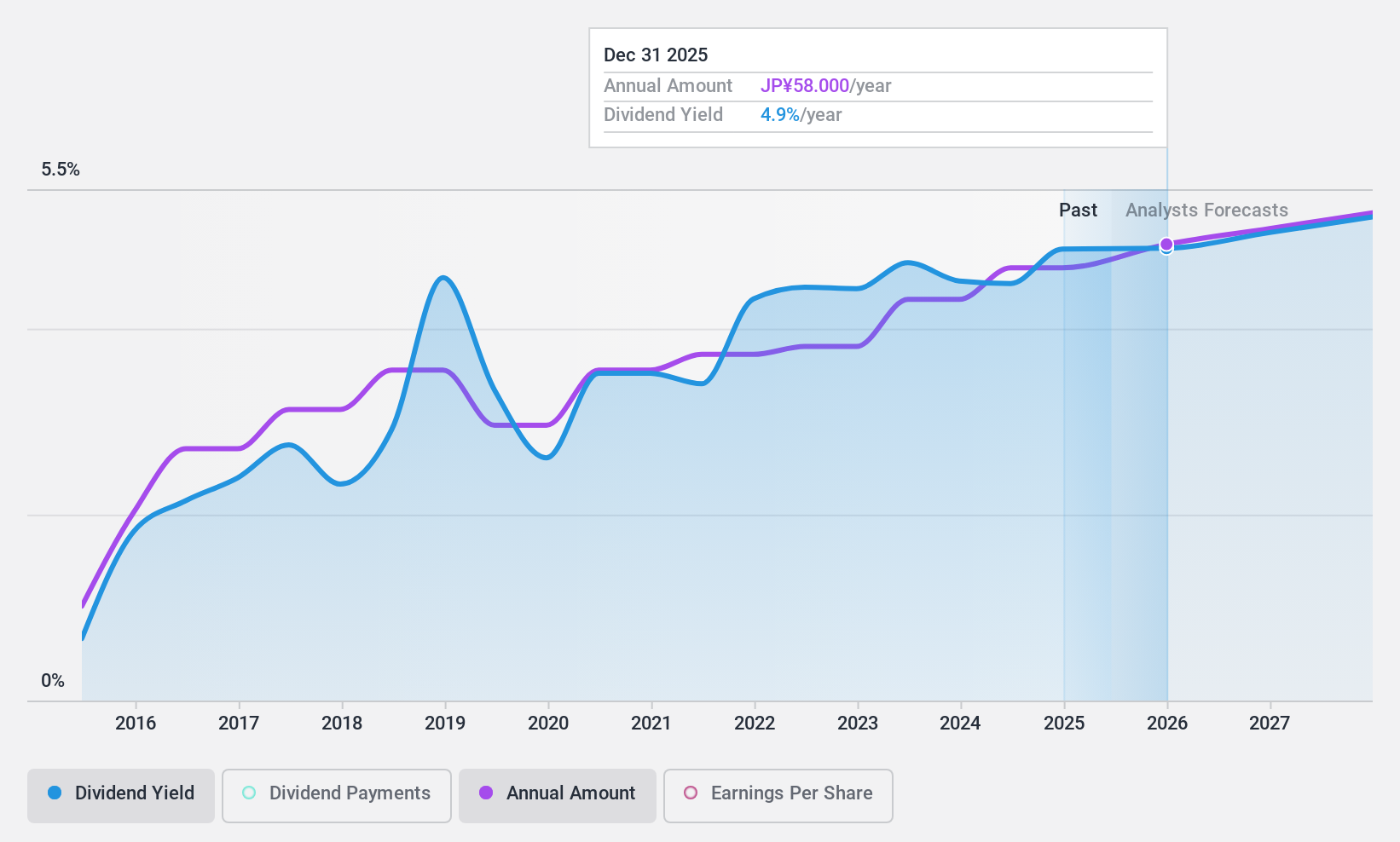

Japan Property Management CenterLtd (TSE:3276)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Property Management Center Co., Ltd. operates in Japan through its subsidiaries, focusing on rental housing management agency and bulk leasing businesses, with a market capitalization of ¥19.67 billion.

Operations: Japan Property Management Center Co., Ltd. generates revenue of ¥58.16 billion from its property management business and related activities.

Dividend Yield: 4.9%

Japan Property Management Center Ltd. offers a notable dividend yield of 4.91%, ranking it in the top quartile of Japanese dividend payers. Although its dividends are well-covered by earnings and cash flows, with payout ratios around 53%, the company's dividend history has been volatile over the past decade. Recent share buybacks totaling ¥287.5 million could enhance shareholder value and capital efficiency, though investors should consider the unstable track record when evaluating long-term reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Property Management CenterLtd.

- The analysis detailed in our Japan Property Management CenterLtd valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Take a closer look at our Top Dividend Stocks list of 1982 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3276

Japan Property Management CenterLtd

Japan Property Management Center Co.,Ltd.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives