Ono Pharmaceutical (TSE:4528) Valuation in Focus After Positive Phase 2 Trial Updates for Pipeline Drugs

Reviewed by Kshitija Bhandaru

Ono Pharmaceutical (TSE:4528) drew investor attention after announcing new Phase 2 results for two experimental treatments. Early findings for ONO-2808 showed slower disease progression in multiple system atrophy. ONO-4578 met a key trial goal in advanced gastric cancer.

See our latest analysis for Ono Pharmaceutical.

Shares of Ono Pharmaceutical have been showing some momentum lately, with a 12% share price return over the past 90 days and 7.5% year-to-date. This signals renewed optimism following its recent drug trial news. Still, the one-year total shareholder return is down 5.4%, and the longer-term picture reflects lingering challenges, with three- and five-year total shareholder returns both negative. The latest clinical updates appear to have sparked short-term interest, but investors continue to weigh these wins against past headwinds.

If you’re curious to see what else is happening in the pharmaceutical world, this is a great chance to explore See the full list for free.

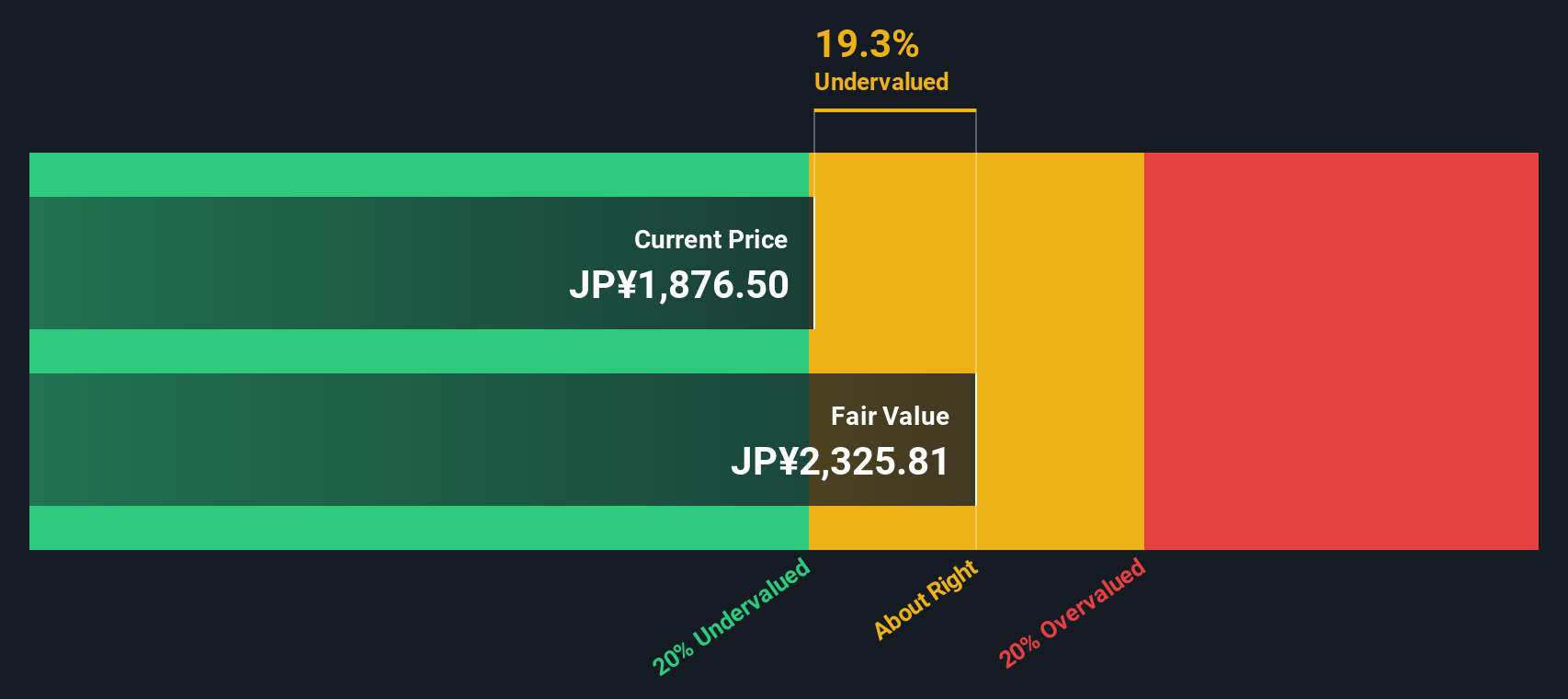

This begs the question: with Ono’s shares rebounding on promising trial data, is the stock trading at a bargain that reflects its potential pipeline success, or are investors already pricing in all future growth?

Price-to-Earnings of 19.5x: Is it justified?

Ono Pharmaceutical trades at a price-to-earnings ratio of 19.5x, compared to peer and industry benchmarks. With the last close at ¥1,792, this multiple puts the focus on how the market is weighing the company’s outlook versus its rivals.

The price-to-earnings (P/E) ratio shows what investors are willing to pay today for a yen of Ono's current earnings. It is a widely used gauge because it balances expectations of future profit growth with present results, which is crucial for pharmaceutical firms navigating complex pipelines.

Ono’s P/E of 19.5x stands higher than the Japanese pharmaceuticals industry average of 15.1x, suggesting the stock has a premium built in. Yet it remains cheaper than the peer average of 27.1x, hinting that the market may view Ono as less risky than some fast growers but more promising than the average pharma company. However, the P/E is only slightly above the “fair” ratio of 19.4x, indicating the current valuation could be close to what models suggest as fair for its forecast growth and quality.

Explore the SWS fair ratio for Ono Pharmaceutical

Result: Price-to-Earnings of 19.5x (ABOUT RIGHT)

However, shrinking annual revenue and the stock's discount to analyst targets highlight ongoing uncertainties. These factors could limit further upside for Ono Pharmaceutical.

Find out about the key risks to this Ono Pharmaceutical narrative.

Another View: Deep Discount to DCF Fair Value

Looking at Ono Pharmaceutical using our DCF model reveals a very different picture. The SWS DCF model estimates fair value at ¥3,432, which is almost double the recent share price. This represents a 48% discount and suggests investors may be overlooking significant long-term value. The question remains whether this gap offers a real opportunity or if the market has valid reasons for its caution.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ono Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ono Pharmaceutical Narrative

If you have a different perspective or want to dive deeper into the data, you can quickly build your own research narrative and see how your take compares. Do it your way

A great starting point for your Ono Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one opportunity. Use the Simply Wall Street Screener to uncover stocks that fit your goals and give you an edge over the market.

- Tap into high-potential AI opportunities by starting with these 24 AI penny stocks, which are transforming industries with innovation and growth momentum.

- Capture stable passive income with these 18 dividend stocks with yields > 3%, offering reliable yields above 3 percent for a stronger long-term foundation.

- Seize the chance to invest in tomorrow’s tech with these 26 quantum computing stocks, leading advancements in quantum computing and redefining what is possible.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4528

Ono Pharmaceutical

Produces, purchases, and sells pharmaceuticals and diagnostic reagents worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives